FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

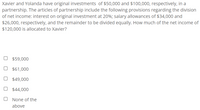

Transcribed Image Text:Xavier and Yolanda have original investments of $50,000 and $100,000, respectively, in a

partnership. The articles of partnership include the following provisions regarding the division

of net income: interest on original investment at 20%; salary allowances of $34,000 and

$26,000, respectively, and the remainder to be divided equally. How much of the net income of

$120,000 is allocated to Xavier?

$59,000

O $61,000

O $49,000

O $44,000

None of the

above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Xavier and Yolanda have original investments of $50,000 and $100,000, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 10%; salary allowances of $38,000 and $28,000, respectively; and the remainder to be divided equally. How much of the net income of $77,000 is allocated to Yolanda? Oa. $77,000 Ob. $36,000 Oc. $44,000 Od. $38,000arrow_forwardXavier and Yolanda have original investments of $51,500 and $100,100, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%; salary allowances of $27,200 and $29,600, respectively; and the remainder to be divided equally. How much of the net income of $114, 400 is allocated to Xavier? a. $37,500 b. $61, 368 с. $51,140 d. $27,200arrow_forwardMay, Jun, and Julie have partnership capital account balances of P225,000, P450,000 and P105,000, respectively. The income sharing ratio is May, 50%; Jun, 40%; and Julie, 10%. May desires to withdraw from the partnership and it is agreed that partnership assets of P195,000 will be used to pay May for her partnership interest. How much is the balance of Jun's capital account after May's withdrawal using the asset revaluation method?arrow_forward

- Xavier and Yolanda have original investments of $46,000 and $103,600, respectively, in a partnership. The articles of partnership include the following provisions regarding the division of net income: interest on original investment at 20%; salary allowances of $26,800 and $31,800, respectively; and the remainder to be divided equally. How much of the net income of $111,000 is allocated to Xavier? Oa. $47,240 Ob. $56,688 Oc. $36,000 Od. $26,800arrow_forwardAhmed contributes cash of $12, 000 and Fatima contributes Office equipment that cost $10,000but valued at $8,000, during the first-year partners earn a profit of $5, 000. Assume the partners agreed to share the profit and loss equally.1. Prepare a journal entry to form the partnership? 2. How much profit should each partner earned?arrow_forwardDouglas pays Selena $45,700 for her 25% interest in a partnership with net assets of $127,900. Following this transaction, Douglas's capital account should have a credit balance of a. $45,700 b. $127,900 c. $11,425 d. $31,975arrow_forward

- Sue and Andrew form SA general partnership. Each person receives an equal interest in the newly created partnership. Sue contributes $16,000 of cash and land with an FMV of $61,000. Her basis in the land is $26,000. Andrew contributes equipment with an FMV of $18,000 and a building with an FMV of $39,000. His basis in the equipment is $14,000, and his basis in the building is $26,000. How much gain must the SA general partnership recognize on the transfer of these assets from Sue and Andrew?arrow_forwardShirley contributes property to a new partnership with a value of $1,000,000 and a basis of $400,000 that is secured by a $500,000 nonrecourse note. Under the terms of the partnership agreement, Shirley will be allocated 25% of all profits. The partnership agreement also states that "excess nonrecourse liabilities" will be allocated to partners according to profit ratios. How much of the nonrecourse liability will be allocated to Shirley? please dont provide answer in images thank youarrow_forwardthree partners, John, Jim, and Alice form a partnership. John invests $27,500; Jim invests $10,700, and Alice invests $8,400. In addition, Jim performs specific management functions for which he is paid $2,000 from the partnership proceeds. if the partnership earns $176,000, how much will jim receive?arrow_forward

- The partners of Triple A Partnership are Adah, Ana and Ara. During the current year, their average capital balances are as follows: Adah –P 180,000; Ana – P160,000; Ara - P 150,000. The articles of partnership provided the following terms: 1. Annual interest of 8% on their average capital balances. 2. Salary allowances as follows: Adah – P 50,000 and Ana - P 80,000. 3. Ana shall receive bonus of 15% of income in excess of P40,000 after partner's interest and salary allowances. 4. Residual profits shall be divided in the ratio of 2:2:6 to Adah, Ana and Ara. What amount will Ana receive if the net income earned is P 470,000? *arrow_forwardThe partnership of Magda and Sue shares profits and losses in a 50:50 ratio after Mary receives a $7,000 salary and Sue receives a $6,500 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: A $10,000 C. ($12,000)arrow_forwardJerry and Sherry own and operate a partnership. Jerry’s capital balance is $50,000 and Sherry’s is $55,000. Jerry and Sherry decided to admit a new partner, Allison, to their partnership. By the terms of their partnership agreement, Jerry and Sherry share income/loss equally. Allison intends to contribute $40,000 cash to receive a twenty-five percent interest in the partnership Required: a. Revalue the partnership assets b. Determine the total equity of the partnership after the new partner is admitted c. Determine the new partner share of the total equity d. Determine the bonus resulting from Allison’s equity of her contribution e. Make journal entries to record Allison’s admission to the partnership. Please solve sub-part e. Show Your Work:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education