Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

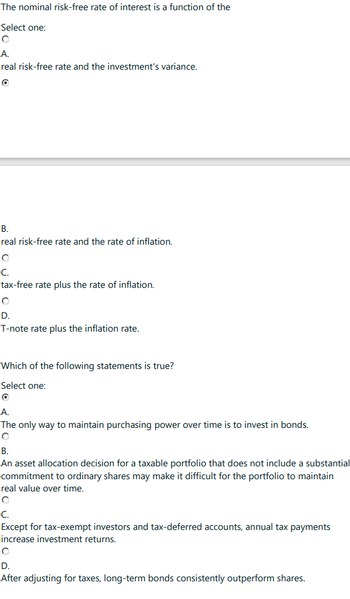

Transcribed Image Text:The nominal risk-free rate of interest is a function of the

Select one:

A.

real risk-free rate and the investment's variance.

B.

real risk-free rate and the rate of inflation.

C.

tax-free rate plus the rate of inflation.

D.

T-note rate plus the inflation rate.

Which of the following statements is true?

Select one:

A.

The only way to maintain purchasing power over time is to invest in bonds.

B.

An asset allocation decision for a taxable portfolio that does not include a substantial

commitment to ordinary shares may make it difficult for the portfolio to maintain

real value over time.

C.

Except for tax-exempt investors and tax-deferred accounts, annual tax payments

increase investment returns.

O

D.

After adjusting for taxes, long-term bonds consistently outperform shares.

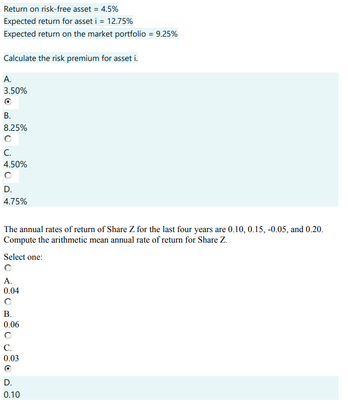

Transcribed Image Text:Return on risk-free asset = 4.5%

Expected return for asset i = 12.75%

Expected return on the market portfolio = 9.25%

Calculate the risk premium for asset i.

A.

3.50%

B.

8.25%

C.

4.50%

D.

4.75%

The annual rates of return of Share Z for the last four years are 0.10, 0.15, -0.05, and 0.20.

Compute the arithmetic mean annual rate of return for Share Z.

Select one:

A.

0.04

B.

0.06

C.

0.03

O

D.

0.10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 4. Explain what the Capital Asset Pricing Model (CAPM) is and calculate and explain the result of the CAPM based on the following data. a. Expected Return: 8% b. Risk-free rate: 4% c. Beta of the investment: 1.2 ER=Rf+B(ERm - Rf) where: ER = expected return of investment Rf risk-free rate B;= beta of the investment - (ERm - Rf) = market risk premiumarrow_forwardWhich of the following instruments has the highest cost? Seleccione una: a. Fed Funds b. Commercial Paper c. Eurodollars d. Prime ratearrow_forwardConsider the calculation of an external rate of return (ERR). The positive cash flows in the cash flow profile are moved forward to t = n using what value of i in the (F|P,i,n–t) factors? a. 0 b. The unknown value of ERR (i′) c. MARR d. IRR.arrow_forward

- 1. What is the most accurate measure of interest rates? a) Current Yield b) Nominal Interest Rate c) Simple Interest Rate d) Yield to Maturityarrow_forwardSome characteristics of the determinants of nominal interest rates are listed as follows. Identify the components (determinants) and the symbols associated with each characteristic: Characteristic It changes over time, depending on the expected rate of return on productive assets exchanged among market participants and people's time preferences for consumption. This is the rate on a Treasury bill or a Treasury bond. This is the premium added to the real risk-free rate to compensate for a decrease in purchasing power over time. It is based on the bond's credit rating; the higher the rating, the lower the premium added, thus lowering the interest rate. It is based on the bond's marketability and trading frequency; the less frequently the security is traded, the higher the premium added, thus increasing the interest rate. As interest rates rise over time, bond prices fall, and as interest rates fall, bond prices rise. Because interest rate changes are uncertain over the life of the…arrow_forward1. The return over the risk free rate of 3.4% A. Real return B. Average return C. Risk premium D. Required return E. Inflation premiumarrow_forward

- What-if forecasting provides information regarding how much net interest income changes when interest rates are assumed to increase/decrease by various amounts. Select one: True Falsearrow_forwardWith regard to interest rate sensitivity measures and bonds: Group of answer choices C. Convexity attempts to capture the sensitivity of a bond’s duration to changes in interest rates. D. Both B & C B. Duration is related to yield approximation and convexity is related to price. A. Convexity is related to yield approximation and duration is related to pricearrow_forwardWhat is the term for the type of interest rates that constitute the yield curve? What do these interest rates represent?arrow_forward

- By which symbol is the break-even interest rate denoted?arrow_forwardWhich of the following is true about Interest Rate? i. The Fisher Effect illustrates the positive relationship between inflation and nominal interest rates. ii. APR will always be greater than the EAR. iii. We can find the nominal interest rate by adding the default and maturity premiums to the sum of the real rate and inflation. O A. ii and i only O B. i and ii only OC. i only O D. i, ii, and iiiarrow_forwardThe slope of the Security Market Line equals to ____, and the slope of Capital Allocation Line equals to____. Select one: A. Beta; Sharpe Ratio B. Market Risk Premium; Sharpe Ratio C. Risk free rate; Volatility D. Market Risk Premium; Volatilityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education