FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Pahy is considering the purchase of...

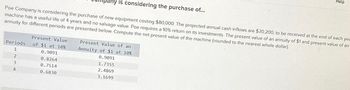

Poe Company is considering the purchase of new equipment costing $80,000. The projected annual cash inflows are $30,200, to be received at the end of each yea

machine has a useful life of 4 years and no salvage value. Poe requires a 10% return on its investments. The present value of an annuity of $1 and present value of an

annuity for different periods are presented below. Compute the net present value of the machine (rounded to the nearest whole dollar).

Periods

1

2

3

4

Present Value

of $1 at 10%

0.9091

0.8264

0.7514

0.6830

Present Value of an

Annuity of $1 at 10%

0.9091

1.7355

2.4869

3.1699

Help

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment: Year OperatingIncome Net CashFlow 1 $18,750 $93,750 2 18,750 93,750 3 18,750 93,750 4 18,750 93,750 5 18,750 93,750 The average rate of return for this investment is a.10% b.15% c.5% d.25%arrow_forwardProject 1 requires an original investment of $54,000. The project will yield cash flows of $8,000 per year for nine years. Project 2 has a calculated net present value of $17,300 over a seven-year life. Project 1 could be sold at the end of seven years for a price of $37,000. Use the Present Value of $1 at Compound Interest and the Present Value of an Annuity of $1 at Compound Interest tables shown below. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402…arrow_forwardThe management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment: Year Income fromOperations Net CashFlow 1 $18,750 $93,750 2 18,750 93,750 3 18,750 93,750 4 18,750 93,750 5 18,750 93,750 The average rate of return for this investment isarrow_forward

- A Company is considering an investment proposal, involving an initial cash outlay of TZS 450,000. The proposal has an expected life of 7 years and zero salvage value. At a required rate of return of 12 percent, the proposal has a profitability index of 1.182. Required: Calculate annual cash inflows.arrow_forwardA firm undertakes a five-year project that requires an initial capital investment of $125,000. The project is then expected to provide cash flow of $15,000 per year for the first two years, $55,000 in the third and fourth years, and $16,000 in the fifth year. The project has an end-of-life salvage value of $7,000.arrow_forwardPlease help me. Thankyou.arrow_forward

- Please show complete steps all parts or skip itarrow_forwardNOVA Company is considering a long-term investment project called STUDY. STUDY will require an investment of $125,190. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $79,000, and annual cash outflows would increase by $40,000. Compute the cash payback period. O 3.21 years O 1.23 years O 1.58 years O 4 yearsarrow_forwardMargaret has a project with a $30560 first cost that returns $4320 per year over its 10-year life. It has a salvage value of $3000 at the end of 10 years. If the MARR is 5 percent, what is the payback period of this project if cash flow is continuous?arrow_forward

- JT Engineering wants to buy a machine that costs $158,000, has a 20-year life, and a $12,000 salvage value. Annual cash inflows are $66,000 and annual cash outflows are $41,000. JT requires a 14% return, which has an annuity present value factor of 6.6231 and a single future amount present value factor of 0.0728. What is the NPV of this purchase to the nearest dollar? Select answer from the options belowarrow_forwardThe management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment: Operating Net Cash Year Income Flow 1 $18,750 $93,750 2 18,750 93,750 3 18,750 93,750 4 18,750 93,750 5 18,750 93,750 The cash payback period for this investment a. 4 years Xb. 3 years c. 5 years d. 20 yearsarrow_forwardByron Corporation is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net cash flow of $130,000. The equipment will have an initial cost of $475,000, a 5-year useful life, and an estimated salvage value of $84,000. If the company's cost of capital is 11%, what is the approximate net present value? (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1) Note: Use the appropriate factors from the PV tables. Multiple Choice $(5,467) $214,000 $130,000 $55,321arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education