FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

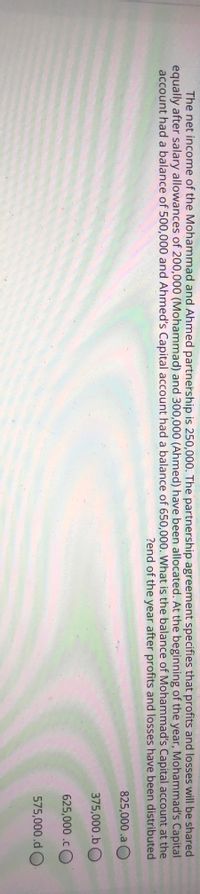

Transcribed Image Text:The net income of the Mohammad and Ahmed partnership is 250,000. The partnership agreement specifies that profits and losses will be shared

equally after salary allowances of 200,000 (Mohammad) and 300,000 (Ahmed) have been allocated. At the beginning of the year, Mohammad's Capital

account had a balance of 500,000 and Ahmed's Capital account had a balance of 650,000. What is the balance of Mohammad's Capital account at the

?end of the year after profits and losses have been distributed

825,000.a O

375,000.b O

625,000 .cO

575,000.d O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Answer the following three questions. Paul and Roger are partners who share income in the ratio of 3:2 (3/5 to Paul and 2/5 to Roger). Their capital balances are $90,000 and $130,000, respectively. The partnership generated net income of $50,000 for the year. What is Paul’s capital balance after closing the revenue and expense accounts to the capital accounts? a.$108,000 b.$115,000 c.$180,000 d.$120,000 Jackson and Campbell have capital balances of $100,000 and $300,000, respectively. Jackson devotes full time and Campbell devotes one-half time to the business. Determine the division of $150,000 of net income in the ratio of capital balances. a.$75,000 and $75,000 b.$37,500 and $112,500 c.$100,000 and $50,000 d.$50,000 and $100,000 Douglas pays Selena $42,600 for her 27% interest in a partnership with net assets of $126,700. Following this transaction, Douglas's capital account should have a credit balance of a.$126,700 b.$11,502 c.$42,600 d.$34,209arrow_forwardXavier and Yolanda have original investments of $47,500 and $90,200, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%; salary allowances of $27,600 and $29,900, respectively; and the remainder to be divided equally. How much of the net income of $115,900 is allocated to Yolanda? a. $18,040 b. $63,370 c. $76,044 d. $47,940arrow_forwardSadie and Sam share income equally. For the current year, the partnership net income is $40,000. Sadie made withdrawals of $14,000 and Sam made withdrawals of $15,000. At the beginning of the year, the capital account balances were: Sadie, Capital, $42,000; Sam, Capital, $58,000. Sam's capital account balance at the end of the year is Question 7 options: $78,000 $43,000 $63,000 $93,000arrow_forward

- Stolton and Bright are partners in a business they started two years ago. The partnership agreement states that Stolton should receive a salary allowance of $10,700 and that Bright should receive a $20,600 salary allowance. Any remaining income or loss is to be shared equally. Determine each partner's share of the current year's net income of $54,000. Note: Enter all allowances as positive values. Enter losses, if any, as negative values. Allocation of Partnership Income Stolton Net income Salary allowances Bright Total $ 54,000 0 Balance of income Balance allocated equally 0 Balance of income $ 0 Shares of the partners $ 0 $ 0arrow_forwardPeter and Paul are partners in a partnership. Their share of the partnership profits and losses are 60% and 40% respectively. Peter is a resident and Paul is a non-resident. In this income year, the partnership derived the following income: interest income from an Australian Bank Account: $30,000 interest income from an overseas bank account: $18,000 Calculate the net income of the partnership and explain how that amount will be allocated and assessed in the hands of Peter and Paul.arrow_forwardRobert and Matthew have a partnership agreement which includes the following provisions regarding sharing net income or net loss: 1. A salary allowance of $47,600 to Robert and $36,400 to Matthew. 2. An interest allowance of 10% on capital balances at the beginning of the year. 3. The remainder to be divided 70% to Robert and 30% to Matthew. The capital balance on January 1, 2020, for Robert and Matthew was $99,000 and $135,000, respectively. During 2020, the Robert and Matthew Partnership had sales of $496,000, cost of goods sold of $285,000, and operating expenses of $84,000. Prepare an income statement for the Robert and Matthew Partnership for the year ended December 31, 2020. As a part of the income statement, include a Division of Net Income to each of the partners.arrow_forward

- PLEASE ANSWER ALL THE FOLLOWING QUESTIONS 1. Seth and Beth have original investments of $50,000 and $100,000, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 10%; salary allowances of $27,000 and $18,000, respectively; and the remainder to be divided equally. How much of the net income of $42,000 is allocated to Seth? a.$32,000 b.$23,000 c.$20,000 d.$0 2. Tucker and Titus are partners who share income in the ratio of 3:1 (3/4 to Tucker and 1/4 to Titus). Their capital balances are $31,500 and $61,000, respectively. The partnership generated net income of $48,000 for the year. What is Tucker's capital balance after closing the revenue and expense accounts to the capital accounts? a.$67,500 b.$81,000 c.$40,500 d.$54,000 3. Xavier and Yolanda have original investments of $50,000 and $100,000, respectively, in a partnership. The articles of partnership include the…arrow_forwardRahularrow_forwardAssume that partners A and B share all profits and losses in the ratio of 3:2. Partner B has $100,000 credited to her Partnership Capital account when net income is allocated at year‐end. The amount of partnership net income for the year is ??? Why is the answer = $250,000?arrow_forward

- Ben and Carrie enter into a partnership agreement whereby they undertake to share profits according to the following rules: (a) Ben and Carrie will receive a salary of $1,500 and $13,500 respectively (b) The next allocation is based on 20% of the parner's capital balances ('c) Any remaining profit or loss is to be borne completely by Carrie The partnership's Net Income for the first year is $40,000. Ben's capital balance is $90,000 and Carrie's capital balance is $10,000 as at the end of the year. Calculate the share of profit/loss to be borne by Carrie. (it's asking for the total share of the Net Income Carrie will obtain) A $ 4,000.00 B $ 17,500.00 C $ 19,500.00 D $ 20,500.00arrow_forwardNancy and Betty enter into a partnership agreement whereby they undertake to share profits according to the following rules: (a) Nancy and Betty will receive a salary of $1,400 and $11,500 respectively. (b) The next allocation is based on 10% of the partner's capital balances. (c) Any remaining profit or loss is to be borne completely by Betty. The partnership's profit for the first year is $40,000. Nancy's capital balance is $88,000 and Betty's capital balance is $12,000 as at the end of the year. Calculate the share of profit/loss to be borne by Betty. Select one: a. $29,800 O b. $9,000 O c. $1,000 O d. $10,200arrow_forwardX, Y and Z are in partnership. X receives a salary of $14,000. If the profits for the year are $80,000 and the partners share profits equally, what is Y's share of the profits? A $14,000 B $22,000 C $26,000 D $26,667arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education