FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

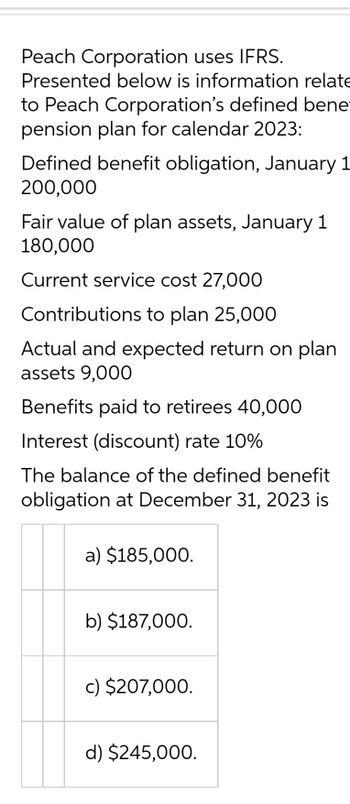

Transcribed Image Text:Peach Corporation uses IFRS.

Presented below is information relate

to Peach Corporation's defined benet

pension plan for calendar 2023:

Defined benefit obligation, January 1

200,000

Fair value of plan assets, January 1

180,000

Current service cost 27,000

Contributions to plan 25,000

Actual and expected return on plan

assets 9,000

Benefits paid to retirees 40,000

Interest (discount) rate 10%

The balance of the defined benefit

obligation at December 31, 2023 is

a) $185,000.

b) $187,000.

c) $207,000.

d) $245,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bb.24.arrow_forwardearrow_forward3-39 CVP analysis, medical sector. Yahama Medical Centre operates a medical surgery in Japan that specializes in the diagnosis and treatment of hay fever allergies. The firm's budget for next year is as follows: Number of beds available In-patient days In-patient fees 80 per day 26,000 per annum ¥1,300,000 Variable Costs Fixed Costs Total Costs Direct supplies ¥ 100,000 ¥ 100,000 Direct salaries Patient service O/H Administration Total costs 800,000 800,000 58,000 ¥102,000 160,000 108,000 ¥1,066,000 150,000 ¥252,000 258,000 ¥1,318,000 1. Calculate the contribution margin ratio. 2. Compute the breakeven point in both in-patient days and in-patient fees. 3. Compute the margin of safety ratio if the clinic operates at full capacity. 4. Suppose the direct salaries were increased to ¥826,000 and total variable costs increased to ¥1,092,000, compute the breakeven point in in-patient days if all matters not specified remain the same. 5. Suppose the fixed patient service overheads increase to…arrow_forward

- Pension Question (30 marks)Sophia Consultants Inc. has had a defined benefit pension plan since January 1, 2018.The following represents beginning balances as at January 1, 2022:Plan Asset $1,155,300; Defined Benefit Obligation $1,275,000; Net Pension Liability $119,700Additional Information is as follows for 2022:Current Service cost is $186,000 for 2022Company Funding/Contribution is $200,000 for 2022. Funding is made on December 31 of each year.Actual return on assets is $55,900 for 2022.There is an increase in obligation for $29,000 due to changes in Actuarial assumptions at Dec 31, 2022.There are payments made equal to $80,000 per year to retired employees in 2022 (payments to retireesare made at the end of the year on December 31).Past service cost of $85,900 from plan amendment dated December 31, 2022: liability is increasedbecause benefits were increased on a retroactive basis.For 2022, the assumed interest rate is 6%. Assume IFRS.Required:1. Determine Defined Benefit…arrow_forwardage Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $198,200; projected benefit obligation $251,000. Other data relating to 3 years’ operation of the plan are as follows. 2019 2020 2021 Annual service cost $16,300 $19,100 $26,400 Settlement rate and expected rate of return 10 % 10 % 10 % Actual return on plan assets 18,400 21,870 24,000 Annual funding (contributions) 16,300 39,200 47,700 Benefits paid 14,200 16,100 21,400 Prior service cost (plan amended, 1/1/20) 161,700 Amortization of prior service cost 54,100 41,700 Change in actuarial assumptions establishesa December 31, 2021, projected benefit obligation of: 524,600 a. How to prepare a pension worksheet presenting all 3 years’ pension balances and activities.arrow_forward10... 10... Headland Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $201,400; projected benefit obligation $245,000. Other data relating to 3 years’ operation of the plan are as follows. 2019 2020 2021 Annual service cost $15,800 $19,400 $26,100 Settlement rate and expected rate of return 10 % 10 % 10 % Actual return on plan assets 18,000 22,150 24,000 Annual funding (contributions) 15,800 40,000 47,500 Benefits paid 13,700 16,500 20,800 Prior service cost (plan amended, 1/1/20) 160,000 Amortization of prior service cost 53,800 41,700 Change in actuarial assumptions establishes a December 31, 2021, projected benefit obligation of: 522,200 Prepare a pension worksheet presenting all 3 years’ pension balances and activities. (Enter all amounts as…arrow_forward

