ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Please solve this questions step by step handwritten solution and do not use ai thank you

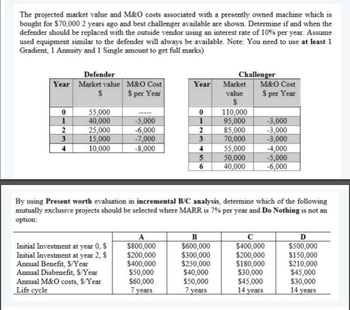

Transcribed Image Text:The projected market value and M&O costs associated with a presently owned machine which is

bought for $70,000 2 years ago and best challenger available are shown. Determine if and when the

defender should be replaced with the outside vendor using an interest rate of 10% per year. Assume

used equipment similar to the defender will always be available. Note: You need to use at least 1

Gradient, 1 Annuity and 1 Single amount to get full marks)

Defender

Challenger

Year Market value M&O Cost

Year

Market

M&O Cost

$

$ per Year

value

$ per Year

$

0

55,000

0

110,000

1

40,000

-5,000

1

95,000

-3,000

2

25,000

-6,000

2

85,000

-3,000

3

15,000

-7,000

3

70,000

-3,000

4

10,000

-8,000

4

55,000

-4,000

5

50,000

-5,000

6

40,000

-6,000

By using Present worth evaluation in incremental B/C analysis, determine which of the following

mutually exclusive projects should be selected where MARR is 7% per year and Do Nothing is not an

option:

A

B

C

D

Initial Investment at year 0, $

$800,000

$600,000

$400,000

$500,000

Initial Investment at year 2, $

$200,000

$300,000

$200,000

$150,000

Annual Benefit, S/Year

$400,000

$250,000

$180,000

$210,000

Annual Disbenefit, $/Year

$50,000

$40,000

$30,000

$45,000

Annual M&O costs, S/Year

Life cycle

$60,000

$50,000

$45,000

$30,000

7 years

7 years

14 years

14 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please correct answer and don't use hand rating and don't use Ai solutionarrow_forward5.24 For the cash flows below, use an annual worth comparison to determine which alternative is best at an interest rate of 1% per month. First cost, $ M&O costs, $/month Overhaul every 10 years, $ Salvage value, $ Life, years X -90,000 -400,000 -30,000 -20,000 - Y 7000 3 - 25,000 10 Z -900,000 -13,000 -80,000 200,000 8arrow_forward10arrow_forward

- An industrial plant has hired a contractor to develop a solar farm nearby for the industrial plant's electricity consumption. During the 3-year construction period, the contractor will need to run a generator to power the construction. Cost analysis from previous projects indicates: Generator Brand Installed Cost Cost per Hour A $22M $500 B $23M $400 C $25M $250 D $30M $150 At the end of 3 years, the generator will have a salvage value equal to the cost of removing them. The generator will operate 6,000 hours per year. The lowest interest rate at which the contractor is willing to invest money is 7%. (The minimum required interest rate for invested money is called the minimum attractive rate of return, or MARR.) Select the alternative with the least present worth of cost. O Choice "C" with $29,872,900 O Choice "B" with $29,298,320 O Choice C with $28,936,450 O Choice "A" with $29,872,900arrow_forwardNew microelectronics testing equipment was purchased 2years ago by Mytesmall Industries at a cost of $600,000. Atthat time, it was expected to be used for 5 years and thentraded or sold for its salvage value of $75,000. Expandedbusiness in newly developed international markets is forcingthe decision to trade now for a new unit at a cost of$800,000. The current equipment could be retained, ifnecessary, for another 2 years, at which time it would have a$5000 estimated market value. The current unit is appraisedat $350,000 on the international market, and if it is used foranother 2 years, it will have M&O costs (exclusive ofoperator costs) of $125,000 per year. Determine the valuesof P, n, S, and AOC for this defender if a replacementanalysis were performed today. P = market value =$350,000AOC = $125,000 per yearn = 2 yearsS = $5,000arrow_forwardPlease answer fastarrow_forward

- Only typed solutionarrow_forwardEconomics Last year, a decision was made to keep the same equipment in lieu of buying new equipment. The old equipment's trade-in value last year was $4000 and its value this year is $2000. The operating cost was $700 last year. If bought last year, the new equipment would have cost $13K, the salvage value after 8 years would be $2000, and it would have an annual operating cost of $4000. If bought last year, what would have been the EUAC of the new equipment (in dollars) at 16% interest rate per year? (provide your answer in the box as a negative value if you arrive at costs) What would have been the correct decision? (provide your answer and justification in your pdf file submission)arrow_forwardShow complete solutiion. Do not use excel. Manual Method. Steel drums manufacturer incurs a yearly operating cost of P 200,000. Each drum manufactured cost P 160 and sells for P 300. A machine use for the production has a first cost of P 20,000 and a salvage value of P 2,000 after producing 1,000 units. What is the break even number of units per year?arrow_forward

- Show the correct answer to this problem. Please not that in excel type of calculation I need a detailed solution with formulas and computations on it. Thank you.arrow_forwardFor th below two machines and based on CC analysis which machine we should select? MARR=10% Machine A Machine B First cost, $ Annual cost, $/year Salvage value, $ Life, years 3 Answer the below question: B- the CC for machine B= 20872 9067 4793 - 123476 infinite 9266arrow_forwardPlease correct answer and don't use hand ratingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education