FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

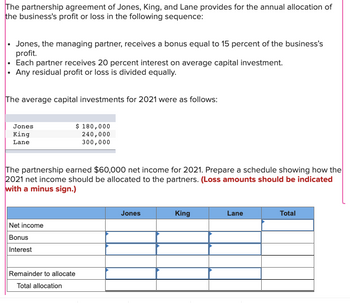

Transcribed Image Text:The partnership agreement of Jones, King, and Lane provides for the annual allocation of the business's profit or loss in the following sequence:

- Jones, the managing partner, receives a bonus equal to 15 percent of the business’s profit.

- Each partner receives 20 percent interest on average capital investment.

- Any residual profit or loss is divided equally.

The average capital investments for 2021 were as follows:

- Jones: $180,000

- King: $240,000

- Lane: $300,000

The partnership earned $60,000 net income for 2021. Prepare a schedule showing how the 2021 net income should be allocated to the partners. (Loss amounts should be indicated with a minus sign.)

### Allocation Schedule

| | Jones | King | Lane | Total |

|----------|------------|-----------|-----------|-----------|

| Net income | | | | $60,000 |

| Bonus | | | | |

| Interest | | | | |

| Remainder to allocate | | | | |

| Total allocation | | | | |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, the capital balances and income ratios in Sunland Company are as follows. Partner Capital Balance Income Ratio Trayer $ 64,500 50% Emig 35,000 30% Posada 34,500 20% (1) Each of the continuing partners agrees to pay $ 19,600 in cash from personal funds to purchase Posada’s ownership equity. Each receives 50% of Posada’s equity. (2) Emig agrees to purchase Posada’s ownership interest for $ 24,200 cash. (3) Posada is paid $ 37,700 from partnership assets, which includes a bonus to the retiring partner. (4) Posada is paid $ 25,780 from partnership assets, and bonuses to the remaining partners are recognized. Journalize the withdrawal of Posada under each of the following assumptions. If Emig’s capital balance after Posada’s withdrawal is $ 38,930, what were (1) the total bonus to the remaining partners and (2) the cash paid by the partnership to Posada?arrow_forwardJenkins, Willis, and Trent invested $252,000, $441,000, and $567,000, respectively, in a partnership. During its first year, the firm recorded profit of $639,000. d- The partners agreed to share profit by providing annual salary allowances of $123,000 to Jenkins, $133,000 to Willis, and $68,000 to Trent; allowing 10% interest on the partners’ beginning investments; and sharing the remainder equally. Record to close income summary account.arrow_forwardThe partnership contract of Ali & Yousif LLP provided for salaries of $45,000 to Ali and $35,000 to Yousif, with any remaining income or loss divided equally. During 2005, pre-salaries income of Ali & Yousif LLP was $100,000. During 2020, Ali's share of net income is: O a. 55000 O b. 37000 O c. 35000 O d. 45000arrow_forward

- The partnership agreement of Jones, King, and Lane provides for the annual allocation of the business's profit or loss in the following sequence: Jones, the managing partner, receives a bonus equal to 15 percent of the business’s profit. Each partner receives 14 percent interest on average capital investment. Any residual profit or loss is divided equally. The average capital investments for 2021 were as follows: Jones $ 100,000 King 200,000 Lane 300,000 The partnership earned $48,000 net income for 2021. Prepare a schedule showing how the 2021 net income should be allocated to the partners. (Loss amounts should be indicated with a minus sign.)arrow_forwardThe partnership agreement of Jones, King, and Lane provides for the annual allocation of the business's profit or loss in the following sequence: • Jones, the managing partner, receives a bonus equal to 15 percent of the business's profit. • Each partner receives 10 percent interest on average capital investment. Any residual profit or loss is divided equally. The average capital investments for 2021 were as follows: Jones King Lane The partnership earned $84,000 net income for 2021. Prepare a schedule showing how the 2021 net income should be allocated to the partners. (Loss amounts should be indicated with a minus sign.) Net income Bonus Interest $ 190,000 380,000 570,000 Remainder to allocate Total allocation Jones King Lane Totalarrow_forwardManjiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education