Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

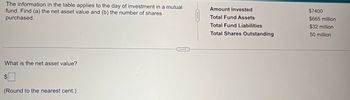

Transcribed Image Text:The information in the table applies to the day of investment in a mutual

fund. Find (a) the net asset value and (b) the number of shares

purchased.

What is the net asset value?

$

(Round to the nearest cent.)

Amount Invested

Total Fund Assets

Total Fund Liabilities

Total Shares Outstanding

$7400

$665 million

$32 million

50 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the Compliance Bond Fund that consists of the seven bonds shown below and has no liabilities. If initially the value of the fund was $2,500,000 and the original shares were offered to the public with a NAV of $25 per share, what is the current NAV of the fund? a. $26.27 b. $25.00 c. $21.67 d. $26.11 e. $27.11arrow_forwardWhich of the following is not considered part of M2? a. money market mutual fund shares b. large time deposits of more than $100,000 c. small time deposits of less than $100,000 d. savings depositsarrow_forwardA1arrow_forward

- Exercise 2: Calculate the NAV of the following fund, assuming 35,000 shares are outstanding. Calculate the percentage change in the NAV of the fund on April 29th 2022. Stock Shares owned price PYPL 3,000 $ 117.65 TWTR 5,000 $ 50.98 PG 9,000 $ 154.62 NVDA 6,000 $ 259.31 RTX 2,000 $98.81 Besides the underlying securities listed above, the fund shows on the Balance Sheet Cash $ 155,000.- Liabilities $ 18,500.- An investor comes the day after computing the above NAV and invests quarter million USD in the fund. Assume no fees or expenses. The money manager buys 2,000 shares of PayPal and 1,500 of Twitter. a) Will the NAV increase or decrease? Why? b) Calculate the return on the investor's shares. How many did he buy with 250k$?arrow_forwardOpen-end Fund A has 187 shares of ATT valued at $46 each and 41 shares of Toro valued at $86 each. Closed-end Fund B has 86 shares of ATT and 83 shares of Toro. Both funds have 1,000 shares outstanding.a. What is the NAV of each fund using these prices? (Round your answers to 3 decimal places. (e.g., 32.161))b. If the price of ATT stock increases to $47.25 and the price of Toro stock declines to $83.292, how does that impact the NAV of both funds? (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))c. Assume that another 166 shares of ATT valued at $46 are added to Fund A. The funds needed to buy the new shares are obtained by selling 630 more shares in Fund A. What is the effect on Fund A’s NAV if the prices remain unchanged from the original prices?arrow_forward15)Consider the following data on two mutual funds: Fund A Fund B Total net assets (assets less Liabilities) at beginning of year ¢ 1,000,000 ¢ 1,000,000 Number of shares outstanding at 100,000 100,000 beginning of year Annual operating expenses ¢ 10,000 ¢ 12,000 Value of securities sold during year ¢ 500, 000 ¢ 800,000 Value of securities purchased during ¢ 400,000 ¢ 900,000 year Brokerage fees for the year ¢ 9,000 ¢ 17,000 Number of shares outstanding at 110,000…arrow_forward

- Situation: I want to invest my 5 million pesos in Mutual funds. Discuss the following: A. Security of MoneyB. Returns on investmentC. Risks involvedD. Impact to government and society Conclusion of Letter A. to D.arrow_forwardLong-term mutual funds primarily invest in assets that have O A. Assets that have maturities of less than one year B. Assets that have maturities of greater than one year OC.US Treasury Bills O D. Hybrid carsarrow_forwardThe composition of the Fingroup Fund portfolio is as follows: Price $ 35 34 26 25 Stock A B C D Shares 200,000 288,000 406,000 660,000 The fund has not borrowed any funds, but its accrued management fee with the portfolio manager currently totals $46,000. There are 5.2 million shares outstanding. What is the net asset value of the fund? (Round your answer to 2 decimal places.) Net asset valuearrow_forward

- 5. Comparing loads and fees Claire wants to buy shares in a mutual fund and has narrowed her selection to the following four funds. Answer the questions below to help assess each fund in terms of the fees each charges. Fund NAV Net Chg. YTD % Ret. MinT p $15.32 -0.05 2.5 IntRA r $18.77 0.05 5.4 MRGG r $27.81 0.19 7.9 MajTrkⁿ $45.21 0.28 9.0 Suppose MajTrkⁿ charges a commission of 8%. This_________an example of a relatively low-load fund. If Claire purchases $4,000 worth of MajTrkⁿ shares, only $___________will actually be invested. This means that the commission—as a percentage of the amount invested—is equal to . The mutual fund MinT p is a no-load fund that imposes a_________on reinvested dividends as well as on the initial investment. Funds that charge this type of fee _________ generally be expected to outperform funds that do not charge these fees. Claire is planning on holding her shares for at least a year and wants a fund that…arrow_forwardThe western capital growth mutual fund has Total assets 812,000,000 Total liabilities 12,000,000 Total number of shares 40,000,000 What is the funds net asset value (NAV)?arrow_forward10. A mutual fund has total assets of P680M and total liabilities of P38M. If the company has 545,000 outstanding shares and you plan to invest money worth P1.5M, how many shares .8 should you receive?ulev sosts diiw llid yauaROTTIysb-00thlyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education