FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

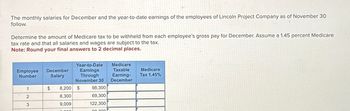

Transcribed Image Text:The monthly salaries for December and the year-to-date earnings of the employees of Lincoln Project Company as of November 30

follow.

Determine the amount of Medicare tax to be withheld from each employee's gross pay for December. Assume a 1.45 percent Medicare

tax rate and that all salaries and wages are subject to the tax.

Note: Round your final answers to 2 decimal places.

Employee

Number

December

Salary

Year-to-Date

Earnings

Medicare

Taxable

Medicare

Through

Earning-

Tax 1.45%

November 30

December

1

$

8,200

$

98,300

2

8,300

69,300

3

9,009

122,300

00:20

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- River Signorini works for New & Old Apparel, which pays employees on a semimonthly basis. River's annual salary is $177,500. Required: Calculate the following Note: Round your final answers to 2 decimal places. Pay Date Prior YTD Earnings October 15 December 31. Social Security Taxable Wages Medicare Taxable Wages Employer Share Social Security Taxi Employer Share Medicare Taxarrow_forwardThe payroll records of Speedy Software show the following information about Marsha Gottschalk, an employee, for the weekly pay period ending September 30. Gottschalk is single and claims one allowance. Compute her Social Security tax (6.2%), Medicare tax (1.45%), federal income tax withholding (use the withholding table in Exhibit 11A.6), state income tax (1.0%), and net pay for the current Day period.arrow_forwardRiver Signorini works for New & Old Apparel, which pays employees on a semimonthly basis. River's annual salary is $193,000. Required: Calculate the following: Note: Round your final answers to 2 decimal places. Pay Date October 13 Prior YTD Earnings Social Security Taxable Wages Medicare Taxable Wages Employer Share Social Security Tax Employer Share Medicare Tax December 29arrow_forward

- During the month of January, an employer incurred the following payroll taxes FICA Social Security taxes of $334.80, FICA Medicare taxes of $78 30, FUTA taxes of $3240, and SUTA taxes of $291.60. Prepare the journal entry to record the employer's payroll tax expense assuming these wages will be paid in early February. (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet Record employer payroll tax expense. Note Enter debits before credits. Date General Journal Debit Credit January 31arrow_forwardDogarrow_forwardA company's payroll records report $3,460 of gross pay and $484 of federal income tax withholding for an employee for the weekly pay period. Compute this employee's FICA Social Security tax (6.2%), FICA Medicare tax (1.45%), state income tax (1.0%), and net pay for the current pay period. Note: Round your final answers to 2 decimal places. Gross pay FICA Social Security tax deduction FICA Medicare tax deduction Federal income tax deduction State income tax deduction Total deductions Net payarrow_forward

- Step by step solutionarrow_forwardSolve the problem using 6.2%, up to $128,400 for Social Security tax and using 1.45%, no wage limit, for Medicare tax. Calculate the monthly Social Security and Medicare withholdings (in $) for the employee as the payroll manager for a cargo and freight company. Year-to-Date Employee Earnings Current Month Social Security Graham, C. $14,300 $1,780 Medicarearrow_forwardK t ht ences The employees of Ethereal Bank are paid on a semimonthly basis. All employees are single. There are no pre-tax deductions. Required: Compute the FICA taxes for the employees for the November 30 payroll. All employees have been employed for the entire calendar year. Note: Round "Social Security Tax" and "Medicare Tax" to 2 decimal places. Employee R. Bellagio B. Khumalo S. Schriver K. Saetang T. Ahmad M. Petrova Semimonthly Pay $ $ $ $ $ $ 9,519 6,719 6,838 8,200 10,700 9,050 YTD Pay for November 15 Pay Date Social Security Tax for November 30 Pay Date Medicare Tax for November 30 Pay Datearrow_forward

- Use the percentage method to compute the federal income taxes to withhold from the wages or salaries of each employee. If an amount is zero, enter "0". If required, round your calculations and final answers to the nearest cent. EmployeeNo. Employee Name Marital Status No. of WithholdingAllowances Gross Wageor Salary Amountto BeWithheld 1 Amoroso, A. M 4 $1,610 weekly $fill in the blank 1 2 Finley, R. S 0 825 biweekly fill in the blank 2 3 Gluck, E. S 5 9,630 quarterly fill in the blank 3 4 Quinn, S. M 8 925 semimonthly fill in the blank 4 5 Treave, Y. M 3 2,875 monthlyarrow_forwardAssume a tax rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare. No one will reach the maximum for FICA. Complete the following payroll register. (Use the percentage method to calculate FIT for this weekly period.) (Use Table 9.1). Note: Do not round intermediate calculations and round your final answers to the nearest cent. Employee Pat Brown Marital status S Gross pay $ 1,900 FIT Social Security FICA Medicare Net payarrow_forwardes For last week, calculate the amount of social security and Medicare taxes to be withheld in each case. Note: Round your intermediate calculations and final answers to 2 decimal places. Employee Blue Bonnett Charlie Lee Cumulative Earnings Earnings Year-to-Date Last Week $150,500.00 $3,500.00 100,500.00 2,500.00 Social Security Tax Withheld Medicare Tax Withheldarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education