FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

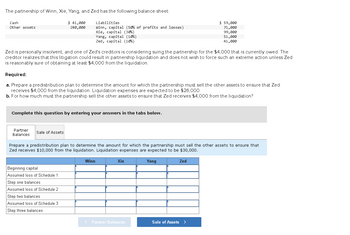

Transcribed Image Text:The partnership of Winn, Xie, Yang, and Zed has the following balance sheet:

$41,000

280,000

Cash

Other assets

Zed is personally insolvent, and one of Zed's creditors is considering suing the partnership for the $4,000 that is currently owed. The

creditor realizes that this litigation could result in partnership liquidation and does not wish to force such an extreme action unless Zed

is reasonably sure of obtaining at least $4,000 from the liquidation.

Required:

a. Prepare a predistribution plan to determine the amount for which the partnership must sell the other assets to ensure that Zed

receives $4,000 from the liquidation. Liquidation expenses are expected to be $26,000.

b. For how much must the partnership sell the other assets to ensure that Zed receives $4,000 from the liquidation?

Complete this question by entering your answers in the tabs below.

Partner

Balances

Liabilities

Winn, capital (50% of profits and losses)

Xie, capital (30%)

Yang, capital (10%)

Zed, capital (10%)

Sale of Assets

Beginning capital

Assumed loss of Schedule 1

Step one balances

Assumed loss of Schedule 2

Step two balances

Assumed loss of Schedule 3

Step three balances

Prepare a predistribution plan to determine the amount for which the partnership must sell the other assets to ensure that

Zed receives $10,000 from the liquidation. Liquidation expenses are expected to be $30,000.

Winn

Xie

< Partner Balances

$ 59,000

71,000

99,000

51,000

41,000

Yang

Zed

Sale of Assets >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The partnership of DBM, TRA and MDS become insolvent on December 31, 2018 and is to be liquidated. DBM, TRA and MDS have the following balances, respectively: P455,000, (P210,000), and (P28,000). After paying their personal liabilities, DBM has still P70,000 while TRA has P105,000 of their personal assets. However, MDS has unpaid personal liabilities amounting to P280,000 and his personal assets amounted only to P210,000. The partners share profits and losses equally. How much is the maximum amount that DBM can expect to receive from the partnership?arrow_forwardAlex and Bess have been in partnership for many years. The partners, who share profits and losses on a 60:40 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $8,500. At the date the partnership ceases operations, the balance sheet is as follows: Cash $ 57,000 Liabilities $ 43,500 Noncash assets 160,000 Alex, capital 96,000 Bess, capital 77,500 Total assets $ 217,000 Total liabilities and capital $ 217,000 Part A: Prepare journal entries for the following transactions: Distributed safe cash payments to the partners. Paid $26,100 of the partnership’s liabilities. Sold noncash assets for $173,500. Distributed safe cash payments to the partners. Paid remaining partnership liabilities of $17,400. Paid $6,800 in liquidation expenses; no further expenses will be incurred. Distributed remaining cash held by the business to the partners.arrow_forwardHector sold his interest in a partnership for $30,000 cash when his outside basis was $6,000. He was relieved of his $15,000 share of partnership liabilities. What is Hector's recognized gain from the sale of his partnership interest? $24,000 $30,000 $39,000 $45,000arrow_forward

- The Field, Brown & Snow are partners and share income and losses equality. The partner decide to liquidate the partnership when their capital balances are as follows: Field, $130,700; Brown, $165,000; and Snow, $153,300. On May 31, the liquidation resulted in a loss of $406,500. 1. Compute the capital account balance of each partner after the loss from liquidation is allocated. Note: Losses and negative capital balances, if any, should be entered with a minus sign. 2. Assume that the partner with a deficit pays cash to cover the deficit. Prepare the journal entries on May 31 to record (a) the cash received to cover the deficit and (b) the final disbursement of cash to the partners.arrow_forward1. Mann, Haney and Young are partners. Haney, who has a capital balance of $140 000, has decided to retire. On February 1, Mann offers Haney $137 000 for his equity, and Haney accepts. Record the entry to record Haney's departure. 2. The book value of the automobile brought into the partnership (cost minus accumulated depreciation) is $18 000, it was determined by the partners that the fair market value was $16 000. Which value would you record? 3. Assume that Chantel Bertran and Steve Davey have a partnership, and each have $90 000 in their capital account. Lisa Dupuis offers to pay $66000, or $33 000 to each existing partner, for a one third interest in the partnership. Lisa is offering more than the $60 000 it would normally cost, because Chantel and Steve have built a successful business and Lisa feels it is worth an extra $6 000. The entry to record Lisa's admission to the partnership is: 4.S. Mann purchases 50% of R. Cameron's equity in the Williams-Cameron Partnership for…arrow_forwardThe partnership of kapos, kulang and kasia was affected by the pandemic do the partners have decided to liquidate on December 31, 2019, and gave you the following balances: Cash 100,000 Outside Creditors 890,000 Non-Cash Asset 1,400,000 Loan due to kapos 10,000 Kapos, capital 90,000 Kulang, capital 190,000 Kasia, capital 320,000 The partners share profit and loss in the ratio 5:3:2, respectively. Non-cash asset was sold for 800,000. Kulang is a limited partner. The personal assets and liabilities of partners are as follows: Asset Liabilities Kapos 300,000 150,000 Kulang 150,000 110,000 Kasia 200,000 150,000 Answer the following: Gain/Loss absorbed by Kapos Gain/Loss absorbed by Kulang Gain/Loss absorbed by Kasia Capital balance of Kapos after the sale of Non – Cash Asset Capital balance of Kulang after the sale of Non – Cash Asset…arrow_forward

- Capital X, Y, and Z are $10,000 and $8,000 and $10,000, respectively: Profits are divided in the ratio of 30%:25%:45%. On liquidation, all assets of the partnership firm are sold and converted into cash in an amount sufficient to pay all claims, except for one claim of $4,000. Z is personally therapeutically insolvent the other two partners are able to fulfill every obligation to the partnership firm. State how the solution should be done.arrow_forwardWright, Bell, and Edison are partners and share income in a 2:5:3 ratio. The partnership's capital balances are as follows: Wright, $33,000, Bell $27,000 and Edison $40,000. Edison decides to withdraw from the partnership, and the partners agree not to revalue the assets upon Edison's retirement. The journal entry to record Edison's June 1 withdrawal from the partnership if Edison sells his interest to Whitney for $45,000 after the other two partners approve Whitney as partner is: Multiple Choice Debit Edison, Capital $45,000, credit Whitney, Capital $45,000 Debit Edison, Capital $40,000; credit Cash $40,000 Debit Edison, Capital $40,000; debit Wright, Capital $2.500; debit Bell, Capital $2.500; credit Whitney, Capital $45,000 Debit Edison, Capital $40,000, credit Whitney, Capital $40,000 Debit Edison, Capital $40,000, debit Cash $5,000, credit Whitney, Capital $45,000.arrow_forwardThe partnership of Matteson, Richton, and O'Toole has existed for a number of years. At the present time, the partners have the following capital balances and profit and loss sharing percentages: Partner Matteson Richton O'Toole Capital Balance $ 143,550 O'Toole elects to withdraw from the partnership, leaving Matteson and Richton to operate the business. Following the original partnership agreement, when a partner withdraws, the partnership and all of its individual assets are to be reassessed to current fair values by an independent appraiser. The withdrawing partner will receive cash or other assets equal to that partner's current capital balance after including an appropriate share of any adjustment indicated by the appraisal. Gains and losses indicated by the appraisal are allocated using the regular profit and loss percentages. 186,450 170,000 An independent appraiser is hired and estimates that the partnership as a whole is worth $530,000. Regarding the individual assets, the…arrow_forward

- Bell’s creditors have filed a $31,000 claim against the partnership’s assets. The partnership currently holds assets of $400,000 and liabilities of $158,000. If the assets can be sold for $240,000, what is the minimum amount that Bell’s creditors would receive? Multiple Choice $1,000 $3,200 $12,000 $0arrow_forwardThe partnership of Ace, Ball, Eaton, and Lake currently holds three assets: Cash, $10,000; Land, $35,000; and Building, $50,000. The partnership has no liabilities. The partners anticipate that expenses required to liquidate their partnership will amount to $5,000. Capital balances are as follows: Ace, capital Ball, capital Eaton, capital Lake, capital $ 25,000 28,000 20,000 22,000 The partners share profits and losses as follows: Ace (30 percent), Ball (30 percent), Eaton (20 percent), and Lake (20 percent). If a preliminary distribution of cash is to be made, what is the amount of safe payment that can be made to each partner? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Ace Ball Eaton Lake Safe payments $ 5,000 $ 5,000 $ 3,333 $ 3,333arrow_forwardThe partnership of kapos, kulang and kasia was affected by the pandemic do the partners have decided to liquidate on December 31, 2019 and gave you the following balances: Cash 100,000 Outside Creditors 890,000 Non-Cash Asset 1,400,000 Loan due to kapos 10,000 Карos, capital Kulang, capital Kasia, capital 90,000 190,000 320,000 The partners share profit and loss in the ratio 5:3:2, respectively. Non cash asset was sold for 800,000. Kulang is a limited partner. The personal assets and liabilities of partners are as follows: w Asset Liabilities Карos Kulang 300,000 150,000 150,000 110,000 Kasia 200,000 150,000 Answer the following: Gain/Loss absorbed by Kapos Gain/Loss absorbed by Kulang Gain/Loss absorbed by Kasia Capital balance of Kapos after sale of Non – Cash Asset Capital balance of Kulang after sale of Non - Cash Asset Additional Investment by Kapos Additional Investment by Kulang Final Settlement to Kapos Final Settlement to Kulang Final Settlement to Kasiaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education