FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Required:

a. Prepare schedule showing the division of net income among the partners.

b. Prepare a Statement of Changes in Partners' Equity on December 31, 2013

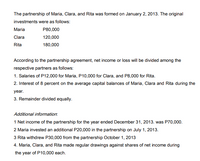

Transcribed Image Text:The partnership of Maria, Clara, and Rita was formed on January 2, 2013. The original

investments were as follows:

Maria

P80,000

Clara

120,000

Rita

180,000

According to the partnership agreement, net income or loss will be divided among the

respective partners as follows:

1. Salaries of P12,000 for Maria, P10,000 for Clara, and P8,000 for Rita.

2. Interest of 8 percent on the average capital balances of Maria, Clara and Rita during the

year.

3. Remainder divided equally.

Additional information.

1 Net income of the partnership for the year ended December 31, 2013. was P70,000.

2 Maria invested an additional P20,000 in the partnership on July 1, 2013.

3 Rita withdrew P30,000 from the partnership October 1, 2013

4. Maria, Clara, and Rita made regular drawings against shares of net income during

the year of P10,000 each.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In partnership liquidation the first cash distribution should be made for Select one: a. loan to bank b. partner capital c. loan to partner d. Liquidation expenses 000arrow_forward3.1 Tasneem and Nazreen were friends with simlar hobbles. They formed a partnershlp with a written partnership agreement to trade in pastry and related products as Tasnaz's Pastry. The following were extracted from their accounting records; Balances In the ledger at 30 June 2021 R Capital : Tas 407 000 Capital : Naz 363 000 Current account: Tas credit balance at 1 July 2020 8 052 Current account: Naz: debit balanoe at1 July 2020 2 640 Drawings : Tas Drawings : Naz 88 000 140 800 Proft for the year 438 636 Additional Information: The partnership agreement provides for the following that needs to be taken Into account: 1. Partners are entitled to salaries as follows: Tas - R8 000 per month, Naz - R10 000 per month. 2. Interest on capital accounts are allowed at 12% per year on each partners capital on a pro-rata basis. Note the following that on 1 January 2021: • Tas decreased her capltal account by R27 000; and • Naz Increase her capital account by R17 00. 3. Interest at 10% per year is…arrow_forwardEntries for Allocation of Net Income Danny Spurlock and Tracy Wilson decided to form a partnership on July 1, 20-1. Spurlock invested $100,000 and Wilson invested $25,000. For the fiscal year ended June 30, 20-2, a net income of $79,000 was earned. Determine the amount of net income that Spurlock and Wilson would receive under each of the following independent assumptions: Income to be allocated $fill in the blank 1 Spurlock Wilson Total 1. There is no agreement concerning the distribution of net income. $fill in the blank 2 $fill in the blank 3 $fill in the blank 4 2. Each partner is to receive 10% interest on their original investment. The remaining net income is to be divided equally. $fill in the blank 5 $fill in the blank 6 $fill in the blank 7 3. Spurlock and Wilson are to receive a salary allowance of $33,000 and $24,000, respectively.The remaining net income is to be divided equally. $fill in the blank 8 $fill in the blank 9 $fill in the blank 10 4. Each…arrow_forward

- X, Y and Z were the partners in a partnership firm. The following information were relating to the business at the end of the year 2019: i. Capital balance of partners X, Y, Z as on 1st January, 2019 was RO 120000, RO 80000 and RO 60000 respectively. ii. Current account balance of partners as on 1st January, 2019: X: RO 45500 (Cr), Y: RO 32600 (Dr) Z: RO 22100 (Cr) iii. Drawings taken by the partners during the year was: X: RO 8800 Y: RO 7500 Z: RO 5400 iv. Interest…arrow_forward33) The withdrawal of capital by a partner from the business of partnership will be: a. Credited to profit and loss account b. Debited to partners' capital account c. Credited to partners' capital account d. Debited to profit and loss appropriation accountarrow_forwardX, Y and Z were the partners in a partnership firm. The following information were relating to the business at the end of the year 2019: i. Capital balance of partners X, Y, Z as on 1st January, 2019 was RO 120000, RO 80000 and RO 60000 respectively. ii. Current account balance of partners as on 1st January, 2019: X: RO 45500 (Cr), Y: RO 32600 (Dr) Z: RO 22100 (Cr) iii. Drawings taken by the partners during the year was: X: RO 8800 Y: RO 7500 Z: RO 5400 iv. Interest on drawings…arrow_forward

- in a partnership, a partner receives a salary allowance based on: a. amount of years the partner is in the business b. time devoted to the business c. amount of sales the business makes d. original investment made in businessarrow_forwardGive at least 3 knowledge about Dissolution by Retirement and Death of a Partner in Partnership Accounting.arrow_forwardPartners' Current account balance changes every yedr because O a. Interest on capital, interest on drawings, salary etc. are recorded O b. Revenue and operating expenses are recorded O c. Assets and liabilities are recorded O d. Additional capital and permanent withdrawal of capital are recordedarrow_forward

- J Prepare adjusting entries to update the balances of some of the partnership accounts. Use "Capital Adjustments" account. If Merlita Pactanac will be admitted by purchasing 1/4 of the adjusted partners interest, how much is she going to pay and what is the journal entry to record her admission if the purchase is at book value. Kareen Labor, Lalaine Dajao and Leah Magno were partners in a business engaged in printing and publishing. The Statement of Financial Position reveals that their business obligations to outside creditors. has no Cash Accounts Receivable Inventories Equipment Total ASSETS 18-4 P120,000 150,000 260,000 300,000 P830,000 Instruction: PARTNERS' EQUITY Labor, Capital (30%) Dajao, Capital (20%) Magno, Capital (50%) Total P400,000 280,000 150,000 P830,000 On January 1, 20A, the partners agree to admit Jimwell Acenas as a new partner after considering the following revaluation and adjustments: 1. Allowance for doubtful accounts of P20,000 is to be established for…arrow_forwardKeri & Nick Consulting’s partners’ equity accounts reflected the following balances on August 31, 2020: Keri Lee, Capital $ 68,000 Nick Kalpakian, Capital 205,000 Lee and Kalpakian share profit/losses in a 2:3 ratio, respectively. On September 1, 2020, Liam Court is admitted to the partnership with a cash investment of $117,000.Required:Prepare the journal entry to record the admission of Liam under each of the following unrelated assumptions, where he is given:a. A 30% interest in equityb. A 20% interest in equityc. A 50% interest in equityarrow_forwardRequirement: Prepare statement of income, with a schedule showing distribution of profitsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education