MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

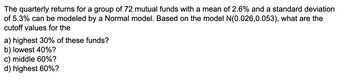

Transcribed Image Text:The quarterly returns for a group of 72 mutual funds with a mean of 2.6% and a standard deviation

of 5.3% can be modeled by a Normal model. Based on the model N(0.026,0.053), what are the

cutoff values for the

a) highest 30% of these funds?

b) lowest 40%?

c) middle 60%?

d) highest 60%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 10 images

Knowledge Booster

Similar questions

- A philosophy professor assigns letter grades on a test according to the following scheme. A: Top 13% of scores B: Scores below the top 13% and above the bottom 62% C: Scores below the top 38% and above the bottom 15% D: Scores below the top 85% and above the bottom 8% F: Bottom 8% of scores Scores on the test are normally distributed with a mean of 69.5 and a standard deviation of 9.5. Find the minimum score required for an A grade. Round your answer to the nearest whole number, if necessary.arrow_forwarda) Researchers studying the returns on mutual funds for 2012 found that they were normally distributed with a mean of 15% and a standard deviation of 10%. What percentage of mutual funds had a gain (i.e. a return greater than 0)? = 93.32% Then, b) What percent of funds had returns less than 10%? a. 30.85%b. 61.70%c. 69.15%d. None of the abovearrow_forwardThe following data represent the exchange rates for Currency A in terms of Currency B for 14 months. Complete parts a through e below. 0.66 0.71 0.93 1.14 1.42 0.95 0.77 0.59 1.51 0.59 0.55 0.86 1.40 0.90arrow_forward

- From this table, compute the ff: Mean: A. 1.40 B. 1.96 C. 1.55 D. 4.12 E. 4.70 Standard deviation A. 1.40 B. 1.96 C. 1.55 D. 4.12 E. 4.70 *The table below shows the number of goals scored by Team Pinoy in the 20 games of the season.arrow_forwardCompute the mean of the distribution?arrow_forwardA study reveals that 82% relationships end in the first two years. A random sample of 100 newly formed couples isselected.a. What is the probability that the sample proportion is less than 0.80?b. What is the probability that the sample proportion is within ±0.02 of the population proportion?arrow_forward

- The number of days ahead of their trip that travelers purchase their airline tickets can be modeled as an exponential distribution with a mean of 12 days. a. Determine the probability that a traveler will purchase their ticket less than 25 days before their trip Answer in exact fraction, or rounded to at least 4 decimal places. b. Determine the 77 percentile number of days by which travellers make an advance purchase of their tickets. Answer in exact fraction, or rounded to at least 4 decimal places. daysarrow_forward1. The amount of time a Tech student spends on Instagram has an approximately exponential distribution with mean 60 minutes. a. What is the probability a randomly selected student spends less than 45 on Instagram? b. Illustrate your answer from a. using the pdf c. Find the cumulative distribution function for the time students spend on Instagram. d. What is the probability a randomly selected student is on Instagram for a time within 2 standard deviation of the mean?arrow_forwardWhat is the standard deviation of the following investment: Actual Return Probability 5% 40% 45% 10% -12% -5% 15% 20% ○ 4.6% 12.8% 11.0% 9.2%arrow_forward

- Suppose that the value of a stock varies each day from $11.82 to $22.17 with a uniform distribution. Find the upper quartile; 25% of all days the stock is above what value? (Enter your answer to the nearest cent.)arrow_forwardIn a Normal distribution, the Empirical Rule states that... ["", "", "", "", ""] of the data is within 1 standard deviation of the mean, ["", "", "", "", ""] of the data is within 2 standard deviation of the mean, and ["", "", "", "", ""] of the data is within 3 standard deviation of the mean.arrow_forwardPlease answer parts b-darrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman