FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:00:01:52

The net advantage (disadvantage) of processing Sweet Meats further is:

Multiple Choice

a $25,000 advantage to process further.

a $25,000 disadvantage to process further.

a $282,143 disadvantage to process further.

a $32,143 advantage to process further.

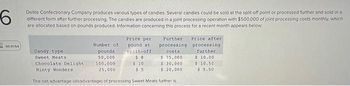

Transcribed Image Text:6

Delite Confectionary Company produces various types of candies. Several candies could be sold at the split-off point or processed further and sold in a

different form after further processing. The candies are produced in a joint processing operation with $500,000 of joint processing costs monthly, which

are allocated based on pounds produced. Information concerning this process for a recent month appears below:

-- ૦૦૧

Price per

pound at

split-off

$8

$10

$5

Further Price after

Number of

pounds

50,000

processing

costs

$ 75,000

Chocolate Delight

100,000

$ 30,000

Minty Wonders

25,000

$ 20,000

The net advantage (disadvantage) of processing Sweet Meats further is:

Candy type

Sweet Meats

processing

further

$ 10.00

$10.50

$5.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vikrambhaiarrow_forwardHw.3. Jenelle Heinke, the owner of Ha'Peppas Pizza is considering a new oven in which to bake the firm's signature disk, veggie pizza. Oven type A can handle 25 pizzas per hour. The fixed costs with oven A are $25,000 and the variable costs are $2.50 per pizza. Oven B is larger and can handle 40 pizzas an hour. The fixed cost associated with oven B is $30,000 and the variable costs are $1.50 per pizza. The pizzas sell for $15 each. a) What is the break-even point for each oven? b) what is fixed coast? c) what is revenue? d) variable coast? what is BEP for pizzas?arrow_forwardMesa Cheese Company has developed a new cheese slicer called Slim Slicer. The company plans to sell this slicer through its online website. Given market research, Mesa believes that it can charge $20 for the Slim Slicer. Prototypes of the Slim Slicer, however, are costing $22. By using cheaper materials and gaining efficiencies in mass production, Mesa believes it can reduce Slim Slicer's cost substantially. Mesa wishes to earn a return of 40% of the selling price. (b) When is target costing particularly helpful in deciding whether to produce a given product?arrow_forward

- Solve 2, the first answer is the wrong. Find the lowest acceptable transfer price.arrow_forwardCan you please explain the statement with an example? Also, check whether my understanding of the example is correct. "If using the same unit fixed costs at different output levels, managers may reach erroneous conclusions. Total fixed costs should be used." My Understanding: For example, if the capacity is 1000 and currently we produce 1000 units and sell it for $20 per unit, variable cost $5 and the fixed cost $10 per unit (within the relevant range); and we have a special order to produce 1200 units for $8 per unit. Should we include additional the Total Fixed Cost of $10000, which is (10*1000) for the range (1001-2000) plus $10000 for the range (0-1000), which means, we will have a total fixed cost of $20000.arrow_forwardBroomfield Corp. has 1,000 carton of oranges that cost $50 per carton in direct costs and $26.50 per carton in indirect costs and sold for $70 per carton. The oranges can be processed further into orange juice at an additional cost of $22.50 and sold at a price of $126. The incremental income (loss) from processing the oranges into orange juice would be: Multiple Choice ($100,500). $103,500. $92,500. $100,500. $93,500.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education