ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

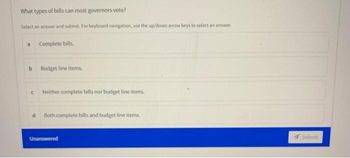

Transcribed Image Text:What types of bills can most governors veto?

Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer

a Complete bills.

b

C

Budget line items.

Neither complete bills nor budget line items.

d Both complete bills and budget line items.

Unanswered

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- To minimize dead weight loss resulting from taxation, a. tax revenue should be maximized. b. tax rates should alternate between 0 and higher rates every other year. c. tax rates should be kept stable over time. d. tax rates should increase in times of need and reduced in other periods.arrow_forward5. Allocation of government expenditures Federal and local governments tax and spend. The following pie charts show the allocation of federal and local government expenditures in 2016. Interest 11% Federal All other 12% Health 30% O True O False Pensions and Income Security 33% National Defense 14% Highways 6.0% State and Local All other 31% Education 33% Health and Public Welfare (includes health and welfare and social services, not disability) 30% (Source: Bureau of Economic Analysis, "Government Current Expenditures by Function," National Income and Product Accounts Tables, www.bea.gov.) True or False: You can validly conclude from these pie charts that local governments do not spend enough on highways.arrow_forwardWhat is your take on the amount of money politicians spend on political campaigns? Does it have a positive/negative impact on the economy?arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardThe largest single portion of the federal budget is devoted to A. interest payments on the national debt.B. national defense.C. Medicare and Medicaid.D. education.E. Social Security and unemployment compensation.arrow_forwardWhich of the following statements about state budget is wrong? a. Budget may be annual or biennial b. About half of the states have dual budget system - operating budget and capital budget c. Most operate under the balanced budget requirement d. All governors have item veto powerarrow_forward

- wich action would a government most likely take to increase its overall gdparrow_forwardDon't use ai to answer I will report your answer Solve it Asap with explanation and calculationarrow_forwardQuestion 18 A possible budget reform is a quadrennial budget O breaking down the budget into increasingly small budget lines O appointing agency heads with different priorities than those of elected representatives O a biennial budget eliminating the operating budgetarrow_forward

- 9. Make a graph showing the spending and tax revenue of your state government for as many years as you can find (use the government of your home country if you are not from the United States). What trends do you notice? What spending categories make up the largest share of the state budget? What are the largest sources of revenue? earrow_forwardPlease help with this practice questionarrow_forwardDo you agree or disagree with this statement: “It is in the best interest ofoureconomy forCongress and the President to run a balanced budget each year.” Explain your answer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education