FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The Field, Brown & Snow are partners and share income and losses equality. The partner decide to liquidate the

2. Assume that the partner with a deficit pays cash to cover the deficit. make the

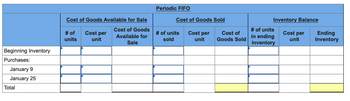

Transcribed Image Text:Beginning Inventory

Purchases:

January 9

January 25

Total

Cost of Goods Available for Sale

Cost of Goods

Available for

Sale

# of

units

Cost per

unit

Periodic FIFO

Cost of Goods Sold

# of units

sold

Cost per

unit

Cost of

Goods Sold

Inventory Balance

Cost per

unit

# of units

in ending

inventory

Ending

Inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- After the accounts are closed on February 3, prior to liquidating the partnership, the capital accounts of William Gerloff, Joshua Chu, and Courtney Jewett are $19,580, $4,020, and $22,460, respectively. Cash and noncash assets total $4,980 and $55,980, respectively. Amounts owed to creditors total $14,900. The partners share income and losses in the ratio of 2:1:1. Between February 3 and February 28, the noncash assets are sold for $36,300, the partner with the capital deficiency pays the deficiency to the partnership, and the liabilities are paid. Required: 1. Prepare a statement of partnership liquidation, indicating (a) the sale of assets and division of loss, (b) the payment of liabilities, (c) the receipt of the deficiency (from the appropriate partner), and (d) the distribution of cash. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers…arrow_forwardRequired Information [The following information applies to the questions displayed below.] The Fleld, Brown & Snow partnership was begun with Investments by the partners as follows: Field, $131,700; Brown, $165,600; and Snow. $153,700. The partners decide to liquidate, sharlng all losses equally. On May 31, after all assets were sold and all creditors were pald, only $43,900 in partnership cash remalned. 1. Compute the capital account balance of each partner after the liquldation of assets and payment of creditors. (Losses and negative capital balances, If any. should be entered with a minus sign.) Field Brown Snow Total Initial investments Allocation of gains (losses) Capital balancesarrow_forward1arrow_forward

- In 2017, Ryan, Chen and Win established a firm partnership and they agreed to share the profits in a 2:1:1 ratio. In mid-2018, with operations running profitably, they decided to dissolve the firm's partnership. Based on the following facts, prepare a summary of the partner's capital balance showing how much, if any, is available to settle in final settlement. A B Value of net assets paid in to partnership firm... $50,000 $22,500 $20,000 Company partnership net income for 1976 $30,000 divided into Ratio 2:1:1.. $15,000 $7,500 $7,500 1986 private take... $15,000 $10,000 $10,000 Net assets at the time of dissolution are assessed For $65,000 and distributed to $16,250 $16,250 Allies according to a ratio of 2:1:1..... $32,500arrow_forwardAfter the accounts are closed on February 3, prior to liquidating the partnership, the capital accounts of William Gerloff, Joshua Chu, and Courtney Jewett are $19,580, $4,020, and $22,460, respectively. Cash and noncash assets total $4,980 and $55,980, respectively. Amounts owed to creditors total $14,900. The partners share income and losses in the ratio of 2:1:1. Between February 3 and February 28, the noncash assets are sold for $36,300, the partner with the capital deficiency pays the deficiency to the partnership, and the liabilities are paid. 1. Prepare a statement of partnership liquidation, indicating (a) the sale of assets and division of loss, (b) the payment of liabilities, (c) the receipt of the deficiency (from the appropriate partner), and (d) the distribution of cash. Be sure to complete the statement heading. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter…arrow_forwardThe Field, Brown & Snow are partners and share income and losses equality. The partner decide to liquidate the partnership when their capital balances are as follows: Field, $131,250; Brown, $165,000; and Snow, $153,750. On May 31, the liquidation resulted in a loss of $405,000. 3. Assume that the partner with a deficit does not reimburse the partnership. Prepare journal entries (a) to transfer the deficit to the other partners and (b) to record the final disbursement of cash to the partners.arrow_forward

- I need help on finding this answer I have tried every scenario I can think of and everytime the answer is wrongarrow_forwardFollowing is a series of independent cases. In each situation, indicate the cash distribution to be made to partners at the end of the liquidation process. Unless otherwise stated, assume that all solvent partners will reimburse the partnership for their deficit capital balances. Part A The Buarque, Monte, and Vinicius partnership reports the following accounts. Vinicius is personally insolvent and can contribute only an additional $34,000 to the partnership. Cash $ 155,000 Liabilities 60,000 Monte, loan 70,000 Buarque, capital (50% of profits and losses) 22,000 Monte, capital (25%) 43,000 Vinicius, capital (25%) (40,000 ) (deficit) Part B Drawdy, Langston, and Pearl operate a local accounting firm as a partnership. After working together for several years, they have decided to liquidate the partnership’s property. The partners have prepared the following balance sheet: Cash $ 45,000 Liabilities $ 59,500…arrow_forwardA1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education