- Douglas-Robert, Inc. has a noncontributory, defined benefit pension plan. At December 31, 2022, Douglas-Robert received the following information: Projected Benefit Obligation ($ in millions) Balance, January 1 $ 140 Service cost 40 Interest cost 14 Benefits paid (10 ) Balance, December 31 $ 184 Plan Assets Balance, January 1 $ 100 Actual return on plan assets 11 Contributions 2021 40 Benefits paid (10 ) Balance, December 31 $ 141 The expected long-term rate of return on plan assets was 10%. There was no prior service cost and a negligible net loss—AOCI on January 1, 2022. Required:1. Determine Douglas-Robert’s pension expense for 2022.2. Prepare the journal entries to record Doublas Robert’s (a) pension expense, (b) funding, and (c) payment of retiree benefits in 2022.arrow_forwardPreparing a Pension Worksheet Levine Co. sponsored a defined benefit plan, which included January 1, 2020, balances of $3,000 and $2,880 in Plan Assets and Projected Benefit Obligation, respectively. During 2020, the company incurred $600 in service cost, made plan contributions of $126, and paid benefits to retirees for $90. The discount rate is 9% and the expected and actual rate of return on plan assets is 10%. Prepare a pension worksheet for 2020.Note: Use a negative sign for credits to accounts. Pension Worksheet Reported Net in Financial Statements Balance Sheet Income Statement PlanAssets PBO Net PensionAsset/Liability CashOutflow PensionExpense Balance, January 1, 2020 Service cost Interest cost Expected return Contributions to fund Benefit payments Balance, December 31, 2020arrow_forwardOn January 1, 2020, McGee Co. had the following balances: Projected benefit obligation $6,400,000 Fair value of plan assets 6,000,000 Other data related to the pension plan for 2019: contributions to the plan 400,000 Benefits paid 350,000 On 1/1/2020, prior service cost was granted having a present value of 150,000 Actual return on plan assets 430,000 Settlement rate 9% Expected rate of return 7% Amortized Prior Service cost…arrow_forward

- Information regarding the defined benefit pension plan of Neo Products included the following for 2024 ($ in millions):Plan assets, January 1$ 210Plan assets, December 31315 Return on plan assets30Employer contributions to the pension plan (end of year)126What amount of retiree benefits was paid at the end of 2024? Multiple Choice$51 million$21 million$72 million$105 millionarrow_forwardPension data for Sterling Properties include the following: Service cost, 2024 Projected benefit obligation, January 1, 2024 Plan assets (fair value), January 1, 2024 Prior service cost-AOCI (2024 amortization, $8) Net loss-AOCI (2024 amortization, $1) Interest rate, 5% Expected return on plan assets, 9% Actual return on plan assets, 10% ($ in thousands) $ 127 560 600 92 113 Required: Determine pension expense for 2024. Note: Enter your answers in thousands (i.e., 10,000 should be entered as 10). Amounts to be deducted should be indicated with a minus sign.arrow_forwardThe following defined pension data of Waterway Corp. apply to the year 2020. Projected benefit obligation, 1/1/20 (before amendment) $509,000 Plan assets, 1/1/20 496,000 Pension liability 13,000 On January 1, 2020, Waterway Corp., through plan amendment, grants prior service benefits having a present value of 123,000 Settlement rate 9 % Service cost 58,300 Contributions (funding) 59,600 Actual (expected) return on plan assets 48,300 Benefits paid to retirees 43,500 Prior service cost amortization for 2020 16,400 For 2020, prepare a pension worksheet for Waterway Corp. that shows the journal entry for pension expense and the year-end balances in the related pension accounts. (Enter all amounts as positive.) WATERWAY CORP.Pension Worksheet—2020 General Journal Entries Memo Record Items Annual PensionExpense Cash OCI–Priorarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education