ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

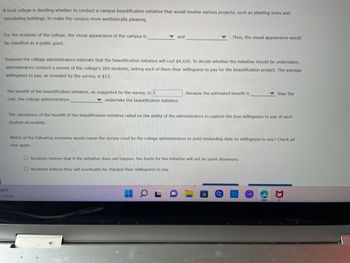

Transcribed Image Text:A local college is deciding whether to conduct a campus beautification initiative that would involve various projects, such as planting trees and

remodeling buildings, to make the campus more aesthetically pleasing.

and

Thus, the visual appearance would

For the students of the college, the visual appearance of the campus is

be classified as a public good.

Suppose the college administrators estimate that the beautification initiative will cost $4,420. To decide whether the initiative should be undertaken,

administrators conduct a survey of the college's 260 students, asking each of them their willingness to pay for the beautification project. The average

willingness to pay, as revealed by the survey, is $13.

Because the estimated benefit is

than the

The benefit of the beautification initiative, as suggested by the survey, is $

cost, the college administrators

undertake the beautification initiative.

The calculation of the benefit of the beautification initiative relied on the ability of the administrators to capture the true willingness to pay of each

student accurately.

Which of the following scenarios would cause the survey used by the college administrators to yield misleading data on willingness to pay? Check all

that apply.

Students believe that if the initiative does not happen, the funds for the initiative will not be spent elsewhere.

O Students believe they will eventually be charged their willingness to pay.

69°F

Cloudy

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The government of a subtropical country is evaluating the costs and benefits of protecting a rainforest versus cutting it down for timber. The estimated value of the wood is $270$270 million. If the same forest is used as a national park, it may attract 0.030.03 million additional tourists per year. Statistically, each tourist spends $1,600$1,600 inside the country during their stay.How long will it take tourism to exceed the estimated value of the wood in the rainforest? Enter your answer in the box below and round to two decimal places if necessary.arrow_forwardAn airline company determines the price of a seat on a particular route between city A and city B to be p = 200 + 0.02n, where p is the airfare price in euro and n is the number of airplane seats sold per day. The travel demand for this route by air has been found to be n = 4700 – 20p a)Determine the equilibrium price charged and the number of seats sold per day, and the resulting revenues of the company.arrow_forwardYour boss has asked you to evaluate the economics of replacing 1,000 60-Watt incandescent light bulbs (ILBs) with 1,000 compact fluorescent lamps (CFLs) for a particular lighting application. During your investigation you discover that 13-Watt CFLs costing $2.00 each will provide the same illumination as standard 60-Watt ILBs costing $0.50 each. Interestingly, CFLs last, on average, eight times as long as incandescent bulbs. The average life of an ILB is one year over the anticipated usage of 1,000 hours each year. Each incandescent bulb costs $2.00 to install/replace. Installation of a single CFL costs $3.00, and it will also be used 1,000 hours per year. Electricity costs $0.12 per kiloWatt hour (kWh), and you decide to compare the two lighting options over an 8-year study period. If the MARR is 12% per year, compare the economics of the two alternatives and write a brief report of your findings for the boss.arrow_forward

- am. 135.arrow_forwardHand written solutions not allowedarrow_forwardNo written by hand solution Version:0.9 StartHTML:0000000105 EndHTML:0000006359 StartFragment:0000000141 EndFragment:0000006319 The demand and the supply of timber for construction in Australia are given by QD =100 – 20P QS = 5P We assume the market is perfectly competitive. 2.1. Compute the equilibrium price PCE and quantity QCE. 2.2. Plot on a graph: the demand curve, the supply curve, and the equilibrium price and quantity. 2.3: Calculate the price elasticity of demand and price elasticity of supply at the equilibrium price and quantity. 2.4. Calculate the producer surplus and consumer surplus in the equilibrium and illustrate them in a graph. 2.5. Suppose there are many construction companies collapsed (and left the market), use a demand and supply graph to explain how the collapse affects the equilibrium price and quantity. 2.6. Consider the setup in 2.1-2.4, and suppose there is a strike of loggers, which change the supply to QS = 4P. Calculate the new…arrow_forward

- Describe in detail why a project with a Present Worth (PW) equal to or greater than zero is economically justifiablearrow_forwardFor the production of part R-193, two operations are being considered. The capital investment associated with each operation is identical. Operation 1 produces 2,100 parts per hour. After each hour, the tooling must be adjusted by the machine operator. This adjustment takes 15 minutes. The machine operator for Operation 1 is paid $24 per hour (this includes fringe benefits). Operation 2 produces 2,350 parts per hour, but the tooling needs to be adjusted by the operator only once every two hours. This adjustment takes 45 minutes. The machine operator for Operation 2 is paid $13 per hour (this includes fringe benefits). Assume an 8-hour workday. Further assume that all parts produced can be sold for $0.35 each. a. Should Operation 1 or Operation 2 be recommended? b. What is the basic tradeoff in this problem?arrow_forwardKipling Equipment Inc. must decide to produce either a face mask or a face shield to X alleviate the spread of a quickly evolving coronavirus. The face mask is disposable and developing it could potentially lead to a profit of $300,000 if competition is high or a profit of $470,000 if competition is low. The face shield, on the other hand, is reusable and has the potential of generating a fixed profit of $430,000 irrespective of high or low competition. The probability of high competition is 52% while that of low competition is 48%. Co Part A Construct a decision tree or a payoff table for the decision problem and use it to answer the following questions. a) What is the expected monetary value of the optimal decision? $ b) Based on expected monetary value, what should the Kipling do? $ Produce face shield c) What is the upper bound on the amount Kipling should pay for additional information? $ Part Barrow_forward

- Hand written solutions are strictly prohibitedarrow_forwardA community public works project will cost $92,000 and will benefit five different individuals. Individual Individual Benefit ($) Individual Cost ($) 1 4,500 6,000 2 18,500 15,000 3 19,000 17,000 4 30,000 24,000 5 29,000 30,000 Does this project meet the Pareto efficiency improvement criterion? If possible, revise the cost shares to allow the project to meet the Pareto criterion and to pass a referendum. please use excel with formulasarrow_forwardPart 1: Breakeven Analysis for a Conference. The Greenville Center for Business Analytics is an outreach center that collaborates with industry partners on applied research and continuing education in business analytics. One of the programs offered by the center is a quarterly Business Intelligence Conference. Each conference features three speakers on the real-world use of analytics. Each corporate member of the center (there are currently 12) receives five free seats to each conference. Nonmembers wishing to attend must pay $80 per person. Each attendee receives breakfast, lunch, and free parking.The following are the costs incurred for putting on this event:Rental cost for the auditorium $150Registration processing $7.50 per personSpeaker costs 3@$1,200 = $3,600Continental breakfast $3.50 per personLunch $8.00 per personParking $10.00 per persona) Use MS Excel drawing tools to build an influence diagram that models the factors that influence total profit for the conference.b) Build…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education