FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

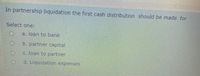

Transcribed Image Text:In partnership liquidation the first cash distribution should be made for

Select one:

a. loan to bank

b. partner capital

c. loan to partner

d. Liquidation expenses

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In a partnership liquidation, the final cash payment to the partners should be made in accordance with the*a. balance of partners' capital accounts.b. partner's profit and loss sharing ratio.c. ratio of the capital contributions by partners.d. safe payment computations.arrow_forwardAn incoming partner may acquire an interest in the partnership for a price in excess of that indicated by the book value of the original partnership’s net assets. This situation would suggest the existence of: a. Unrecognized Goodwill b. Recognized Profit c. Unrecognized capital d. Unrecognized excess of casharrow_forwardUnder what circumstance might goodwill be allocated to a new partner entering a partnership?arrow_forward

- What are the steps involved in a partnership liquidation?arrow_forwardHow does a newly formed partnership handle the contribution of previously depreciated assets?arrow_forwardOne of the final steps in terminating a partnership is the distribution of remaining assets to the partners after all obligations have been met. What is the basis for distributing any remaining assets/cash among the partners? How would loans from partners affect the distribution of partnership assets?arrow_forward

- What is a partnership dissolution? Does dissolution automatically necessitate the cessation of business and the liquidation of partnership assets?arrow_forwardThere is a liquidation of assets of a partnership. Describe the order in which assets must be distributed upon liquidation of a partnership, and explain the "right-of-offset" concept.arrow_forwardWhen a partnership is created, what is the contract called that gives the amounts invested by each partnership, how income and losses should be distributed, etc.? Group of answer choices partnership charter partnership partnership agreement none of thesearrow_forward

- What information do the capital accounts found in partnership accounting convey?arrow_forwardCurrent cash distributions from partnerships are nontaxable unless they exceed the partner's basis in the partnership. T or Farrow_forwardIn a partnership, distinguish between the goodwill and bonus methods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education