Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

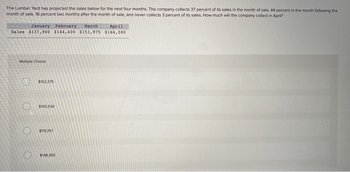

Transcribed Image Text:The Lumber Yard has projected the sales below for the next four months. The company collects 37 percent of i sales in the month of sale, 44 percent in the month following the

month of sale, 16 percent two months after the month of sale, and never collects 3 percent of its sales. How much will the company collect in April?

April

January February March

Sales $137,900 $144,400 $151,975 $166,000

Multiple Choice

O

$152,375

$155,530

$119,767

$148,365

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Catulla Corporation predicts the following sales in units for the coming four months April May 240 200 June July 300 sales in units Each moners ending Finished Goods Inventory in units should be 40% of the next month's sales Mech 21 Fished Goods inventory a 00 unts A freshed unit requires five pounds of dract material 8 at a cost of $2.00 per pound. The March 31 Raw Materials inventory has 200 pounds of direct matal 8. Each moners ending Raw Materials twentary should be 30% of the following months production needs The budgeted purchases of pounds of direct material during May should be O 1422 pounds 4xpr 210 panarrow_forwarda pharmacy takes up its spring time shipment of sunglasses to provide of cost and a profit of 70% of cost. for overhead expense of 40% at the end of the summer what rate of markdown can the pharmacy apply to the remaining inventory of sungLASSES and still break even on sales at this level ? round to the neares 0.1%arrow_forwardToronto Donuts Bakery collects 50% of its monthly sales immediately and the rest a month later. Its production costs are 70% of sales. It holds 1 month of sales in inventory, and it pays all of its bills immediately. Calculate the cash conversion cycle. 30 Days 45 Days This company does not have Cash Cycle. 60 Days 15 Daysarrow_forward

- Jenny Inc. has the following projected costs for the second quarter of 20YY: Projected Costs Expenses April May June Selling and marketing expenses (i) $200,000 $250,000 $300,000 Office insurance expense (ii) 800 800 800 Office depreciation expense 500 500 500 Property tax expense (iii) 700 700 700 Jenny’s payment policy for selling and administrative expenses is as follows: Of the selling and marketing expenses, 50% is paid in the month they are incurred; the remaining 50% to be paid in the following month. The selling and admin expense payable at the end of March was $70,000, which represents 50% of March’s selling expenses. Insurance expense is $800 a month; however, the insurance is paid quarterly in the first month of each quarter, (i.e., in January, April, July, and October). Property taxes are paid once a year in December. The projected total selling and admin expenses for April are: Group of answer choices None of the above $172,400 $202,000 $204,400arrow_forwardMM Co. predicts sales of $45,000 for May. MM Co. pays a sales manager a monthly salary of $4,200 plus a commission of 6% of sales dollars. MM's production manager recently found a way to reduce the amount of packaging MM uses. As a result, MM's product will receive better placement on store shelves and thus May sales are predicted to increase by 9%. In addition, MM's shipping costs are predicted to decrease from 4% of sales to 2% of sales. Compute (1) budgeted sales and (2) budgeted selling expenses for May assuming MM switches to this more sustainable packaging. Answer is not complete. (1) Budgeted sales (2) Budgeted selling expensesarrow_forward22. Sheffield corp estimates it’s sales at…arrow_forward

- Nonearrow_forwardMazon Inc. plans to sell 7,000 units each quarter next year. During the first two quarters each unit will sell for OMR12; during the last two quarters the sales price will increase OMR1.50 per unit. What is Mazon's estimated sales revenue for next year? Select one: a. OMR 397,000 b. OMR 357,000 c. OMR 378,000 d. OMR 336,000arrow_forwardA book publishing company is planning its inventory. The cost to store one book is $4 per month. The cost for a production run is $8 per run and $0.50 per book. The company sells 3,600 books per month. How many should be in a production run to minimize inventory costs?arrow_forward

- Miggy Co. projects the following monthly revenues for next year: 250,000 January February March 100,000 500,000 July August September October 275,000 300,000 350,000 452,000 450,000 Аpril May 557,000 300,000 November 400,000 525,000 June December Miggy's terms are net 30 days. The company typically receives payment on 80% of sales the month following the sale and 17% is collected two months after the sale. Approximately 3% of sales are deemed bad debt. What amount represents the expected cash collection in the second calendar quarter of next year? a. 1,405,540 b. 1,293,630 c. 1,320,540 d. 1,234,250arrow_forwardamm.01arrow_forwardAarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education