EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer general accounting

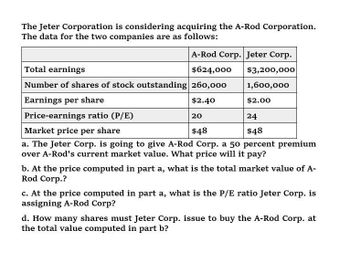

Transcribed Image Text:The Jeter Corporation is considering acquiring the A-Rod Corporation.

The data for the two companies are as follows:

Total earnings

Number of shares of stock outstanding 260,000

Earnings per share

Price-earnings ratio (P/E)

Market price per share

A-Rod Corp. Jeter Corp.

$624,000

$3,200,000

1,600,000

$2.40

$2.00

20

24

$48

$48

a. The Jeter Corp. is going to give A-Rod Corp. a 50 percent premium

over A-Rod's current market value. What price will it pay?

b. At the price computed in part a, what is the total market value of A-

Rod Corp.?

c. At the price computed in part a, what is the P/E ratio Jeter Corp. is

assigning A-Rod Corp?

d. How many shares must Jeter Corp. issue to buy the A-Rod Corp. at

the total value computed in part b?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please need answer do fast and correct calculation for these accounting questionarrow_forwardHello. I need help with the following question please. Thank you!arrow_forwardLinpro Industries is considering the acquisition of Odetics Inc. in a stock-for-stock exchange. Assume no immediate synergistic benefits are expected. Selected financial data on the two companies are shown below: Linpro Odetics Sales (millions) $480 $90 Net income (millions) $38 $10.4 Common shares outstanding (millions) 10 2.1 Earnings per share $3.80 $4.95 Common stock (price per share) $45.60 $74.25 Calculate Linpro's post-merger EPS if the Odetics shareholders accept an offer of $90 a share in a stock-for-stock exchange. Question 9Answer a. $4.38 b. $3.81 c. $4.29 d. $3.42arrow_forward

- 9arrow_forwardRRRarrow_forwardA merger between Minnie Corporation and Mickey Corporation is under consideration. The financial information for these firms is as follows: Minnie Corporation Mickey Corporation Total earnings $1,682,000 $2,581,000 Number of shares of stock outstanding 290,000 890,000 EPS $5.80 $2.90 P/E ratio 10X 20X Market price per share $58 $58 a. On a share-for-share exchange basis, what will the postmerger EPS be? (Round the final answer to 2 decimal places.) Postmerger earnings per share $ b. If Mickey Corporation pays a 25 percent premium over the market value of Minnie Corporation, how many shares will be issued? (Do not round intermediate calculations.) Shares issued shares c. With the 25 percent premium, what will the postmerger EPS be? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Postmerger earnings per share $arrow_forward

- Suppose that Home Depot, Inc. (HD) is currently holding shares of Apple Inc. (AAPL) and Autozone Inc. (AZO). It owns 57% of AAPL and 43% of AZO. The market values of shares are $2,910,800 and $5,710,200, respectively. HD has total 48,750 shares outstanding. Based on the efficient market approach, the per-share value of HD is closest to O A. $98.15. OB. $92.70. O C. $84.40. D. $73.79.arrow_forwardConsider the table shown below to answer the question posed in part a. Parts b and c are independent of the given table. Number of Share Market Capitalization ($ millions) 1547.66 (millions) Stock Price = Callaway Golf (ELY) Alaska Air Group (ALK) Yum! Brands (YUM) Caterpillar Tractor (CAT) Microsoft (MSFT) $ 16.36 $ 61.96 $ 85.13 $597.63 $ 91.27 94.6 123.4 7645.86 $ 28,305.73 $ 88,090.66 332.5 147.4 7,705.0 $703,235.35 a. The price of Yum! Brands stock has risen to $185. What is the market value of the firm's equity if the number of outstanding sha does not change? (Enter your answer in billions rounded to 3 decimal places.) O Answer is complete but not entirely correct. Market value $33,114.270 8 b. The rating agency has revised Catalytic Concepts' bond rating to BBB (use Table 2.2). What interest rate, approximately, would the company now need to pay on its bonds? (Enter your answer as a percent rounded to 1 decimal place.) Interest rate Ac Graw Hill 1 of 8 Prev Next > MacBook Air…arrow_forwardData for Henry Company and Mayer Services are given in the following table : Item Henry Company Mayer Services Earnings available for common stock $195,000 $45,000 Number of shares of common stock outstanding 75,000 25,000 Market price per share $31 $23 Henry Company is considering merging with Mayer by swapping 1.25 shares of its stock for each share of Mayer stock. Henry Company expects its stock to sell at the same price/earnings (P/E) multiple after the merger as before merging. a. Calculate the ratio of exchange in market price. b. Calculate the earnings per share (EPS) and price/earnings (P/E) ratio for each company. c. Calculate the price/earnings (P/E) ratio used to purchase Mayer Services.arrow_forward

- Data for Henry Company and Mayer Services are given in the following table : Item Henry Company Mayer Services Earnings available for common stock $195,000 $45,000 Number of shares of common stock outstanding 75,000 25,000 Market price per share $31 $23 Henry Company is considering merging with Mayer by swapping 1.25 shares of its stock for each share of Mayer stock. Henry Company expects its stock to sell at the same price/earnings (P/E) multiple after the merger as before merging. d. Calculate the post-merger earnings per share (EPS) for Henry Company. e. Calculate the expected market price per share of the merged firm.arrow_forwardSuppose that in July 2022, Nike Inc. had EBITDA of $6,561 million, excess cash of $12,944 million, $12,541 million of debt, and 1,473.2 million shares outstanding. a. Using the average enterprise value to EBITDA multiple from the table here,, estimate Nike's share price. b. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above? a. Using the average enterprise value to EBITDA multiple in the table, estimate Nike's share price. Nike's share price for this case will be $ 52.78. (Round to the nearest cent.) b. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table? The highest price will be $106.27. (Round to the nearest cent.) Data table TABLE 10.1 Stock Prices and Multiples for the Footwear Industry (excluding Nike), July 2022 Name Nike, Inc. Adidas AG Under Armour Puma AG Skechers U.S.A. Wolverine World Wide Steven Madden, Ltd. Rocky Brands,…arrow_forwardplease solve this Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning