FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

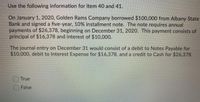

Transcribed Image Text:Use the following information for item 40 and 41.

On January 1, 2020, Golden Rams Company borrowed $100,000 from Albany State

Bank and signed a five-year, 10% installment note. The note requires annual

payments of $26,378, beginning on December 31, 2020. This payment consists of

principal of $16,378 and interest of $10,000.

The journal entry on December 31 would consist of a debit to Notes Payable for

$10,000, debit to Interest Expense for $16,378, and a credit to Cash for $26,378.

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer the follarrow_forwardUnder the allowance method, when $600 is authorised to be written off, the journal entry would be Select one: a. Debit Accounts Receivable $600, Credit Allowance for Doubtful Debts $200 b. Debit Bad Debts Expense $600, Credit Accounts Receivable $600 c. Debit Bad Debts Expense $600, Credit Allowance for Doubtful Debts $600 d. Debit Allowance for Doubtful Debts $600, Credit Accounts Receivable $600arrow_forwardkk. Subject :- Accountingarrow_forward

- Entries during the first month would include a O debit to Cash of $110,380. O debit to Bad Debt Expense of $2,980. O debit to Allowance for Doubtful Accounts of $2,980. Odebit to Accounts Receivable of $114.710.arrow_forwardOn December 1, 2022, Blossom Company had the following account balances. Cash Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Dec. 7 1. 12 2. 17 During December, the company completed the following transactions. 19 22 26 31 Debit Adjustment data: $18,800 Accumulated Depreciation-Equipment 2,400 Accounts Payable Common Stock Retained Earnings 7,000 15,500 1,700 29,000 $74,400 Credit Received $3,600 cash from customers in payment of account (no discount allowed). Purchased merchandise on account from Vance Co. $12,400, terms 1/10, n/30. Sold merchandise on account $16,400, terms 2/10, n/30. The cost of the merchandise sold was $9,600. $2,900 6,200 50,100 15,200 $74,400 Paid salaries $2,100. Paid Vance Co. in full, less discount. Received collections in full, less discounts, from customers billed on December 17. Received $2,800 cash from customers in payment of account (no discount allowed). Depreciation was $200 per month. Insurance of $400 expired in December.arrow_forwardOn 1 June, Mason and Boyce had Accounts Receivable and Allowance for Doubtful Debts accounts as below. Ignore GST. Accounts receivable 1/6 balance 849,555 Allowance for doubtful debts 1/6 balance 12,100 During June, the following transactions occurred: Revenue earned on credit, $1,195,000. Sales returns, $24,100. Accounts receivable collected, $1,400,000. Accounts written off as uncollectible, $15,851. Based on an ageing of accounts receivable on 30 June, the firm determined that the Allowance for Doubtful Debts account should have a credit balance of $13,500 on the balance sheet as at 30 June. Ignore GST. Required: (a) Prepare general journal entries to record the four transactions and to adjust the Allowance for Doubtful Debts account. (b) Showhowaccountsreceivableandtheallowancefordoubtfuldebtswouldappearonthebalance sheet at 30 June. (c) On 29 June, Kim Ltd, whose $2,400 account had been written off as uncollectable in June,…arrow_forward

- Mar. 17 Received $810 from Shawn McNeely and wrote off the remainder owed of $4,820 as uncollectible. July 29 Reinstated the account of Shawn McNeely and received $4,820 cash in full payment. Journalize the above transactions, using the direct write-off method of accounting for uncollectible receivables. Refer to the Chart of Accounts for exact wording of account titlesarrow_forward11. Please answer which is best forarrow_forwardIn the statement of financial position at 31 December 20X5, Ken reported net receivables of $12,000. During 20X6 Ken made sales on credit of $125,000 and received cash from credit customers amounting to $ 115,500. At 31 December 20X6, Ken wished to write off debts of $7,100 and increase the allowance for receivables by $950 to $2,100. What is the net receivables figure to include in the statement of financial position at 31 December 20X6?arrow_forward

- A $9,600, 60-day, 12% note recorded on November 21 is not paid by the maker at maturity. The journal entry to recognize this event is a.debit Cash, $9,792; credit Notes Receivable, $9,792. b.debit Notes Receivable, $9,792; credit Accounts Receivable, $9,600; Credit Interest Receivable, $192. c.debit Notes Receivable, $9,792; credit Accounts Receivable, $9,792. d.debit Accounts Receivable, $9,792; credit Notes Receivable, $9,600; Credit Interest Revenue, $192.arrow_forwardOn March 12, jangles corporation received $20, 100 invoice dated March 9. Cash discount terms were 2/10, n/30. On March 16 jangles spent an $8,040 partial payment. What credit should jangles receive? What is jangles outstanding balance?arrow_forwarda. During February, $90,040 was paid to creditors on account, and purchases on account were $115,250. Assuming the February 28 balance of Accounts Payable was $38,720, determine the account balance on February 1. $ b. On October 1, the accounts receivable account balance was $50,800. During October, $442,000 was collected from customers on account. Assuming the October 31 balance was $58,400, determine the fees billed to customers on account during October. $ c. On April 1, the cash account balance was $18,070. During April, cash receipts totaled $274,660 and the April 30 balance was $13,010. Determine the cash payments made during April. $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education