FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

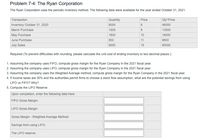

Transcribed Image Text:Problem 7-4: The Ryan Corporation

The Ryan Corporation uses the periodic inventory method. The following data were available for the year ended October 31, 2021.

Transaction

Quantity

Price

Qty"Price

Inventory October 31, 2020

6000

8.

48000

March Purchase

1500

9

13500

May Purchase

1800

10

18000

June Purchase

800

11

8800

July Sales

6000

15

90000

Required (To prevent difficulties with rounding, please calculate the unit cost of ending inventory to two decimal places ):

1. Assuming the company uses FIFO, compute gross margin for the Ryan Company in the 2021 fiscal year.

2. Assuming the company uses LIFO, compute gross margin for the Ryan Company in the 2021 fiscal year.

3. Assuming the company uses the Weighted Average method, compute gross margin for the Ryan Company in the 2021 fiscal year.

4. If income taxes are 30% and the authorities permit firms to choose a stock flow assumption, what are the potential savings from using

LIFO vs FIFO? Why?

5. Compute the LIFO Reserve

Upon completion, enter the following data here:

FIFO Gross Margin:

LIFO Gross Margin:

Gross Margin - Weighted Average Method:

Savings from using LIFO:

The LIFO reserve:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- H1.arrow_forwardJames's Televisions produces television sets in three categories: portable, midsize, and flat-screen. On January 1, 2025, James adopted dollar-value LIFO and decided to use a single inventory pool. The company's January 1 inventory consists of: Category Portable Midsize Flat-screen Category Portable Midsize Quantity Cost per Unit $100 Flat-screen 3,000 4,000 1,500 8,500 Quantity Purchased 7,500 During 2025, the company had the following purchases and sales. 10,000 5,000 250 22,500 400 Cost per Unit $110 300 Total Cost 500 $300,000 1,000,000 600,000 $1,900,000 Quantity Sold 7,000 12,000 3,000 22,000 Selling Price per Unit $150 400 600arrow_forwardSheridan Company's record of transactions for the month of April was as follows. Compute cost of goods sold assuming periodic inventory procedures and inventory priced at FIFO. Cost of goods sold $ eTextbook and Media Save for Later Attempts: 0 of 5 used (d) In an inflationary period, which inventory method - FIFO, LIFO, average - cost - will show the highest net income? inventory method will show the highest net income. 4132129Purchases1,650 @ 5.801,320 @770 @ 550 @5,8306.206.30a 6.502327Sales1,540 @ 10.001,320 @ 11.00990 @5,06012.00arrow_forward

- Coronado uses LIFO inventory costing. At January 1, 2020, inventory was $427,200 at both cost and market value. At December 31, 2020, the inventory was $543,600 at cost and $511,200 at market value. Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method and (b) loss method. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (a) (b)arrow_forwardThe Rockwell Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company in 1982. In 2021, the company decided to change to the average cost method. Data for 2021 are as follows: Beginning inventory, FIFO (6,500 units @ $45.00) Purchases: 6,500 units @ $51.00 6,500 units @ $55.00 Cost of goods available for sale Sales for 2021 (11,000 units @ $85.00) Additional information: 1. The company's effective income tax rate is 25% for all years. 2. If the company had used the average cost method prior to 2021, ending inventory for 2020 would have been $266,500. 3. 8,500 units remained in inventory at the end of 2021. Answer is not complete. Complete this question by entering your answers in the tabs below. $331,500 357,500 Required: 1. Prepare the journal entry at the beginning of 2021 to record the change in principle. 2. In the 2021-2019 comparative financial statements, what will be the amounts of cost of goods sold and inventory reported…arrow_forwardDuring January 2019, Marta Company, which maintains a perpetual inventory system, recorded the following information pertaining to its inventory: Units Unit Cost Bal. 1/1/19 Purchased on 1/4/19 Sold on 1/20/18 Purchased on 1/25/18 Under the moving average method, what amount should Metro report as Cost of Sales on January 1,000 40 600 @ 120 900 400 @ 200 31,arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education