FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Question 2

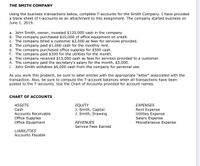

Transcribed Image Text:THE SMITH COMPANY

Using the business transactions below, complete T-accounts for the Smith Company. I have provided

a blank sheet of t-accounts as an attachment to this assignment. The company started business on

June 1, 2019.

a. John Smith, owner, invested $120,000 cash in the company.

b. The company purchased $10,000 of office equipment on credit.

c. The company billed a customer $2,000 as fees for services provided.

d. The company paid $1,000 cash for the monthly rent.

e. The company purchased office supplies for $500 cash.

f. The company paid $300 for the utilities for the month.

g. The company received $15,000 cash as fees for services provided to a customer.

h. The company paid the secretary's salary for the month, $3,000.

i. john Smith withdrew $6,000 cash from the company for personal use.

As you work this problem, be sure to label entries with the appropriate "letter" associated with the

transaction. Also, be sure to compute the T-account balances when all transactions have been

posted to the T-accounts. Use the Chart of Accounts provided for account names.

CHART OF ACCOUNTS

ASSETS

EQUITY

J. Smith, Capital

J. Smith, Drawing

EXPENSES

Cash

Accounts Receivable

Office Supplies

Office Equipment

Rent Expense

Utilities Expense

Salary Expense

Miscellaneous Expense

REVENUES

Service Fees Earned

LIAjILITIES

Accounts Payable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- WP Corporation produces products X, Y, and Z from a single raw material input in a joint production process. Budgeted data for the next month is as follows: A) B) Product X yes yes no no Units produced Per unit sales value at split-off Added processing costs per unit Per unit sales value if processed further The cost of the joint raw material input is $90,000. Which of the products should be processed beyond the split-off point? Product Y yes no yes yes Product X 2,700 $ 25.00 $ 2.00 $31.00 Product Z no yes no yes Product Y 3,200 $ 28.00 $ 4.00 $31.00 Product Z 4,200 $ 27.00 $4.00 $36.00arrow_forwardAnswer each of the following independent question: a and barrow_forwardwhy did you not answer b?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education