SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

financial account

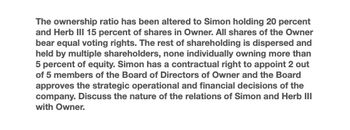

Transcribed Image Text:The ownership ratio has been altered to Simon holding 20 percent

and Herb III 15 percent of shares in Owner. All shares of the Owner

bear equal voting rights. The rest of shareholding is dispersed and

held by multiple shareholders, none individually owning more than

5 percent of equity. Simon has a contractual right to appoint 2 out

of 5 members of the Board of Directors of Owner and the Board

approves the strategic operational and financial decisions of the

company. Discuss the nature of the relations of Simon and Herb III

with Owner.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- general accountarrow_forwardA VIE has three equity holders, Equity Holder 1 owns 20% of the C/S. Equity holder 2 owns 30% of the C/S and equity holder 3 owns 50% of the C/S. Each of the equity holders has 2 votes on a 6-person board. The board makes all decisions affecting the VIE’s policies and practices. Determine which party, if any, is the primary beneficiary and explain briefly why.arrow_forward4) The articles of Spades Ltd. Provide, inter alia: i) Any shareholder appointed to the position of managing director shall hold the position for life. ii) Any shareholder who at any time wishes to transfer any or all of his shares shall first offer them to existing shareholders of the company who shall be obliged to purchase such shares at the original purchase price” In September, Karen, a shareholder, was appointed managing director of Spades Limited The Board of Directors has decided to dismiss Karen immediately because of her poor performance on the job to date. Joseph, a shareholder, wishes to sell his shares and has received an offer from Peter, who is not a shareholder, to buy shares well above the original price. Melissa, an existing shareholder, is adamant that she should be allowed to purchase Joseph’s shares at the original price. Joseph is the only shareholder who currently holds less than 5% of the shares of Spades Limited Question: Advise Karen and Melissa.arrow_forward

- ‘An associate is an entity over which the investor has significant influence’ (para 3). Which of the following indicate the presence of significant influence? A. The investor controls the votes of a majority of the board members B. The investor is able to insist that all of the sales of the investee are made to a subsidiary of the investor C. The investor owns 330,000 of the 1,500,000 equity voting shares of the investeearrow_forwardP Ltd owns 55% of the shares of S Ltd. Each share entitles the holder to one vote at the AGM.The decisions made at the AGM direct the relevant activities of S Ltd.Identify the correct statement(s) regarding control.(i) P Ltd holds the majority of the voting rights at the AGM.(ii) P ltd has the ability to use its majority voting rights at the AGM to affect its returns.(iii) P Ltd is not exposed to variable returns from S Ltd through dividends and the value of investment in S Ltd.(iv) P Ltd has control over S Ltd and S Ltd is a subsidiary of P Ltd.Select one:a.(i), (ii) and (iii)b.(i) and (iv)c.(i), (iii) and (iv)d.(i), (ii) and (iv)arrow_forwardAn associate is an entity in which an investor has significant influence over the investee.Which TWO of the following indicate the presence of significant influence?I The investor owns 360,000 of the 1,500,000 equity voting shares of the investee.II The investor has representation on the board of directors of the investee.III The investor is able to insist that all of the sales of the investee are made to a subsidiary of theinvestor.IV The investor controls the votes of a majority of the board membersA I and IIIB II and IVC I and IID III and IVarrow_forward

- Which of the following statements about business entity income is TRUE? Blair is a shareholder in a C corporation. She owns 55% of the shares and performs services for the company. Her wages will be reported on Form W-2, and her share of the company's ordinary income will be reported to her on Schedule K-1 (Form 1120). Estrada is a limited partner who materially participates in the partnership and receives guaranteed payments. The partnership will report her guaranteed payments on Schedule K-1 (Form 1065). Estrada's guaranteed payments will be subject to self-employment tax. O Laura is a shareholder in an S corporation. She owns 15% of the shares and does not perform services for the company. The company will report her share of income on Schedule K-1 (Form 1120-S). Laura will pay self-employment tax on her share of the ordinary income. O Tanita is a sole proprietor. She may report her business income on Schedule C (Form 1040) or Form 1065. Mark for follow uparrow_forwardAn associate is an entity in which an investor has significant influence over the investee. Which the following indicate the presence of significant influence? (I) The investor owns 660,000 of the 3,000,000 equity voting shares of the investee. (II) The investor has representation on the board of directors of the investee. (Ill) The investor is able to insist that all of the sales of the investee are made to a subsidiary of the investor. (IV) The investor controls the votes of a majority of the board members. Choose one of the correct pair. Please provide your explaination A) (I) , (II) B) (II), (Ill), (IV) C) (I), (III), (IV) D) (I), (II), (III), (IV) E) None of the above.arrow_forward1.) PT Patua owns 51% of PT Anaka's shares. The Board of Directors consists of 4 directors. There are 2 directors who are representatives of PT Patus. In every Board of Directors meeting, decision making is mostly determined by the director of PT Patua. Does PT Patua have control over PT Anaka under these conditions? Explain why using the IFRS 10 definition of control.arrow_forward

- Susan Casulla, Margie Landicho and Christine Supapo decided to incorporate their business and invited Irene Beltran and Eleanor Eno to join with them. The partnership shall transfer all assets and liabilities to the corporation. Irene Beltran and Eleanor Eno will purchase 250 each of the corporation’s ordinary share. The corporation is authorized to issue 5,000 shares at P50.00 par value per share. The post-closing trial balance after adjustments in preparation for incorporation follows: Yummy Cakes and Pastries Post-closing Trial Balance September 30, 20A Debit Credit Cash 40,000 Merchandise Inventory 70,000 Furniture and Equipment 100,000 Accumulated Depreciation 20,000 Accounts Payable…arrow_forwardWhich of the following situations are unlikely to represent control over an investee? A. Owning 51%, but the constitution requires that decisions need the unanimous consentof shareholders B. Having currently exercisable options which would take the shareholding in theinvestee to 55% C. Owning 40% of the shares but having majority of voting rights within the investee D. Owning 55% and being able to elect 4 of the 7 directorsarrow_forwardDale Fullerton was chairman of the board of Envirosearch and the sole stockholder in Westover Hills Management. James Anderson was president of AGFC. Fullerton and Anderson agreed to form a limited partnership to purchase certain property from WYORCO, a joint venture of which Fullerton was a member. The parties intended to form a limited partnership with Westover Hills Management as the sole general partner and AGFC and Envirosearch as limited partners. The certificate filed with the Wyoming Secretary of State, however, listed all three companies as both general and limited partners of Westover Hills Ltd. Anderson and Fullerton later became aware of this error and filed an amended certificate of limited partnership, which correctly named Envirosearch and AGFC as limited partners only. Subsequently Westover Hills Ltd. became insolvent. What is the liability of Envirosearch and AGFC to creditors of the limited partnership?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage