ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

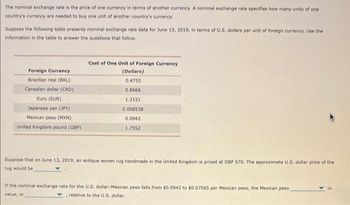

Transcribed Image Text:The nominal exchange rate is the price of one currency in terms of another currency. A nominal exchange rate specifies how many units of one

country's currency are needed to buy one unit of another country's currency.

Suppose the following table presents nominal exchange rate data for June 13, 2019, in terms of U.S. dollars per unit of foreign currency. Use the

information in the table to answer the questions that follow.

Foreign Currency

Brazilian real (BRL)

Canadian dollar (CAD)

Euro (EUR)

Japanese yen (JPY)

Mexican peso (MXN)

United Kingdom pound (GBP)

Cost of One Unit of Foreign Currency

(Dollars)

0.4755

0.8666

1.2151

0.008538

0.0942

1.7552

Suppose that on June 13, 2019, an antique woven rug handmade in the United Kingdom is priced at GBP 570. The approximate U.S. dollar price of the

rug would be

If the nominal exchange rate for the U.S. dollar-Mexican peso falls from $0.0942 to $0.07065 per Mexican peso, the Mexican peso

value, or

" relative to the U.S. dollar.

in

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 11. Pricing foreign goods The nominal exchange rate is the price of one currency in terms of another currency. A nominal exchange rate specifies how many units of one country's currency are needed to buy one unit of another country's currency. Suppose the following table forecasts nominal exchange rate data for February 1, 2019, in terms of Canadian dollars per unit of foreign currency. Use the information in the table to answer the questions that follow. Foreign Currency United States dollar (USD). euro (EUR) Japanese yen (JPY) Mexican peso (MXN) United Kingdom pound (GBP) Cost of One Unit of Foreign Currency (Dollars) 1.31 1.50 0.012 0.068 1.72 Source: "Bank of Canada," https://www.bankofcanada.ca/rates/exchange/daily-exchange-rates/. Suppose that on February 1, 2019, a marble statue handmade in Mexico is priced at 20,000 MXN. The approximate Canadian dollar price of the statue would bearrow_forwardSuppose that the Japanese yen rises against the U.S. dollar-that is, it will take more dollars to buy a given amount of Japanese yen. Explain why this increase simultaneously increases the real price of Japanese cars for U.S. consumers and decreases the real price of U.S. automobiles for Japanese consumers. dollars, and the purchase of a U.S. As the value of the yen grows relative to the dollar, the purchase of a Japanese automobile priced in yen requires automobile priced in dollars requires yen. more fewerarrow_forwardIf a country had exports of $100 billion and imports of $300 billion, they would be considered a net exporter or importerarrow_forward

- You work for the Bureau of Economic Analysis (BEA) of the U.S. Department of Commerce. Your supervisor gives you the following U.S. International Transactions Accounts for the Year 20XX (figures are in billions of dollars) and wants it reported in a coherent fashion in accordance with accepted conventions: Investment income payments (27.3); Export of goods 80.6; Balance of services 5.1; Capital outflow (44.5); Imports of goods (110.9); Change in Official Reserves 2; Investment income receipts 24.7; Capital inflow 73.6; Net unilateral transfers (3.3). (a) He wants you to compute the balances of trade, current account, capital account and statistical discrepancy. (b) He also wants you to find out (based on your calculation) if the U.S. is a net debtor or a net creditor and whyarrow_forwardYou work for the Bureau of Economic Analysis (BEA) of the U.S. Department of Commerce. Your supervisor gives you the following U.S. International Transactions Accounts for the Year 20XX (figures are in billions of dollars) and wants it reported in a coherent fashion in accordance with accepted conventions: Investment income payments $24; Export of goods $456; Balance of services $57; U.S purchases of foreign assets were $147.; Imports of goods $589; Change in Official Reserves $15; Investment income receipts $28; Foreign purchases of U.S. assets were $230; Net unliteral transfers were ($32). ($32) means -$32. a)- He wants you to compute the balances of trade, current account, capital account and statistical discrepancy. b)- He also wants you to find out (based on your calculation) if the U.S. is a net debtor or a net creditor. Explainarrow_forwardThis question relates to the following news article New Zealand dollar drops to lowest value against US dollar since 2020 (27/09/2022) The New Zealand dollar has dropped to its lowest value against its US equivalent since March 2020. The bad news for Kiwis is that it means it'll take longer for consumer price inflation to fall. ...a weak Kiwi dollar means importing is more expensive. "While we do expect inflation rates to slowly fall from here, the longer the New Zealand dollar remains low. the slower it will take for those inflation rates to fall." ASB senior economist Mark Smith said. Six months ago the New Zealand dollar was US68.9c - now it's at US56.6c, a fall of 18 percent. Aotearoa's dollar is suffering because the US dollar is being pumped up by the US Federal Reserve lifting interest rates to tackle inflation. "interest rates globally are going up, and when rates are going up, generally people tend to look to where their money will be safest, and at the moment it's certainly…arrow_forward

- eBook Problem 6-03 Consider the following information: Imports Net income from foreign investments Foreign investments in U.S. Government spending abroad Exports U.S. investments abroad Foreign securities bought by U.S. U.S. securities bought by foreigners Purchase of short-term foreign securities Foreign purchases of U.S. short-term securities $244.0 73.4 8.9 4.0 170.7 21.2 5.2 2.5 5.8 8.7 Determine the balance on the U.S. current account and capital accounts. Use a minus sign to enter the amount as a negative value. Round your answers to one decimal place. Balance on current account: $ Balance on capital account: $arrow_forwardIf in 2020 one Australian dollar exchanged for 0.75 U.S. dollars and in 2021 one Australian dollar exchanged for 0.69 U.S. dollars, then we know with certainty that: Australian goods became more expensive to Americans the Australian dollar depreciated relative to the U.S. dollar American goods became more expensive to Australians the U.S. dollar depreciated relative to the Australian dollar dollar the value of the Australian dollar did not changearrow_forwardSuppose the GDP of Honduras is 100,000 lempiras and the exchange rate between Honduran currency lempiras and USD is 20 lempira=$1. What is the GDP of Honduras when measured in USD?arrow_forward

- Give an example of how a change in the exchange rate alters the relative price of domestic goods in terms of foreign goods.arrow_forwardConsider the exchange rate between Jamaica and Tunisia. Typically, exchange rates vary over time, sometimes quite dramatically. The scenarios present various changes that may affect the exchange rate. Indicate whether each scenario will tend to cause an appreciation or depreciation of, or have no effect on, the value of Jamaican dollars relative to Tunisian dinars. The magazine The Economist publishes an article indicating that analysts expect the value of Tunisian dinars to rise relative to Jamaican dollars. The central bank in Jamaica announces that it will raise interest rates on government bonds. Based on a World Bank report, the inflation rate in Jamaica will be 1% next year, whereas the inflation rate in Tunisia will be 10.5%. The price of a specific basket of goods in Jamaica is roughly 2.0 times higher than the price of an identical basket of goods in Tunisia, even after adjusting for the exchange rate. Answer Bank appreciate no effect depreciatearrow_forwardYou are given the following information about an economy: Gross private domestic investment = 35 Government purchases of goods and services = 30 Gross national product (GNP) = 250 Current account balance = 10 Taxes = 40 Government transfer payments to the domestic private sector = 30 Interest payments from the government to the domestic private sector = 20 (Assume all interest payments by the government go to domestic households.) Factor income received from rest of world = 7 Factor payments made to rest of world = 8 Find the following, assuming that government investment is zero. Net factor payments from abroad = -1. (Enter your answer as a whole number.) GDP = 251. (Enter your answer as a whole number.) Net exports = (Enter your answer as a whole number.) Consumption = . (Enter your answer as a whole number.) Private saving = (Enter your answer as a whole number.) Government saving = (Enter your answer as a whole number.) National saving = (Enter your answer as a whole number.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education