ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

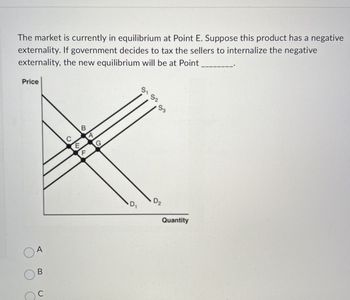

Transcribed Image Text:The market is currently in equilibrium at Point E. Suppose this product has a negative

externality. If government decides to tax the sellers to internalize the negative

externality, the new equilibrium will be at Point

Price

C

E

B

B

5152

53

D₂

D₁

Quantity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 7. Failing to correct negative externalities will create a deadweight loss. Graph it! 8. Explain how the government can discourage negative externalities. Graph it!arrow_forwardConsider placing a tax on a good that has a positive benefit externality of MEB=3 where MSC=2Q and MPB = 21-Q. a. Compare the equilibrium outputs with (i) no tax, (ii) with a Tax of $3, and (iii) at the social optimu. b. In this case, what happens to DWL when a tax is added? Show and explain your reasoning.arrow_forwardThe market for plasticans is perfectly competitive. Market Supply is givenby Q=3P and Market Demand is given by Q=469-3P. Each extra unit ofplastican produced imposes a negative externality of $9. What is the totalsurplus at the market quantity?arrow_forward

- how a tax on pollution affects the market equilibrium, consumer surplus, and producer surplus (Ctrl) ▼arrow_forward(a). In today's economy, it's harder for workers to get promoted. In 2006, it took an average of 2 ½ years to get a promotion; today it takes 4 ½ years. As a result, fewer workers are willing to boost their productivity in an effort to impress the boss and get the promotion. In 2006, 25 percent of employees said they were willing to give "an extra oomph" at work (boost their productivity): today about 15 percent are willing to do so. Explain the connection to the Phillips curve. (b). When an employer lists a job opening, they receive hundreds of applications. Eightfold is a new product that uses artificial intelligence (Al) to scan resumes and quickly and accurately identify the applicants who are the best fit for the job. An economist who studied the use of Al in hiring said, "You get the more nontraditional, equally qualified, equally high-performing people, but the employer doesn't seem to have to compete for them as much." What effect might the use of Al have on the slope of the…arrow_forwardWhat exactly is a Pigovian tax? Give some instances of how the Pigovian tax can be used to tackle environmental issues.arrow_forward

- 21 24 P 500 300 250 50 50 M DE J F CH 91 ABG K S MSB D 50 80 90 100 Q Which of the following would lead to the allocatively efficient outcome? A subsidy A price floor of $250 A quota of 90 units A taxarrow_forwardShow work..arrow_forwardSetup Suppse that the Demand and Supply for Electricity is given below. The production of electricity has a negative externality. Demand: QD= 9.875 -0.125P Supply: QS= 4P -19 Inverse Demand: P=79-8QD Inverse Supply: P=4.75+0.25QS Marginal Spillover Cost: MSPC= 9.5 +Q 1) Determine the Efficient Quantity. 2) Calculate the Deadweight Loss from Externality. 3) Calculate Optimal Pigovian Per Unit Tax 4) Calculate Tax Revenues Market Price: $7.00 Market Quantity: 9arrow_forward

- Only typed answer You are an industry analyst that specializes in an industry where the market inverse demand is P = 100 - 3Q. The external marginal cost of producing the product is MCExternal = 6Q, and the internal cost is MCInternal = 14Q. Instruction: Round your answers to the nearest two decimal places. a. What is the socially efficient level of output? units b. Given these costs and market demand, how much output would a competitive industry produce? units c. Given these costs and market demand, how much output would a monopolist produce? units d. Which of the following are actions the government could take to induce firms in this industry to produce the socially efficient level of output. Instructions: You may select more than one answer. Click the box with a check mark for the correct answers and click twice to empty the box for the wrong answers. You must click to select or deselect each option in order to receive full credit. Pollution taxes…arrow_forwardDue to a firm generating external costs (a negative externality), the government decides to ________ the firm. In response, the firm will produce ________ units of output in order to continue maximizing profits and reach the new producer equilibrium. Question 4Answer a. tax; fewer b. subsidize; more c. tax; more d. subsidize; fewerarrow_forwardHow does the price elasticity of demand for gasoline impact the effectiveness of taxes on gasoline aimed at correcting a negative externality?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education