Economics (MindTap Course List)

13th Edition

ISBN: 9781337617383

Author: Roger A. Arnold

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:esources

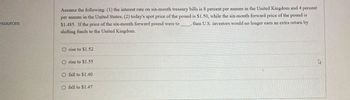

Assume the following: (1) the interest rate on six-month treasury bills is 8 percent per annum in the United Kingdom and 4 percent

per annum in the United States; (2) today's spot price of the pound is $1.50, while the six-month forward price of the pound is

$1.485. If the price of the six-month forward pound were to then U.S. investors would no longer earn an extra return by

shifting funds to the United Kingdom.

O rise to $1.52

O rise to $1.55

O fall to $1.40

O fall to $1.47

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose $2, 400 CAD could be used to purchase $2, 086.96 USD last year. Part (a): What was the nominal exchange rate last year? Be sure to quote your answer in the proper format (example: CAD = 1 USD). Roud your answer to the nearest cent (two decimal places: 0.50). Part (b): This year, if the exchange rate is $1.02 CA) = $1 USD, has the USD experienced a nominal appreciation or a nominal depreciation? Part (c): How will this change to the nominal exchange rate impact Canada's NX levels? Use a few sentences to explain how you arrived at this conclusion.arrow_forwardThe following graphs depict the market for loanable funds and the relationship between the real interest rate and the level of net capital outflow (NCO) measured in terms of the Mexican currency, the peso. The Market for Loanable Funds in MexicoDemandSupply012345678987654321REAL INTEREST RATE (Percent)LOANABLE FUNDS (Billions of pesos)Demand Supply Mexican Net Capital OutflowNCO-4-3-2-10123456987654321REAL INTEREST RATE (Percent)NET CAPITAL OUTFLOW (Billions of pesos)NCO Complete the first row of the table to reflect the state of the markets in Mexico. Real Interest Rate Net Capital Outflow (NCO) (Percent) (Billions of pesos) Initial state After capital flight Now, suppose that Mexico experiences a sudden bout of political turmoil, which causes world financial markets to become uneasy. Because people now view Mexico as unstable, they decide to pull some of their assets out of Mexico and put them into more…arrow_forwardView the data below for the exchange rate between the US dollar and the Japanese yen. How many yen could you get per dollar at the earliest date shown on the chart? Explain. How many yen could you get per dollar at the most recent date shown on the chart? Explain. Has the dollar appreciated or depreciated in value over time? Explain.arrow_forward

- New Zealand dollar drops to lowest value against US dollar since 2020 (27/09/2022) The New Zealand dollar has dropped to its lowest value against its US equivalent since March 2020. The bad news for Kiwis is that it means it'll take longer for consumer price inflation to fall....a weak kiwi dollarmeans importing is more expensiveWhile we do expect inflation rates to slowly fall from here, the longer the New Zealand dollar remains low, the slower it will take for those inflation rates to fall, ASB senior economist Mark Smith said Six months ago the New Zealand dollar was US68.9c - now it's at US56.6c. a fall of 18 percent. Aotearoa's dollar is suffering because the US dollar is being pumped up by the US Federal Reserve lifting interest rates to tackle inflation. "Interest rates globally are going up, and when rates are going up, generally people tend to look to where their money will be safest, and at the moment it's certainly the US economy," saidSmithBut Finance Minister Grant…arrow_forwardNew Zealand dollar drops to lowest value against US dollar since 2020 (27/09/2022) The New Zealand dollar has dropped to its lowest value against its US equivalent since March 2020. The bad news for Kiwis is that it means it'll take longer for consumer price inflation to fall....a weak kiwi dollarmeans importing is more expensiveWhile we do expect inflation rates to slowly fall from here, the longer the New Zealand dollar remains low, the slower it will take for those inflation rates to fall, ASB senior economist Mark Smith said Six months ago the New Zealand dollar was US68.9c - now it's at US56.6c. a fall of 18 percent. Aotearoa's dollar is suffering because the US dollar is being pumped up by the US Federal Reserve lifting interest rates to tackle inflation. "Interest rates globally are going up, and when rates are going up, generally people tend to look to where their money will be safest, and at the moment it's certainly the US economy," saidSmithBut Finance Minister Grant…arrow_forwardIn the last 4 years, the exchange rate Pound to Euro depreciated (decreased) to an average of 1.13 (from 1.30 before 2016). When citizens from the UK would go on holidays in a Euro zone country (e.g. Spain), would a lower exchange rate of 1.13(Sterling Pound to Euro) instead of an exchange rate of 1.30 (Pound to Euro) be of advantage or disadvantage for British tourists in Europe? Explain.arrow_forward

- Assume that the total value of investment transactions between the United States and Mexico is minimal. Also, assume that the total dollar value of trade transactions between these two countries is very large. Now assume that Mexico's inflation has suddenly increased, and Mexican interest rates have suddenly increased. a) Please draw a graph to show how the equilibrium value of Mexican Pesos will change. b) What's more important for Mexican Pesos given the circumstances, change in interest rates, or change in inflation in Mexico?arrow_forwardYou work for the Bureau of Economic Analysis (BEA) of the U.S. Department of Commerce. Your supervisor gives you the following U.S. International Transactions Accounts for the Year 20XX (figures are in billions of dollars) and wants it reported in a coherent fashion in accordance with accepted conventions: Investment income payments $24; Export of goods $456; Balance of services $57; U.S purchases of foreign assets were $147.; Imports of goods $589; Change in Official Reserves $15; Investment income receipts $28; Foreign purchases of U.S. assets were $230; Net unliteral transfers were ($32). ($32) means -$32. a)- He wants you to compute the balances of trade, current account, capital account and statistical discrepancy. b)- He also wants you to find out (based on your calculation) if the U.S. is a net debtor or a net creditor. Explainarrow_forwardSuppose that the Japanese yen rises against the U.S. dollar-that is, it will take more dollars to buy a given amount of Japanese yen. Explain why this increase simultaneously increases the real price of Japanese cars for U.S. consumers and decreases the real price of U.S. automobiles for Japanese consumers. dollars, and the purchase of a U.S. As the value of the yen grows relative to the dollar, the purchase of a Japanese automobile priced in yen requires automobile priced in dollars requires yen. more fewerarrow_forward

- Urgently need. Y = C + I + G + NX Y=$6000 G=$1000 T=$1150 C=$200+0.75(Y−T) I=1100−50r NX=913−913ε r=r*=7r=r*=7 b. Suppose now that G rises to $1400. Solve for private saving, public saving, national saving, investment, the trade balance, and the equilibrium exchange rate.arrow_forwardPlease answer intuitively and completely pleasearrow_forwardYour friend, a loyal Apple customer, has set out a table of Apple’s net sales also adding his/her expectations about 2021 developments. Assuming that net sales of iPhones not being largely affected by the exchange rate developments but by new versions of iPhones, would you expect percentage share of net sales of iPhones to increase or decrease with stronger US. dollar against foreign currencies in 2021 (but without launching new iPhone models)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning