FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

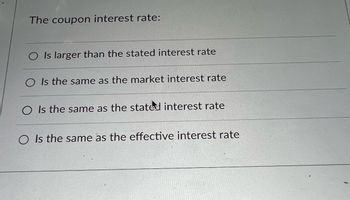

Transcribed Image Text:The coupon interest rate:

O Is larger than the stated interest rate

O Is the same as the market interest rate

O Is the same as the stated interest rate

O Is the same as the effective interest rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Interest Rate risk depends upon how sensitive the bond price is to interest rate changes (i.e., maturity and coupon rate). T/Farrow_forwardPlease expalin why this statement is (True). The traditional liquidity premium theory states that long-term interest rates are greater than the average of current and expected future short-term interest rates.arrow_forwardThe following figures illustrate which theory concerning interest rates? Yield to Maturity Time to Maturity Multiple Choice Yield to Maturity O liquidity premium theory O expectations hypotnesis Time to Maturity O term structure of interest rates risk structure of Interest rates Yield to Maturity Time to Maturityarrow_forward

- The yield to maturity on a bond a is fixed in the indenture. b is lower for higher-risk bonds. c is the required return on the bond. d is generally equal to the coupon interest rate.arrow_forwardHow does a bond’s current yield differ from its total return?arrow_forward1. What is the most accurate measure of interest rates? a) Current Yield b) Nominal Interest Rate c) Simple Interest Rate d) Yield to Maturityarrow_forward

- Some characteristics of the determinants of nominal interest rates are listed as follows. Identify the components (determinants) and the symbols associated with each characteristic: Characteristic It changes over time, depending on the expected rate of return on productive assets exchanged among market participants and people's time preferences for consumption. This is the rate on a Treasury bill or a Treasury bond. This is the premium added to the real risk-free rate to compensate for a decrease in purchasing power over time. It is based on the bond's credit rating; the higher the rating, the lower the premium added, thus lowering the interest rate. It is based on the bond's marketability and trading frequency; the less frequently the security is traded, the higher the premium added, thus increasing the interest rate. As interest rates rise over time, bond prices fall, and as interest rates fall, bond prices rise. Because interest rate changes are uncertain over the life of the…arrow_forwardConsider the supply and demand equilibrium bond graph of the market. Consider the effects of the following scenarios on bond prices, bond interest rates and equilibrium quantities traded. a. Firms expect a decrease in their future profits. b. Expected rises. inflationarrow_forwardWhat-if forecasting provides information regarding how much net interest income changes when interest rates are assumed to increase/decrease by various amounts. Select one: True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education