Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting

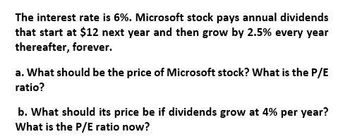

Transcribed Image Text:The interest rate is 6%. Microsoft stock pays annual dividends

that start at $12 next year and then grow by 2.5% every year

thereafter, forever.

a. What should be the price of Microsoft stock? What is the P/E

ratio?

b. What should its price be if dividends grow at 4% per year?

What is the P/E ratio now?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the stock price today if the dividend grow at 2% forever, the required rate of return r=10%, dividend today is $2.00. What is the stock price at year 3?arrow_forwardYou expect that Microsoft will pay a dividend of $1.50 in one year, $1.75 in two years, and $2.00 in three years. After that, dividends are expected to grow at 3% per year. If your required rate of return is 8%, what should be the price of Microsoft today according to the Dividend Discount Model?arrow_forwardWhizcom Inc. is expected to pay a dividend of $1 next period. Dividends are expected to grow at 2% per year and the investors require a return of 12%. a) What would be the likely stock price in year 5? b) What would be per annum rate of return implied by a change in prices from time 0 to time 5?arrow_forward

- Suppose dividends on a stock are expected to be €1 per share for the next 3 years, and the required return is 10% . If the price of a stock is €100 in 3 years 'time when you plan to sell it, what price does this stock need to currently fetch on the market to make it worth buying? If the stock price is expected to increase by €1 three years from now, does the current stock price also increase by €1 ? Why or why not?arrow_forwardSuppose Malaysian Electronics stock is selling for $100 a share (Po = 100). Investors expect a $5 cash dividend over the next year (DIV1 = 5). They also expect the stock to sell for $110 a year hence (P1 = 110). What is the expected return to the stockholders?arrow_forwardWhizcom Inc. is expected to pay a dividend of $1 next period. Dividends are expected to grow at 2% per year and the investors require a return of 12%. i) Compute the current stock price for Whizcom Inc.ii) What would be the likely stock price in year 5?iii) What would be per annum rate of return implied by a change in prices from time 0 to time 5?arrow_forward

- A stock will pay a dividend next quarter of $1.00. If the expected return is 10% per year, compounded annually, what is the price of the stock? Suppose a stock will pay $0 for the next 4 years, and then pay $1 every quarter after that. The required return is 10% per year, compounded annually. What is the price of the stock? Suppose a stock will pay $0.50, $1.00, $1.50, $2.00 and then grow at 4% per year compounded quarterly. The required return is 10% per year compounded annually. What is the price of the stock?arrow_forwardWhat should you pay for a stock if next year's annual dividend is forecast to be $5.25, the constant-growth rate is 2.85%, and you require a 15.5% rate of return?arrow_forwardSuppose currently Samsung's common stock is selling for $195. The company announced that it will give $2.30 dividend next year and it plans to grow the dividend by 5% every year. Given the information what is the market's required rate of return for the stock?arrow_forward

- Suppose Lilly V, Inc. has just paid a dividend. The next dividend, to be paid in a year, is forecasted to be $4. If the growth rate of dividends is 7% and the discount rate is 11%, at what price will the stock sell? a.Less than $100 b.More than $100 c.$100 d.$111arrow_forwardSuppose Facebook Inc. currently pays $1 dividend. Analysts project that the dividend for the next three years will be $1, $2, and 5$. After that the annual dividend is predicted to grow at 5% per year. Investors require a 10% rate of return. What is the value of one share of Facebook stock under these assumptions?arrow_forwardgrey manufacturing is expected to pay a dividend of $1.25 per share at the end of the year (D1=$1.25). The stock sells fo $27.50 per share, and its required rate of return is 10.5%. The dividend is expected to grow at some constant rate, g, forever. What is the equilibrium expected growth rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning