FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

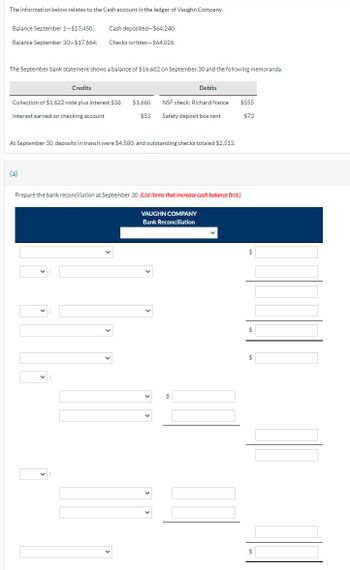

Transcribed Image Text:The information below relates to the Cash account in the ledger of Vaughn Company.

Balance September 1-$17,450;

Balance September 30-$17,664;

The September bank statement shows a balance of $16,682 on September 30 and the following memoranda.

Cash deposited-$64.240.

Checks written-$64,026.

Credits

Collection of $1,622 note plus interest $38 $1,660

Interest earned on checking account

$53

(a)

At September 30, deposits in transit were $4,580, and outstanding checks totaled $2,513.

:

NSF check: Richard Nance $555

Safety deposit box rent

$73

Debits

Prepare the bank reconciliation at September 30. (List items that increase cash balance first.)

VAUGHN COMPANY

Bank Reconciliation

$

$

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following information: The bank statement balance is $5,289. The cash account balance is $5,764. Outstanding checks amounted to $751. Deposits in transit are $1,174. The bank service charge is $43. A check for $71 for supplies was recorded as $62 in the ledger. Prepare a bank reconciliation for Candace Co. for May 31. Candace Co.Bank ReconciliationMay 31 Cash balance according to bank statement $fill in the blank 1 Adjustments: $fill in the blank 3 fill in the blank 5 Total adjustments fill in the blank 6 Adjusted balance $fill in the blank 7 Cash balance according to company's records $fill in the blank 8 Adjustments: $fill in the blank 10 fill in the blank 12 Total adjustments fill in the blank 13 Adjusted balance $fill in the blank 14arrow_forwardUsing the following information: The bank statement balance is $3,093. The cash account balance is $3,305. Outstanding checks amounted to $767. Deposits in transit are $815. The bank service charge is $155. A check for $40 for supplies was recorded as $31 in the ledger. Prepare a bank reconciliation for Miller Co. for August 31. Miller Co.Bank ReconciliationAugust 31 Cash balance according to bank statement $fill in the blank 1 Adjustments: $- Select - - Select - Total adjustments fill in the blank 6 Adjusted balance $fill in the blank 7 Cash balance according to company's records $fill in the blank 8 Adjustments: $- Select - - Select - Total adjustments fill in the blank 13 Adjusted balance $fill in the blank 14arrow_forwardPeterson Company's general ledger shows a cash balance of $7,720 on May 31. May cash receipts of $1,340, included in the general ledger balance, are placed in the night depository at the bank on May 31 and processed by the bank on June 1. The bank statement dated May 31 shows an NSF check for $190 and a service fee of $60. The bank processes all checks written by the company by May 31 and lists them on the bank statement, except for one check totaling $1,710. The bank statement shows a balance of $7,840 on May 31. Prepare a bank reconciliation to calculate the correct ending balance of cash on May 31. (Amounts to be deducted should be indicated with a minus sign.) Bank's Cash Balance Before reconciliation After reconciliation PETERSON COMPANY Bank Reconciliation May 31 SA Company's Cash Balance Before reconciliation 0 After reconciliation SA 0arrow_forward

- Presented below is information related to Shamrock Inc. Balance per books at October 31, $58,586.99; receipts $242,933.47; disbursements $230,850.96. Balance per bank statement November 30, $78,783.88. The following checks were outstanding at November 30. 1224 $2,289.41 1230 1232 1233 3,455.62 (a) 2,975.21 675.04 Included with the November bank statement and not recorded by the company were a bank debit memo for $38.36 covering bank charges for the month, a debit memo for $520.98 for a customer's check returned and marked NSF, and a credit memo for $1,960 representing bond interest collected by the bank in the name of Shamrock Inc. Cash on hand at November 30 recorded and awaiting deposit amounted to $2,681.56. Prepare a bank reconciliation (to the correct balance) at November 30, for Shamrock Inc. from the information above. (Enter answers to 2 decimal places, e.g. 125.62.)arrow_forwardThe following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,127 debit balance, but its July bank statement shows a $27,260 cash balance. b. Check Number 3031 for $1,420, Check Number 3065 for $486, and Check Number 3069 for $2,188 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,290 but was erroneously entered in the accounting records as $1,280. d. The July bank statement shows the bank collected $9,000 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $14 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification…arrow_forwardGiven the following information, determine the adjusted cash balance per books from the following information: a. Balance per books as of June 30, $8,600. b. Outstanding checks, $820. с NSF check returned with bank statement, $130. d. Deposit mailed the afternoon of June 30, $300. e Check printing charges, $30. Interest earned on checking account, $12. Adjusted cash balance per books $arrow_forward

- Refer to the information given below: a. The August 31 balance shown on the bank statement is $9,050. b. There is a deposit in transit of $1,300 at August 31. c. Outstanding checks at August 31 totaled $1,620. d. Interest credited to the account during August but not recorded on the company's books amounted to $68. e. A bank charge of $44 for checks was made to the account during August. Although the company was expecting a charge, the amount was not known until the bank statement arrived. f. In the process of reviewing the canceled checks, it was determined that a check issued to a supplier in payment of accounts payable of $142 had been recorded as a disbursement of $412. g. The August 31 balance in the general ledger Cash account, before reconciliation, is $8,436. Required: a-1. Show the reconciling items in a horizontal model that should be prepared to reflect the reconciling items as on August 31. (Use amounts with + for increases and amounts with for decreases.) Cash Assets…arrow_forwardThe phone data where accumulated for use and reconciling the bank account of Mathers Co. For July: 1. Cash balance according to the company's records at July 31st $18,310. 2. Cash balance according to the bank statement at July 31st, $19,360. 3. Checks outstanding, $3,720. 4 . Deposit in transit, not recorded by Bank $2,980. 5. A check for $480 in payment of an account was erroneously record it in the check register as $840. 6. Bank debit memo for service charges, $50. A. Prepare a bank reconciliation, using the format showing in exhibit 14 Mather Co. Bank Reconciliation July 31 ___________________________________________ Cash balance according to bank statement $ _______ _______ ______ Adjusted balance. $_____ Cash balance according to companies records $ ___ ________ ________ Adjusted balance.…arrow_forwardThe bank statement for Jeffrey Co. indicates a balance of $8,785 on October 31. After the journals for October had been posted, the cash account had a balance of $8,998. a. Cash sales of $945 had been erroneously recorded in the cash receipts journal as $495. b. Deposits in transit not recorded by bank, $778. c. Bank debit memo for service charges, $40. d. Bank credit memo for note collected by bank, $23,985 plus $885 interest. e. Bank debit memo for $756 NSF (not sufficient funds) check from Calin Sams, a customer. f. Checks outstanding, $1,860. Record the appropriate journal entries that would be necessary for Jeffrey Co. Record the entry that increases cash first. If an amount box does not require an entry, leave it blank.arrow_forward

- The April 30, Current Year, bank statement and the April ledger account for cash showed the following (summarized): Balance, April 1, Current. Year Deposits during April Interest collected Checks cleared during April NSF check-A. B. Wright Bank service charges Balance, April 30, Current Year Debit April 1 Balance April Deposits BANK STATEMENT Cash balance Checks Cash (A) $45,500 270 150 Deposits $37,200 1,210 Credit 25,300 April Checks written 43,400 Balance $31,500 68,700 69,910 24,410 24,140 23,990 23,990 43,700 A comparison of checks written before and during April with the checks cleared through the bank showed outstanding checks at the end of April of $4,400 (including $2,600 written before and $1,800 written during April). No deposits in transit were carried over from March, but a deposit was in transit at the end of April. 3. What was the beginning balance in the cash account in the ledger on May 1, Current Year?arrow_forwardAs of June 30, Year 1, the bank statement showed an ending balance of $18,181. The unadjusted Cash account balance was $17,028. The following information is available: 1. Deposit in transit, $2,795. 2. Credit memo in bank statement for interest earned in June: $14. 3. Outstanding check: $3,946. 4. Debit memo for service charge: $12. Required: Determine the true cash balance by preparing a bank reconciliation as of June 30, Year 1, using the preceding information. Note: Negative amounts should be indicated with minus sign. Bank Reconciliation Unadjusted bank balance 6/30/Year 1 True cash balance 6/30/Year 1 Unadjusted book balance 6/30/Year 1 True cash balance 6/30/Year 1 $ $ $ 18,181 18,181 4 0arrow_forwardThe following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,127 debit balance, but its July bank statement shows a $27,260 cash balance. b. Check Number 3031 for $1,420, Check Number 3065 for $486, and Check Number 3069 for $2,188 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,290 but was erroneously entered in the accounting records as $1,280. d. The July bank statement shows the bank collected $9,000 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $14 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education