Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

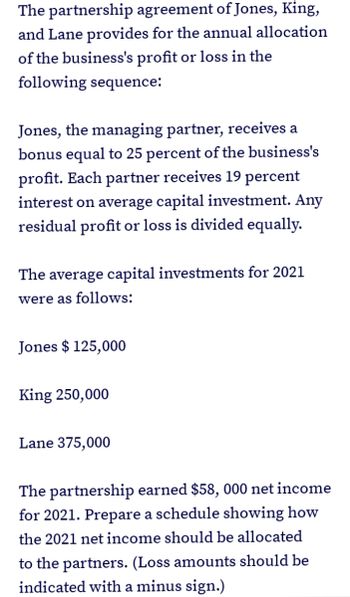

Transcribed Image Text:The partnership agreement of Jones, King,

and Lane provides for the annual allocation

of the business's profit or loss in the

following sequence:

Jones, the managing partner, receives a

bonus equal to 25 percent of the business's

profit. Each partner receives 19 percent

interest on average capital investment. Any

residual profit or loss is divided equally.

The average capital investments for 2021

were as follows:

Jones $ 125,000

King 250,000

Lane 375,000

The partnership earned $58, 000 net income

for 2021. Prepare a schedule showing how

the 2021 net income should be allocated

to the partners. (Loss amounts should be

indicated with a minus sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ben London owns and operates Fantastic Footage, a film-editing company in Los Angeles that does contract work mostly for production companies in Hollywood. Not long ago, a local landscaping business completed nearly $8,500 worth of work around London's offices. While the initial bid seemed a little high for the amount of work that was actually done, there is no question that the work completed was of high quality, and London finally feels comfortable inviting potential clients to meet him at his office to discuss possible deals. However, because of an apparent oversight, the landscaping contractor never submitted a bill. It's been more than 15 months since the completion of the project, and London has come to conclude that the contractor somehow lost track of the project. He is thinking about calling the company to ask for a final invoice so that he can settle up, but business has been really slow over the last year or so, and it hasn't been easy to pay all of the bills as it is.…arrow_forwardOn January 1, Oriole Corporation had 97,500 shares of no-par common stock issued and outstanding. The stock has a stated value of $6 per share. During the year, the following occurred. Apr. 1 Issued 29,500 additional shares of common stock for $19 per share. June 15 Declared a cash dividend of $3 per share to stockholders of record on June 30. July 10 Paid the $3 cash dividend. Dec. 1 Issued 1,000 additional shares of common stock for $18 per share. 15 Declared a cash dividend on outstanding shares of $4.90 per share to stockholders of record on December 31. (a) Prepare the entries to record these transactions. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forwardRead and analyze the following situation:Ms. Rosado, general manager of Rosado & Associates, finds herself in a financial dilemma. She must decide between firing 25% of the employees by paying them only 50% of the amount they are entitled to under the law or by paying them what they are legally entitled to. Complying with the law would entail closing the doors of the business and ending that source of employment, which for her would be a failure. Mrs. Rosado asks you for advice, you are in charge of handling aspects related to personnel in the company. You must answer the following discussion questions (You must demonstrate analysis and critical thinking when answering the questions):Explain in detail how Human Resources policies relate to a company's ethics and strategy. Provide examples of what was discussed.Do you think that the proposal to fire employees paying them less than what the law establishes is ethical?arrow_forward

- Marie Collins, owner of Grand Canyon Helicopter Adventures (a sole proprietorship), wants to expand her business. To do this, she needs an influx of cash and help running the business. Should she bring in her friend who is quite wealthy, is good at handling day-to-day operations, but has a less than perfect flying record? Or should she continue to fly solo? List the risks and benefits associated with bringing in the new partner. Are there other options?arrow_forwardTo acquire a 400,000 square foot industrial park in Boca Raton, Florida at a purchase price of $40 million, an investor put down 40% and borrowed $24 million with a 30-year fully amortizing fixed rate mortgage loan at an annual contract interest rate of 5% payable monthly. The borrower was charged two points by the lender that was deducted from the loan amount at closing. If the monthly payments on the loan were paid on time each month and if the loan was fully repaid at the end of 10 years with no prepayment penalty, what was the effective annual yield on the loan to the payoff date? a.5.28% b.5.38% c.5.18% d.5.08%arrow_forwardsubject; accoutingarrow_forward

- Answer please with correct optionarrow_forwardif julio ruiz has an income of $25,00, pays $6000 in rent, $1200, in utiliteis, and $5000 in taxes per year, his disposable income isarrow_forwardNylah and Toddare friends. Nylah is engaged and wants to have the wedding of her dreams, but she cannot afford it. Todd wants to help with this, so he tells Nylah he will give her $10,000 today, and she can pay him back in monthly installments of $100 beginning next month when she returns from her honeymoon. Nylah agrees and does have the wedding of her dreams. A month later, Todd asks Nylah for the first installment of $100. Nylah refuses. Todd sues Nylah. The court will a. order Nylah to pay Todd the money because there was consideration. b. not order Nylah to pay the money because there was nothing in writing. c. not order Nylah to pay the money because they are friends. d. order Nylah to pay Todd the money because there was noconsideration.arrow_forward

- In 2014, The W D Co. had total liabilities of $22,704 million and total assets of $43,679 million. In 2013, they had total liabilities of $21,990 million and total assets of $41,378 million. Calculate their debt to equity ratio for 2014 and 2013, respectively. a) 0.48 and 0.47 b) 0.52 and 0.53 c) 0.92 and 0.88 d) 1.08 and 1.13arrow_forwardA cattle producer purchased an insurance contract form the USDA Risk Management Agency. The contract pays a fixed dollar amount if and only if the rainfall in the 10 by 10 miles grid surrounding the producer’s land falls below 90 percent of the historical average rainfall. According to the lecture, this is a type of _____ insurance A cattle producer purchased an insurance contract form the USDA Risk Management Agency. The contract pays a fixed dollar amount if and only if the rainfall in the 10 by 10 miles grid surrounding the producer’s land falls below 90 percent of the historical average rainfall. According to the lecture, this is a type of _____ insurance weather pure parametric aggregate loss index parametric indexarrow_forwardYou own 1,260 shares in Corporation X that are worth $40 per share. Your cousin o° ers to trade you his 700 shares in Corporation Y that are worth $55 per share and will add $10,000 in cash. Should you make the trade?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON