Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

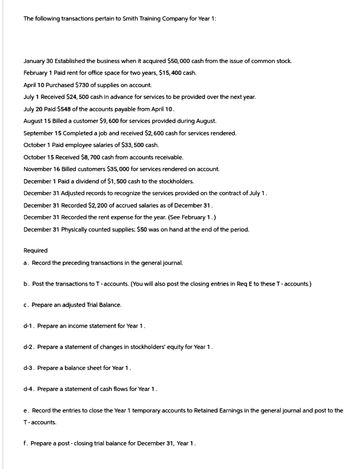

Transcribed Image Text:The following transactions pertain to Smith Training Company for Year 1:

January 30 Established the business when it acquired $50,000 cash from the issue of common stock.

February 1 Paid rent for office space for two years, $15,400 cash.

April 10 Purchased $730 of supplies on account.

July 1 Received $24,500 cash in advance for services to be provided over the next year.

July 20 Paid $548 of the accounts payable from April 10.

August 15 Billed a customer $9,600 for services provided during August.

September 15 Completed a job and received $2,600 cash for services rendered.

October 1 Paid employee salaries of $33,500 cash.

October 15 Received $8,700 cash from accounts receivable.

November 16 Billed customers $35,000 for services rendered on account.

December 1 Paid a dividend of $1,500 cash to the stockholders.

December 31 Adjusted records to recognize the services provided on the contract of July 1.

December 31 Recorded $2,200 of accrued salaries as of December 31.

December 31 Recorded the rent expense for the year. (See February 1.)

December 31 Physically counted supplies; $50 was on hand at the end of the period.

Required

a. Record the preceding transactions in the general journal.

b. Post the transactions to T - accounts. (You will also post the closing entries in Req E to these T-accounts.)

c. Prepare an adjusted Trial Balance.

d-1. Prepare an income statement for Year 1.

d-2. Prepare a statement of changes in stockholders' equity for Year 1.

d-3. Prepare a balance sheet for Year 1.

d-4. Prepare a statement of cash flows for Year 1.

e. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general journal and post to the

T-accounts.

f. Prepare a post-closing trial balance for December 31, Year 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- H5. Gabriella was in the business of purchasing sculptures from Brazil and selling them in Toronto at her boutique. On one consignment listed at $2,400, she received trade discounts of 9.00%, 7.00%, and 8.00%. The overhead expenses were 16.00% of her costs and she wanted to make a profit of 34.00% on cost. a. What is the regular selling price of the sculptures? b. Calculate the profit she will make if she decides to markdown the selling price by 16.00%. c. Calculate the maximum rate of markdown that she can offer so that she breaks even on the sale.arrow_forwardFor tax purposes, assume that the maximum taxable earnings are $118,500 for Social Security and $7,000 for the unemployment tax and that all earnings are taxable for Medicare. For the payroll register for the month of November for Shelby, Inc., determine the taxable earnings for each employee. If an amount is zero, enter "0". NAME BEGINNING CUMULATIVE EARNINGS TOTAL EARNINGS ENDING CUMULATIVE EARNINGS TAXABLE EARNINGS UNEMPLOYMENT SOCIAL SECURITY MEDICARE Axton, C. 109,798.00 10,668.00 120,466.00 Edgar, E. 145,398.00 19,392.00 164,790.00 0 Gorman, L. 36,979.00 3,041.00 40,020.00 0 Jolson, R. 24,149.00 2,440.00 26,589.00 Nixel, P. 6,813.00 2,214.00 9,027.00 Feedback Check My Work First, make sure that the amount of beginning Cumulative Earnings plus the total earnings for this pay period do not exceed the maximum amount for Social Security. If they do, only multiply the percentage times the amount that brings you to the maximum amount. For example: Beginning cumulative amount =…arrow_forwardsubject; accoutingarrow_forward

- The Time of Payment of Claims provision requires that an insurance company pay Disability Income benelit, no less frequently than A annually OB semiannually quarterly OD monthly C.arrow_forwardLoan interest income ► S.15(1)(i) 。 sums, not otherwise chargeable to tax under this Part (i.e. not chargeable under s.14), received by or accrued to a financial institution by way of interest which arises through or from the carrying on by the financial institution of its business in Hong Kong, notwithstanding that the moneys in respect of which the interest is received or accrues are made available outside Hong Kong 。 Contrast to s.14: arising in or derived from HK What does "arises through or from" mean? Loan interest income is deemed taxable even though the loan is made available outside Hong Kong? 74arrow_forward15. The annual increase diene cash duander value of a life insurance policy: a. Is taxed when the individual dies and the heirs collect the insurance proceeds. b. Must be included in gross income each year under the original issue discount rules. c. Reduces the deduction for life insurance expense. d. Is not included in gross in ych y sach year because of the substantial restrictions on gaining access to the policy's value.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON