Database System Concepts

7th Edition

ISBN: 9780078022159

Author: Abraham Silberschatz Professor, Henry F. Korth, S. Sudarshan

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

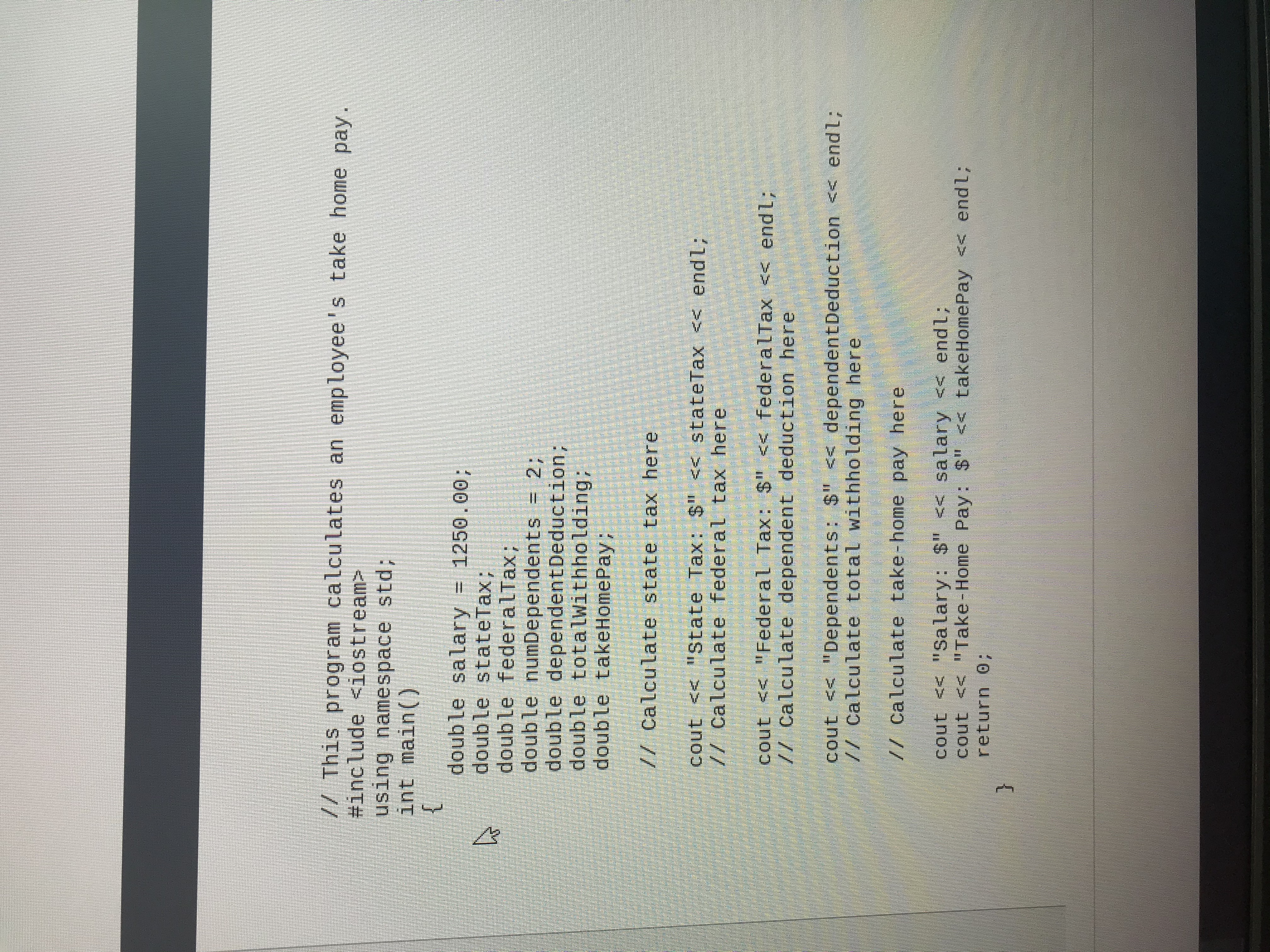

Transcribed Image Text:The Payroll program calculates the amount of tax withheld form an employee's weekly salary, the tax deduction to which the employee in

entitled for each dependent, and the employee's take home pay. The program output includes state tax withheld, federal tax withheld,

dependent tax deductions, salary, and take-home pay.

1. Open the source code file named Payroll.cpp using Dev-C++.

2. Variables have been declared and initialized, and output statements have been written. Read the code carefully.

3. Write the C++ code needed to perform the following:

a. Calculate sate withholding tax by multiplying the employee's salary by 5.5%

b. Calculate the federal withholding tax by multiplying the employee's salary by 21%

c. Calculate the depended deduction by multiplying the employee's salary by 3.5% then multiply that result by the number of

dependents

d. Calculate the total withholding by adding the total sate withholding and total federal withholding

e. Calculate take-home pay as salary minus total withholding plus total dependent deductions

4. Compile and run the program you should get the following output:

F\EFSC Spring 2015\COP 1000 Principles of Programming\Instructor Material Spring 2015\Workb.

State Tax: $101.75

Federal Tax: $388.5

De pendents : $259

Salary: $1850

Take-Home Pay: $1618.75

Press any key to continue

5. Upload the Payroll.cpp source file

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Similar questions

- in phython language Create a package folder named shapes. Inside this package, place two more package folders: 2d and 3d. Inside 2d package, place a module file: circle.py circle.py module has two function definitions: areaCircle(), circCircle(). areaCircle() function takes a parameter: radius, calculates and returns the area of the circle. You may assume PI is 3.14. circCircle() function also takes a parameter: radius, calculates and returns the circumference of the circle. Inside 3d package, place two module files: sphere.py and cylindir.py sphere.py module has two function definitions: areaSphere() and volumeSphere() which both take a parameter for radius, calculates and returns area and volume of a sphere respectively. cylindir.py module has two function definitions: areaCylindir() and volumeCylindir() which both take two parameters: height and radius. They calculate area and volume of a cylindir and return the values respectively. You may find the formulas for those shapes…arrow_forwardIN C# PLEASE Create class Cube. The class has attributes length and width and depth, each of which defaults to 1. It has read-only properties that calculate the Perimeter and the Area for a side of the cube, and another that calculates the cubed feet for the cube. (You will have to research how to do that calculation online) It has properties for length and width and depth. The set accessors should verify that length and width and depth are all floating-point numbers greater than 0.0 and less than 20.0. Write an app to test class Cube by creating 3 cubes of different sizes.arrow_forwardX609: Magic Date A magic date is one when written in the following format, the month times the date equals the year e.g. 6/10/60. Write code that figures out if a user entered date is a magic date. The dates must be between 1 - 31, inclusive and the months between 1 - 12, inclusive. Let the user know whether they entered a magic date. If the input parameters are not valid, return false. Examples: magicDate(6, 10, 60) -> true magicDate(50, 12, 600) –> falsearrow_forward

- Create a new module named beautyid.py. Define a function named beautyidtag that accepts 4 parameters: face, hair, number, vitamins. The function should create a 10-digit identifier composed of the first 2 letters of the user input for the variable face, first 2 letters from the user input for the variable hair, the number from the variable number, the number of vitamins, and a random integer between 11 and 90. Identifiers must all be uppercase. Return the value of the 10-digit identifier back to the calling method when called. I have made another module called beautyinventory.py where the variables are stored. I'm going to import this module back into beautyinventory.pyarrow_forwardProject: Two Formulas in Separate Class Write two formulas your choice in separate file and you call it in some manner from your from main program. In Java the pic for examplearrow_forward2. Name the demo file firstname_lastname_PE2 Create a program that simulates a dumpster diving game. Dumpster diving is when you search for loot in large industrial sized trash bins. In the game you will roll a ten-sided dice to determine what the user has received. Use the UML below as a guide for the Die class (Name the class Die.java). Die - sideUp: int = 10 - value: int + Die() + roll(): void + getvalue(): int Below are some suggestions to aid you in designing the game: • Each round of the game is performed as an iteration of a loop that repeats as long as the player wants to "dive" for more items. • At the beginning of each round, the program will ask the user whether or not he or she wants to continue diving. The program simulates the rolling of a ten-sided die Each item that can be caught is represented by a number generated from the die; for example, 1 for "a half-eaten sandwich", 2 for "a left shoe", 3 for "a broken watch", and so on. • Each item the user catches is worth a…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education

Database System ConceptsComputer ScienceISBN:9780078022159Author:Abraham Silberschatz Professor, Henry F. Korth, S. SudarshanPublisher:McGraw-Hill Education Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON

Starting Out with Python (4th Edition)Computer ScienceISBN:9780134444321Author:Tony GaddisPublisher:PEARSON Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON

Digital Fundamentals (11th Edition)Computer ScienceISBN:9780132737968Author:Thomas L. FloydPublisher:PEARSON C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON

C How to Program (8th Edition)Computer ScienceISBN:9780133976892Author:Paul J. Deitel, Harvey DeitelPublisher:PEARSON Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning

Database Systems: Design, Implementation, & Manag...Computer ScienceISBN:9781337627900Author:Carlos Coronel, Steven MorrisPublisher:Cengage Learning Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Programmable Logic ControllersComputer ScienceISBN:9780073373843Author:Frank D. PetruzellaPublisher:McGraw-Hill Education

Database System Concepts

Computer Science

ISBN:9780078022159

Author:Abraham Silberschatz Professor, Henry F. Korth, S. Sudarshan

Publisher:McGraw-Hill Education

Starting Out with Python (4th Edition)

Computer Science

ISBN:9780134444321

Author:Tony Gaddis

Publisher:PEARSON

Digital Fundamentals (11th Edition)

Computer Science

ISBN:9780132737968

Author:Thomas L. Floyd

Publisher:PEARSON

C How to Program (8th Edition)

Computer Science

ISBN:9780133976892

Author:Paul J. Deitel, Harvey Deitel

Publisher:PEARSON

Database Systems: Design, Implementation, & Manag...

Computer Science

ISBN:9781337627900

Author:Carlos Coronel, Steven Morris

Publisher:Cengage Learning

Programmable Logic Controllers

Computer Science

ISBN:9780073373843

Author:Frank D. Petruzella

Publisher:McGraw-Hill Education