Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Accounting question

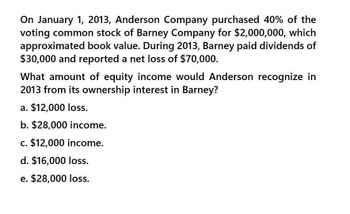

Transcribed Image Text:On January 1, 2013, Anderson Company purchased 40% of the

voting common stock of Barney Company for $2,000,000, which

approximated book value. During 2013, Barney paid dividends of

$30,000 and reported a net loss of $70,000.

What amount of equity income would Anderson recognize in

2013 from its ownership interest in Barney?

a. $12,000 loss.

b. $28,000 income.

c. $12,000 income.

d. $16,000 loss.

e. $28,000 loss.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need answer the questionarrow_forwardQuestion: On January 1, 2011, Anderson Company purchased 40% of the voting common stock of Barney Company for $2,000,000, which approximated book value. During 2011, Barney paid dividends of $30,000 and reported a net loss of $70,000. What amount of equity income would Anderson recognize in 2011 from its ownership interest in Barney?arrow_forwardIncomearrow_forward

- On July 1, 2015, Cleopatra Corporation acquired 25% of the shares of Marcus, Inc. for P1,000,000. At that date, the equity of Marcus was P4,000,000, with all the identifiable assets and liabilities being measured at amounts equal to fair value. The table below shows the profits and losses made by Marcus during 2015 to 2019: Year Profit (Loss) 2015 200,000 2016 2,000,000 2017 2,500,000 2018 160,000 2019 300,000 How much will the Investment in Associate account be debited/credited in 2018? P1,035,000 Cr. P1,060,000 Cr. P40,000 Dr. No entry How much will the Investment in Associate account be debited/credited in 2019? P960,000 Cr. No Entry P15,000 Dr. P75,000 Dr.arrow_forwardOn January 1, 2012, Par Company purchased 80% of the common stock of Sar Company for $640,000. On this date, Sar had common stock, other paid-in capital, and retained earnings of $120,000, $220,000, and $360,000, respectively. Net income and dividends for 2 years for Sar Company were as follows: 2012 2013 Net income $200,000 $250,000 Dividends 30,000 60,000 On January 1, 2012, the only tangible assets of Sar that were undervalued were inventory and building. Inventory, for which FIFO is used, was worth $20,000 more than cost. The inventory was sold in 2012. Building, which was worth $40,000 more than book value, has a remaining life of 10 years, and straight-line depreciation is used. Any remaining excess is goodwill. Required: Please show all of your computations in good form Prepare a value analysis schedule Prepare a determination and distribution of excess schedule Prepare Par’s 2012 and 2013 journal entries (after the purchase has been…arrow_forwardOn January 1, 2015, Paro Company purchases 80% of the common stock of Solar Company for $320,000. On this date, Solar has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $100,000, and $150,000, respectively. Net income and dividends for two years for Solar Company are as follows: 2015 2016Net income . . . . . . . . . . . . . . . . . . . . .$60,000 $90,000Dividends. . . . . . . . . . . . . . . . . . . . . . . 20,000 30,000On January 1, 2015, the only undervalued tangible assets of Solar are inventory and the building. Inventory, for which FIFO is used, is worth $10,000 more than cost. The inventory is sold in 2015. The building, which is worth $30,000 more than book value, has a remaining life of 10 years, and straight-line depreciation is used. The remaining excess of cost over book value is attributable to goodwill.The trial balances for Paro and Solar are as…arrow_forward

- Power Corporation purchased a 70% interest in Star Company on January 1, 2013 for P140,000, when Star’s stockholders’ equity consisted of P30,000 common stock, P100,000 additional paid-in-capital, and P200,000 retained earnings. Income and dividends data for Star are as follows: Net income (or loss) P50,000 Dividends 5,000 NCI is measured at fair value What is the NCI at December 31, 2013? P149,600 P148,000 P73,500 P151,370arrow_forwardOn July 1, 2016 TICKLE Company purchased 80% of the outstanding shares of DOODLE Company at a cost of P1,600,000. On that date, DOODLE had P1,000,000 of capital stock and P1,400,000 of retained earnings. For 2016, TICKLE had income of P560,000 from its separate operations and paid dividends of P300,000. For 2016, DOODLE reported income of P130,000 and paid dividends of P60,000. All the assets and liabilities of DOODLE have book values equal to their respective fair market values. Assume income was earned evenly throughout the year except for the intercompany transaction on October 1. On October 1, TÍCKLE purchased an equipment from DOODLE for P200,00O. The book value of the equipment on that date was P240,000. The loss of P40,000 is reflected in the income of DOODLE indicated above. The equipment is expected to have a useful life of 5 years from the date of sale. In the December 31, 2016 consolidated statement of financial position, determine the consolidated net income attributable to…arrow_forwardAssume that Horicon Corp acquired 25% of the common stock of Sheboygan Corp. on January 1, 2015, for $300,000. During 2015, Sheboygan Corp. reported net income of $160,000 and paid total dividends of $60,000. If Horicon uses the equity method to account for its investment, the balance in the investment account on December 31, 2015, will be:arrow_forward

- On January 1, 2015, Paro Company purchases 80% of the common stock of Solar Company for $320,000. Solar has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $100,000, and $150,000, respectively. Net income and dividends for two years for Solar are as follows: 2015 2016Net income . . . . . . . . . . . . . . . . . . . . . . $60,000 $90,000Dividends. . . . . . . . . . . . . . . . . . . . . . . . 20,000 30,000On January 1, 2015, the only undervalued tangible assets of Solar are inventory and the building. Inventory, for which FIFO is used, is worth $10,000 more than cost. The inventory is sold in 2015. The building, which is worth $30,000 more than book value, has a remaining life of 10 years, and straight-line depreciation is used. The remaining excess of cost over book value is attributed to goodwill.1. Using this information and the information in the following…arrow_forwardOn January 1, 2015, Paro Company purchases 80% of the common stock of Solar Company for $320,000. On this date, Solar has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $100,000, and $150,000, respectively. Net income and dividends for two years for Solar Company are as follows: 2015 2016 Net income . . . . . . . . . . . . . . . . . . . . . . $60,000 $90,000 Dividends. . . . . . . . . . . . . . . . . . . . . . . . 20,000 30,000 On January 1, 2015, the only undervalued tangible assets of Solar are inventory and the building. Inventory, for which FIFO is used, is worth $10,000 more than cost. The inventory is sold in 2015. The building, which is worth $30,000 more than book value, has a remaining life of 10 years, and straight-line depreciation is used. The remaining excess of cost over book value is attributable to goodwill. 1. Using this…arrow_forwardOn January 1 2013, Ahmed Company purchased 90,000 of the 100,000 outstanding shares of common stock of Singer Company as a longer-term investment. The purchase price of OMR 4,850,000 was paid in cash. Additional data on Singer Company for the four years following the purchase are 2013 2014 2015 2016 Net Income (loss) 1,800,000 700,000 (320,000) (260,000) Cash dividends paid, 12/30 500,000 500,000 500,000 500,000 Required: Prepare journal entries under each of the following methods to record the purchase and all investment-related subsequent events on the books of Ahmed Company for the four years. Ahmed uses the cost method to account for its investment in Singer. Ahmed uses the partial equity method to account for its investment Singer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning