FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

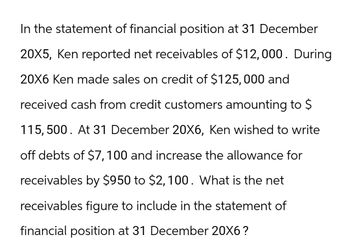

Transcribed Image Text:In the statement of financial position at 31 December

20X5, Ken reported net receivables of $12,000. During

20X6 Ken made sales on credit of $125,000 and

received cash from credit customers amounting to $

115,500. At 31 December 20X6, Ken wished to write

off debts of $7,100 and increase the allowance for

receivables by $950 to $2,100. What is the net

receivables figure to include in the statement of

financial position at 31 December 20X6?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Using the allowance method of accounting for uncollectible receivables. Transactions: April 1 Sold merchandise on account to Jim Dobbs, $7,200. The cost of the merchandise is $5,400. June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. Oct. 11 Reinstated the account of Jim Dobbs and received cash in full payment. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Alan Albertson 122 Accounts Receivable-Jim Dobbs 123 Accounts Receivable-John Groves 124 Accounts Receivable-Jan Lehn 125 Accounts Receivable-Jacob Marley 126 Accounts Receivable-Mr.Potts 127 Accounts Receivable-Chad Thomas 128 Accounts Receivable-Andrew Warren 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Inventory 145 Supplies…arrow_forwardOn December 31, 20X1, the company reported a debit balance of $200,000 in accounts receivable and a credit balance of $5,000 in the allowance for expected credit losses. December 31 is the company’s reporting date. During 20X2, the company had the following transactions: a. The company made a credit sale of $300,000. b. The company collected accounts receivable for 350,000. c. The company wrote off the uncollectible accounts for $12,000. d. The company collected the receivable of $4,000 that had been written off previously. Required Note: Show calculation: (1) Prepare journal entries to record the above four transactions. (2) Assume that 2% of the company’s accounts receivable cannot be collected, prepare the adjusting journal entry at the end of 20X2.arrow_forwardDuring the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $120,000, of which $60,000 was on credit. At the start of 2021, Accounts Receivable showed a $12,000 debit balance and the Allowance for Doubtful Accounts showed a $500 credit balance. Collections of accounts receivable during 2021 amounted to $58,000. Data during 2021 follow: a. On December 10, a customer balance of $1,000 from a prior year was determined to be uncollectible, so it was written off. b. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Required: 1. Give the required journal entries for the two events in December. 2-a. Show how the amounts related to Bad Debt Expense would be reported on the income statement. 2-b. Show how the amounts related to Accounts Receivable would be reported on the balance sheet. 3. On the basis of the data available, does the 2 percent rate appear to be reasonable?arrow_forward

- Calculation of Net Realizable Value K. L. Dearborn owns a department store that has a $45,500 balance in Accounts Receivable and a $3,000 credit balance in Allowance for Doubtful Accounts. 1. Determine the net realizable value of the accounts receivable? 2. Assume that an account receivable in the amount of $500 was written off using the allowance method. Determine the net realizable value of the accounts receivable after the write-off?arrow_forwardIn June, Widgets, Inc. makes on account sales to Customs Motors of $800 and receives a payment of $500 from them. How would this affect the Accounts Receivable control account? O A. The AR total would be decreased by $300. O B. The AR total would be decreased by $500. O C. The AR total would be increased by $800. O D. The AR total would be increased by $300.arrow_forward. Journalize the following transactions using the allowance method of accounting for uncollectible receivables. April 1 Sold merchandise on account to Jim Dobbs, $7,200. The cost of the merchandise is $5,400. June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. Oct. 11 Reinstated the account of Jim Dobbs and received cash in full payment.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education