FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

For the Beach Comber problem, what shelf space allocation (in feet) for Monster, V6, and Punch maximizes the daily contribution from ALL drink sales, and what is the total contribution margin per day (rounded to the nearest dollar) from that optimal shelf space allocation? (Consider lemonade in solving the problem even though the question does not ask you to indicate how many feet of shelf space is allocated to lemonade in the optimal solution.) (Also, please enter numbers ONLY--for example, do not enter "$" or "feet")

Monster:

V6:

Punch:

Total CM/day:

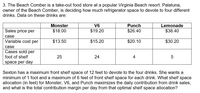

Transcribed Image Text:3. The Beach Comber is a take-out food store at a popular Virginia Beach resort. Palatuna,

owner of the Beach Comber, is deciding how much refrigerator space to devote to four different

drinks. Data on these drinks are:

Monster

V6

Punch

Lemonade

Sales price per

$18.00

$19.20

$26.40

$38.40

case

Variable cost per

$13.50

$15.20

$20.10

$30.20

case

Cases sold per

foot of shelf

25

24

4

5

space per day

Sexton has a maximum front shelf space of 12 feet to devote to the four drinks. She wants a

minimum of 1 foot and a maximum of 6 feet of front shelf space for each drink. What shelf space

allocation (in feet) for Monster, V6, and Punch maximizes the daily contribution from drink sales,

and what is the total contribution margin per day from that optimal shelf space allocation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Image of whole problem included. If possible, I would like a full detailed explanation for how to find the Contribution due to net new volume and The increase in total contributionarrow_forwardI need help figuring out how the Break Even units. You have conducted some market research for style and size of products you want to use to launch your business. The market research has indicated the following sales price ranges will be optimal for your area depending on style of products you choose to sell: ● Collars o With pricing at $20 per collar, you can expect to sell 30 collars per day. o With pricing at $24 per collar, you can expect to sell 25 collars per day. o With pricing at $28 per collar, you can expect to sell 20 collars per day ● Leashes o With pricing at $22 per leash, you can expect to sell 28 leashes per day. o With pricing at $26 per leash, you can expect to sell 23 leashes per day. o With pricing at $30 per leash, you can expect to sell 18 leashes per day. ● Harnesses o With pricing at $25 per harness, you can expect to sell 25 harnesses per day. o With pricing at $30 per harness, you can expect to sell 22 harnesses per day. o With pricing at $35 per harness, you…arrow_forwardConsider McDonald’s for a moment and list an example of each of the following costs that would be incurred by a McDonald’s restaurant: (a) a fixed cost, (b) variable cost, and (c) mixed cost. Please be specific and explain why each is a good fit in that category. (Note: For the variable cost on your list, please identify the activity base (driver))arrow_forward

- The line that begins at the origin on a CVP graph represents total expenses. total fixed expenses. total sales revenues. both the total expenses and the total sales revenues. Which of the following best describes the concept of a "constraint?" Expected future costs that differ among alternatives. None of the items in this list of answers. A benefit foregone by choosing one alternative course over another. The distribution of all products to be sold.arrow_forwardSolve the quantitative analysis problembelow: Formulas: BEP : Fixed cost / (selling price per unit)-(variable cost per unit) : f / s - v profit : sX - f - vX (selling price per unit)(number of units sold) - [fixed cost + ( variable costs per unit)(number of units sold)] Jacob&Zach Co is a company that offers financial advice for people want to plan their retirement ahead of time. This company offers seminars and trainings on important topics related to retirement planning. For every seminar, the company rents a conference hall for P5,000.00. The company also spends a total of P7,500.00 to cover the cost of advertising and other expenses related to the conduct of the seminar. In every seminar, the company gives token to all attendees and each token costs P85.00. Lastly, the companycharges P350.00 per person who wants to attend seminar. Questions:1.) How many people should attend the seminar to break-even? 2.) Given this BEP number, how much is the a. revenue?b.…arrow_forward1. Complete the following comparison alternatives. Per 600 pounds Process Further Sell Difference Revenues Bags Shipping Grinding 2. Should Zanda sell depryl at split-off, or should depryl be processed and sold as tablets and why. 3. If Zanda normally sells 265,000 pounds of depryl per year, what will be the difference in profits, in dollars, if deprul is processed further? Bottles Totalarrow_forward

- Requirement 1. If SnowDelights cannot reduce its costs, what profit will it earn? State your answer in dollars and as a percent of assets. Will investors be happy with the profit level? Complete the following table to calculate SnowDelights' projected income. Revenue at market price Less: Total costs Operating income (Round the percentage to the nearest hundredth percent, X.XX%.) SnowDelights's projected operating income (profit) as a percent of assets amounts to Will investors be happy with this profit level? %.arrow_forwardImagine that you could increase the price for a product that has a profit margin of 8% on its price. If you could increase the price by 1% AND simultaneously keep the sales volume (in unit terms) at the same level as before the price increase, calculate the impact of this price increase on the profit margin. (For this question, assume there are no fixed costs. You just need to calculate the PERCENTAGE CHANGE in profit margin)arrow_forwardPlease I want to learn how to make these problems with a good explanation. One of those there is the possible answer. I need only question 1 Thank youarrow_forward

- Which of the following are reasonable ways to deal with excess demand? (select ALL correct answers) increase advertising reduce prices reduce advertising use all available capacity to make the product with the highest CM per unit of capacityarrow_forwardSuppose that the profit (in dollars) from the sale of Kisses and Kreams is given by P(x, y) = 10x + 6.9y-0.001x²-0.045y² where x is the number of pounds of Kisses and y is the number of pounds of Kreams. Find P/ay, and give the approximate rate of change of profit with respect to the number of pounds of Kreams that are sold if 100 pounds of Kisses and 14 pounds of Kreams are currently being sold. (Give an exact answer. Do not round.) What does this mean? If the number of pounds of Kisses is held constant and the number of pounds of Kreams is increased from 14 to 15, the profit will increase by approximately $ Need Help? Read It Watch itarrow_forwardCompute breakeven sales. (Use the rounded contribution margin ratio calculated in the previous part to compute breakeven sales.) Breakeven sales eTextbook and Media Save for Later (b2) S What is Pharoah's margin of safety? Margin of safety $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education