ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

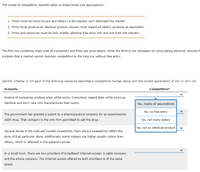

Transcribed Image Text:The model of competitive markets relies on these three core assumptions:

1. There must be many buyers and sellers-a few players can't dominate the market.

2. Firms must produce an identical product-buyers must regard all sellers' products as equivalent.

3. Firms and resources must be fully mobile, allowing free entry into and exit from the industry.

The first two conditions imply that all consumers and firms are price takers. While the third is not necessary for price-taking behavior, assume f

problem that a market cannot maintain competition in the long run without free entry.

Identify whether or not each of the following scenarios describes a competitive market, along with the correct explanation of why or why not.

Scenario

Competitive?

Dozens of companies produce plain white socks. Consumers regard plain white socks as

identical and don't care who manufactures their socks.

Yes, meets all assumptions

No, no free entry

The government has granted a patent to a pharmaceutical company for an experimental

AIDS drug. That company is the only firm permitted to sell the drug.

No, not many sellers

No, not an identical product

Several stores in the mall sell hooded sweatshirts. Each store's sweatshirts reflect the

style of that particular store. Additionally, some makers use higher-quality cotton than

others, which is reflected in the apparel's prices.

In a small town, there are two providers of broadband Internet access: a cable company

and the phone company. The Internet access offered by both providers is of the same

speed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 4 Consider the market for lumber, which we assume here to be perfectly competitive. 4a) Suppose that for each unit of lumber produced, the firms also generate $10 of damage to the environment. Draw the social marginal cost curve in the diagram. 4b) Show the allocatively efficient level of lumber output on the diagram. Explain. 4c) Describe and show the new market outcome if lumber producers are required to pay a tax of $10 per unit of lumber produced. Explain. 4d) In part (c), does the equilibrium price of lumber rise by the full $10 of the tax? Explain. Quantity of Lumberarrow_forwardQ8. What role does the U.S. government play with respect to market competition? a.) It preserves competition by regulating prices and intervening in the price and output decisions of businesses. b.) It preserves competition by maintaining abundant government-owned firms to ensure consumer-friendly pricing. c.) It polices anticompetitive behavior and prohibits contracts that restrict competition.arrow_forwardAnswer the following for the given example (for a perfectly competitive market): Your neighbours holding a physical gathering during the pandemic (a) Does an externality exist? If so, is it positive/negative (or both) (b) Use Coase’s framework to identify the cause of the externality (c) If an externality exists, determine whether the Coase theorem applies (i.e. is it possible/feasible to assign property rights and solve the problem?). Provide reasoning. (d) If an externality exists and the Coase theorem does not apply, discuss a government/institutional solution that can mitigate the problem of externality. Provide reasoning.arrow_forward

- Fill in the table by the main characteristics of the competitive markets. Criteria: Pure and perfect competition Imperfect competition Monopolistic competition Oligopoly Monopoly Number of sellers Number of buyers Type of the commodity Price control Barriers of entry to the market Access to the market information Examples of real production marketsarrow_forward1. Characteristics of competitive markets The model of competitive markets relies on these three core assumptions: 1. There must be many buyers and sellers-a few players can't dominate the market. 2. Firms must produce an identical product-buyers must regard all sellers' products as equivalent. 3. Firms and resources must be fully mobile, allowing free entry into and exit from the industry. The first two conditions imply that all consumers and firms are price takers. While the third is not necessary for price-taking behavior, assume for this problem that a market cannot maintain competition in the long run without free entry. Identify whether or not each of the following scenarios describes a competitive market, along with the correct explanation of why or why not. Scenario There are hundreds of colleges that serve millions of students each year. The colleges vary by location, size, and educational quality, which enables students with diverse preferences to find schools that match…arrow_forwardAssume that banana squash is traded in a perfectly competitive market in which the demand curve captures buyers' full willingness to pay while the supply curve reflects all production costs. For each of the following situations, indicate whether the total output should be increased, decreased, or kept the same in order to achieve allocative and productive efficiency. The maximum willingness to pay exceeds minimum acceptable price. ( increased, decreased, or kept the same) Marginal Benefit. ( increased, decreased, or kept the same) а. く-- Choose a correct answer! Total surplus is at a maximum. ( increased, decreased, or kept the same) <-- Choose a correct answer! С. d. The current quantity produced exceeds the market equilibrium quantity. ( increased, decreased, or kept the same) <--Choose a correct answer! Blank # 1 Blank # 2 Blank # 3 Blank # 4arrow_forward

- The model of competitive markets relies on these three core assumptions: 1. There must be many buyers and sellers-a few players can't dominate the market. 2. Firms must produce an identical product-buyers must regard all sellers' products as equivalent. 3. Firms and resources must be fully mobile, allowing free entry into and exit from the industry.arrow_forwardQ2. Cournot Model (production competition model) Consider a Cournot model. The market demand is p=180-q1-q2. The marginal cost for both firms is 30 and there are no fixed costs. A. Derive each firm's best response function. B. Find the Nash equilibrium. C. Find the equilibrium price and each firm's profit. D. Find the consumer surplus and the social welfare at equilibrium.arrow_forwardHomework (Ch 14) 1. There must be many buyers and sellers-a few players can't dominate the market. 2. Firms must produce an identical product-buyers must regard all sellers' products as equivalent. 3. Firms and resources must be fully mobile, allowing free entry into and exit from the industry. The first two conditions imply that all consumers and firms are price takers. While the third is not necessary for price-taking behavior, assume for th problem that a market cannot maintain competition in the long run without free entry. Identify whether or not each of the following scenarios describes a competitive market, along with the correct explanation of why or why not. Scenario Competitive? In a small town, there are two providers of broadband Internet access: a cable company and the phone company. The Internet access offered by both providers is of the same speed. Several stores in the mall sell hooded sweatshirts. Each store's sweatshirts reflect the style of that particular store.…arrow_forward

- Recently, the Obama administration proposed a $1.00 per unit (pack) excise tax on cigarettes (which would be imposed legally or statutorily on cigarettes sellers). Some news reports have suggested that the proposed tax would increase cigarettes prices by $1.00 per pack and be paid by smokers (cigarette buyers). Using (separate) competitive supply and demand diagrams of the cigarettes market carefully show and explain TWO extreme demand and supply conditions under which these news reports would be true?arrow_forwardPLEASE ANSWER QUESTION 4arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education