FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

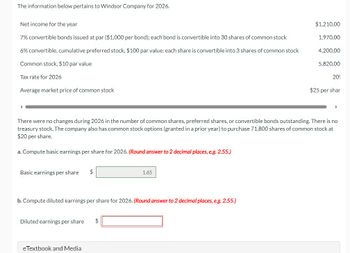

Transcribed Image Text:The information below pertains to Windsor Company for 2026.

Net income for the year

7% convertible bonds issued at par ($1,000 per bond); each bond is convertible into 30 shares of common stock

6% convertible, cumulative preferred stock, $100 par value; each share is convertible into 3 shares of common stock

Common stock, $10 par value

Tax rate for 2026

Average market price of common stock

4

a. Compute basic earnings per share for 2026. (Round answer to 2 decimal places, e.g. 2.55.)

Basic earnings per share $

b. Compute diluted earnings per share for 2026. (Round answer to 2 decimal places, e.g. 2.55.)

Diluted earnings per share

There were no changes during 2026 in the number of common shares, preferred shares, or convertible bonds outstanding. There is no

treasury stock. The company also has common stock options (granted in a prior year) to purchase 71,800 shares of common stock at

$20 per share.

eTextbook and Media

1.65

$

$1,210,00

1,970,00

4,200,00

5,820,00

20%

$25 per shar

▶

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jay Give me correct answer with explanationarrow_forwardCurrent Attempt in Progress On January 2, 2021, Crane Company issued at par $1920000 of 5% convertible bonds. Each $1000 bond is convertible into 10 shares of common stock. No bonds were converted during 2021. Crane had 206000 shares of common stock outstanding during 2021. Crane's 2021 net income was $904000 and the income tax rate was 25%. Crane's diluted earnings per share for 2021 would be (rounded to the nearest penny): O $4.47. O $4.77. O $4.39. O $4.33. Save for Later Attempts: 0 of 1 used Submit Answer MacBook Airarrow_forwardEPS with Convertible Bonds and Preferred Stock The Ehrlich Corporation issued 10-year, $5,000,000 par, 7% callable convertible bonds on January 2, 2022. The bonds have a par value of $1,000, with interest payable annually. Each bond is convertible into 18 shares of common stock. The bonds were issued at 100. Ehrlich's effective tax was 20%. Net income in 2022 was $9,500,000, and the company had 2,000,000 shares outstanding during the entire year.Instructions: a. Compute both basic and diluted earnings per share. Show calculations. b. Recompute the schedule as if the security was convertible cumulative preferred stock, $5,000,000, 8%, $100 par value. Each share of preferred stock is convertible into 1 share of common stock.arrow_forward

- The information below pertains to TV Johnny Company for Year 11: Net income for the year $1,200,000 7% convertible bonds issued at par ($1,000 bond); each bond convertible into 30 shares of common stock 2,000,000 6% convertible, cumulative preferred stock, $100 par value; each share convertible into 3 shares of common stock 4,000,000 Common stock, $10 par value 6,000,000 Income tax rate for Year 11 20% Average market price of common stock during Year 11 $25 per share Market price of common stock on December 31, Year 11 $30 per share There were no changes during Year 11 in the number of common shares, preferred shares, or convertible bonds outstanding. There is no treasury stock. The company also has common…arrow_forwardJones Corporation’s capital structure follows. December 31 2020 Outstanding shares of stock Common stock, outstanding shares 110,000 Convertible preferred stock, outstanding shares 10,000 8% Convertible bonds $1,000,000 During 2020, Jones declared and paid dividends of $3.00 per share on its preferred stock. The preferred shares are convertible into 20,000 shares of common stock. The 8% bonds are convertible into 30,000 shares of common stock. Net income for 2020 is $850,000. Assume that the income tax rate is 25%. a) Compute basic EPS for 2020. b) Compute diluted EPS for 2020. c) Prepare the bottom of the company’s income statement in proper form, beginning with the net income.arrow_forwardOriole Corporation issued $6600000 of 9%, ten-year convertible bonds on July 1, 2024 at 96.1 plus accrued interest. The bonds were dated April 1, 2024 with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line basis. On April 1, 2025, $1320000 of these bonds were converted into 600 shares of $20 par value common stock. Accrued interest was paid in cash at the time of conversion. If Interest Payable was credited when the bonds were issued, what amount should be debited to Interest Expense on October 1, 2024? O $155100 O $297000 O $141900 O $148500arrow_forward

- The table below shows a partial view of Webster Corporation's balancesheet. Webster CorporationBalance Sheet (partial)At December 31, 2021 Long-term debt Notes payable 10% $2,000,00010% convertible bonds payable 2,500,00012% convertible bonds payable 3,000,000Total long-term debt $7,500,000 Stockholders' equity 6% cumulative, convertiblepreferred stock, $100 par, 50,000shares outstanding. 5,000,000 Common stock, $1 par, 600,000shares outstanding. 600,000Additional paid-in capital 2,500,000 Retained earnings 8,500,000Total stockholders' equity $16,600,000 Notes and Assumptions December 31, 20211. Options were granted in December 2020 to purchase 25,000 shares of common stock at $25 per share. The average market price of common stock during 2021 was $35 per share. All options are still outstanding atthe end of 2021 2. Both the 10 percent and 12 percent convertible bonds were issued in2020 at face value. Each convertible bond is convertible into 50 shares of common stock.…arrow_forwardRakesharrow_forwardProblem: Earnings per Share. (Pls help and provide supporting computations)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education