Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

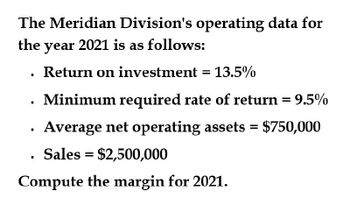

Transcribed Image Text:The Meridian Division's operating data for

the year 2021 is as follows:

.

Return on investment = 13.5%

.

•

Minimum required rate of return = 9.5%

Average net operating assets = $750,000

Sales

$2,500,000

Compute the margin for 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose the MARR is 12%. Use the following table to answer the question-The IRR on the CMS Investment is FMS Initial Investment Annual Revenue Useful Life (Years) A. 17.0 % - 18.0% OB. 15.0 % - 16.0% OC. 11.0% - 12.0% O D.0.5% -1.0% O E.20.0% -21.0% CMS $20,000 6,688 $29,000 9,102arrow_forwardAverage rate of return Determine the average rate of return for a project that is estimated to yield total income of 936,000 over eight years, has a cost of 1,200,000, and has a 100,000 residual value.arrow_forwardSuppose the MARR is 12%. Use the following table to answer the question--The IRR on the CMS Investment is CMS FMS Initial Investment Annual Revenue Useful Life (Years) A. 17.0% - 18.0% B. 20.0% - 21.0% C. 15.0% - 16.0% D. 0.5% -1.0% E. 11.0% - 12.0% $20,000 6,688 15 $29,000 9,102 in 5arrow_forward

- kararrow_forwardDatabase Systems is considering expansion into a new product line. Assets to support expansion will cost $890,000. It is estimated that Database can generate $1,860,000 in annual sales, with an 13 percent profit margin. What would net income and return on assets (investment) be for the year? (Input your return on assets answer as a percent rounded to 2 decimal places.) Net Income Return on assets 96arrow_forwardThe business units of contractor companies carry out investment expenditures for a capital of 80,015,000 the investment is expected to be generate a cash flow of 6,015,000 per year for 8 years, costs capital (cost of money) of 5% per year and an assumed interest rate of 10%. Pelase Count : a. Payback Period of Investment b. NPV c. Profitability Index d. IRRarrow_forward

- A company's current net operating income is $16,800 and its average operating assets are $80,000. The company's required rate of return is 18%. A new project being considered would require an investment of $15,000 and would generate annual net operating income of $3,000. What is the residual income of the new project? Select one: a. 20.8% b. 20% c. ($150) d. $300arrow_forwardAn Investment center has sales of $30,000,000, income of $9,000,000, and average assets of $40,000,000. Assuming a target income of 12% of sverage eens, residual lncome is $4,200,0 0. True or False True False 2 of 25 Prevarrow_forwardCalculate the net present value (NPV), the return on investment (ROI) and the payback period using a discount rate of 8 percent for the following systems development project. Year Anticipated Annual Benefits Expected Annual Operating Costs Discount Factors at 8 Percent 1 $55,000 $5,000 .9259 $60,000 $5,000 .8573 3. $70,000 $5,500 7938 $75,000 $5,500 7349 $80,000 $7,000 6805 6. $80,000 $7,000 .6301 $80,000 $7,000 5833 8. $80,000 $8,000 .5401 The initial development costs for the system were $225,000.arrow_forward

- General Accountingarrow_forwardCompute the net present value of each potential investment.arrow_forward22) Consider a position of 2,000,000 investment in asset X and 3,000,000 in Investment Y. Daily volatilities for both assets is 0.1% and the correlation coefficient is .30 What is the 10 day 99% VAR? (Closest to! i.e. approximately) A) $59,300 B) $5,931 C) $33,400 D) $30,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning