FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

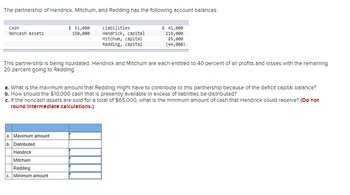

Transcribed Image Text:The partnership of Hendrick, Mitchum, and Redding has the following account balances:

Cash

Noncash assets

$ 51,000

150,000

Liabilities

Hendrick, capital

Mitchum, capital

Redding, capital

a. Maximum amount

b. Distributed:

Hendrick

Mitchum

Redding

c. Minimum amount

$ 41,000

119,000

85,000

(44,000)

This partnership is being liquidated. Hendrick and Mitchum are each entitled to 40 percent of all profits and losses with the remaining

20 percent going to Redding.

a. What is the maximum amount that Redding might have to contribute to this partnership because of the deficit capital balance?

b. How should the $10,000 cash that is presently available in excess of liabilities be distributed?

c. If the noncash assets are sold for a total of $65,000, what is the minimum amount of cash that Hendrick could receive? (Do not

round Intermediate calculations.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The E.N.D. partnership has the following capital balances as of the end of the current year: $ 280,000 240,000 210,000 190,000 $ 920,000 Pineda Adams Fergie Gomez Total capital Answer each of the following independent questions: a. Assume that the partners share profits and losses 3:3:2:2, respectively. Fergie retires and is paid $262,000 based on the terms of the original partnership agreement. If the goodwill method is used, what is the capital balance of the remaining three partners? b. Assume that the partners share profits and losses 4:3:2:1, respectively. Pineda retires and is paid $305,000 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (Do not round your intermediate calculations. Round your final answers to the nearest dollar amounts.) Capital Balance a. Pineda Adams Gomez b. Adams Fergie Gomezarrow_forwardA partnership has the following capital balances: Natalie (70% of gains and losses). Annie (30% of gains and losses)... Rachel is going to pay a $80,000 to these two partners to acquire a 20% interest from each. Goodwill is to be recorded. What's Natalie's capital balance after the transaction? $216,000 $200,000 $188,000 $235,000 ..$200,000 .$150,000arrow_forwardThe partnership of Winn, Xie, Yang, and Zed has the following balance sheet: Cash Other assets $ 39,000 256,000 Liabilities $ 51,000 Winn, capital (50% of profits and losses) Xie, capital (38%) 69,000 87,000 Yang, capital (10%) zed, capital (18%) 49,000 39,000 Zed is personally insolvent, and one of Zed's creditors is considering suing the partnership for the $5,000 that is currently owed. The creditor realizes that this litigation could result in partnership liquidation and does not wish to force such an extreme action unless Zed is reasonably sure of obtaining at least $5,000 from the liquidation. Required: a. Prepare a predistribution plan to determine the amount for which the partnership must sell the other assets to ensure that Zed receives $5,000 from the liquidation. Liquidation expenses are expected to be $24,000. b. For how much must the partnership sell the other assets to ensure that Zed receives $5,000 from the liquidation? Complete this question by entering your answers in…arrow_forward

- The following condensed balance sheet is for the partnership of Miller, Tyson, and Watson, who share profits and losses in the ratio of 6:2:2, respectively: Cash $ 50,000 Liabilities $ 42,000 Other assets 150,000 Miller, capital 69,000 Tyson, capital 69,000 Watson, capital 20,000 Total assets $ 200,000 Total liabilities and capital $ 200,000 a. Assuming no liquidation expenses, calculate the safe payments that can be made to partners at this point in time.arrow_forwardAdams, Peters, and Blake share profits and losses for their APB Partnership in a ratio of 2:3:5. When they decide to liquidate, the balance sheet is as follows: Assets Liabilities and Capital $ 49,000 Cash Adams, Loan Other Assets Total Assets 11,800 218,000 Liabilities Adams, Capital Peters, Capital Blake, Capital Total Liabilities and Equities $ 278,800 $ 45,500 64,900 88,500 79,900 $ 278,800 Liquidation expenses are expected to be negligible. No interest accrues on loans with partners after termination of the business. During the liquidation process for the APB Partnership, the following events occurred: 1. During the first month of liquidation, noncash assets with a book value of $89,500 were sold for $68,000, and $22,500 of the liabilities were paid. 2. During the second month, the remaining noncash assets were sold for $78,000. The loan receivable from Adams was collected, and the rest of the creditors were paid. 3. Cash is distributed to partners at the end of each month.…arrow_forwardA partnership has the following account balances: Cash, $84,000; Other Assets, $610,000, Liabilities, $374,000; Nixon (50% of profits and losses), $150,000; Cleveland (30%), $100,000; Pierce (20%), $70,000. The company liquidates, and $15,000 becomes available to the partners. Who gets the $15,000? 4- 5- The partnership of W, X, Y, and Z has the following balance sheet: Cash Other assets $50,000 305,000 Liabilities W, capital (50% of profits and losses) X, capital (30%) Y, capital (10%) Z, capital (10%) $ 60,000 80,000 105,000 60,000 50,000 Z is personally insolvent, and one of his creditors is considering suing the partnership for the $25,000 that is currently due. The creditor realizes that liquidation could result from this litigation and does not wish to force such an extreme action unless the creditor is reasonably sure of getting the money that is due. If the partnership sells the other assets, how much money must it receive to ensure that $25,000 would be available from Z's…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education