FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

22. Sheffield corp estimates it’s sales at…

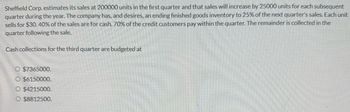

Transcribed Image Text:Sheffield Corp. estimates its sales at 200000 units in the first quarter and that sales will increase by 25000 units for each subsequent

quarter during the year. The company has, and desires, an ending finished goods inventory to 25% of the next quarter's sales. Each unit

sells for $30. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. The remainder is collected in the

quarter following the sale.

Cash collections for the third quarter are budgeted at

O $7365000.

O $6150000.

O $4215000.

O $8812500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blossom Corp. has annual sales totaling $1146000 and an average gross profit of 20% of cost. What is the dollar amount of the gross profit? $286500. $171900. $229200. $191000.arrow_forward5. Shelton, Inc., has sales of $14 million, total assets of $12 million, and total debt of $6.7 million. Assume the profit margin is 7 percent. (a) What is the company's net income? (b) What is the company's ROA? (c) What is the company's ROE?arrow_forward.arrow_forward

- Last year, Jumpin' Trampolines (JT) had a quick ratio of 1.0, a current ratio of 1.8, an inventory turnover of 3.5, total current assets of $67,500, and cash and equivalents of $15,00. If the cost of goods sold equaled 70 percent of sales, what were JT's annual sales and DSO?arrow_forwardEfficiency ratio: Bummel and Strand Corp. has a gross profit margin of 33.7 percent, Sales of $47,112,365, and inventories of $14,595,435. What is its inventory turnover ratio?arrow_forwardAdams Inc. has the following data, rRF = 5%, RPm = 6% and Beta = 1.05. What is the firms cost of common from reinvested earning using CAPM? (11.30%, 12.72%, 11.64%, 11.99%, and 12.35%)arrow_forward

- 5. Calculate the ratio of variable-costs-to-sales for a firm with RM1,500,000 break-even revenues and RM400,000 fixed costs.arrow_forwardOliver Incorporated has a current ratio equal to 1.6 and a quick ratio equal to 1.2. The company has $2 million in sales and its current liabilities are $1 million. What is the company’s inventory turnover ratio?arrow_forwardLast year, Genten Company had sales of $7465 million. If Genten’s net profit margin was 0.41 and its return on assets was 0.37, what was Genten’s total assets?arrow_forward

- Oliver Incorporated has a current ratio sales and its current liabilities are $2 million. What is the company's inventory turnover ratio? = 2.6, and a quick ratio equal to 2.2. The company has $4 million inarrow_forwardRequired: a. Firm D has net income of $54,250, sales of $1,085,000, and average total assets of $775,000. Calculate the firm's margin, turnover, and ROI. b. Firm E has net income of $100,100, sales of $1,540,000, and ROI of 7.15%. Calculate the firm's turnover and average total assets. c. Firm F has ROI of 13.00 %, average total assets of $1,600,000, and turnover of 0.8. Calculate the firm's sales, margin, and net income. Complete this question by entering your answers in the tabs below. Required A Required B Required C Firm F has ROI of 13.00 %, average total assets of $1,600,000, and turnover of 0.8. Calculate the firm's sales, margin, and net income. Note: Do not round intermediate calculations. Round "Turnover" answer to 2 decimal places. Margin Sales Net income % Required: a. Firm D has net income of $54,250, sales of $1,085,000, and average total assets of $775,000. Calculate the firm's margin, turnover, and ROI. b. Firm E has net income of $100,100, sales of $1,540,000, and ROI…arrow_forwardMm. 130.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education