FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:a)

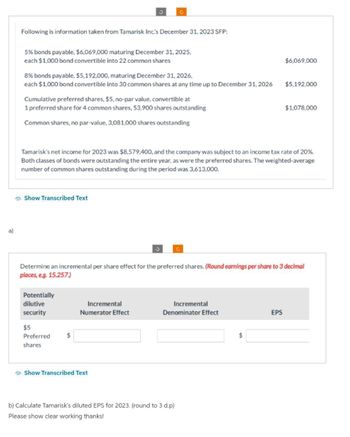

Following is information taken from Tamarisk Inc.'s December 31, 2023 SFP:

5% bonds payable, $6,069,000 maturing December 31, 2025,

each $1,000 bond convertible into 22 common shares

8% bonds payable, $5,192,000, maturing December 31, 2026,

each $1,000 bond convertible into 30 common shares at any time up to December 31, 2026

Cumulative preferred shares, $5, no-par value, convertible at

1 preferred share for 4 common shares, 53,900 shares outstanding

Common shares, no par-value, 3,081,000 shares outstanding

Show Transcribed Text

3

Potentially

dilutive

security

$5

Preferred

shares

G

Tamarisk's net income for 2023 was $8,579,400, and the company was subject to an income tax rate of 20%.

Both classes of bonds were outstanding the entire year, as were the preferred shares. The weighted-average

number of common shares outstanding during the period was 3,613,000.

$

Incremental

Numerator Effect

Show Transcribed Text

3

Determine an incremental per share effect for the preferred shares. (Round earnings per share to 3 decimal

places, e.g. 15.257.)

Incremental

Denominator Effect

b) Calculate Tamarisk's diluted EPS for 2023. (round to 3 d.p)

Please show clear working thanks!

$6,069,000

$

$5,192,000

EPS

$1,078,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardConvertible Preferred Stock, Convertible Bonds, and EPS Francis Company has 12,000 shares of common stock outstanding at the beginning of 2019. Francis issued 1,500 additional shares on May 1 and 1,000 additional shares on September 30. It also has two convertible securities outstanding at the end of 2019. These are: Convertible preferred stock: 1,250 shares of 8.5%, $50 par, preferred stock were issued on January 2, 2016, for $55 per share. Each share of preferred stock is convertible into 3 shares of common stock. Current dividends have been declared and paid. To date, no preferred stock has been converted. Convertible bonds: Bonds with a face value of $125,000 and an interest rate of 5.5% were issued at par in 2018. Each $1,000 bond is convertible into 20 shares of common stock. To date, no bonds have been converted. Francis earned net income of $50,000 during 2019. The income tax rate is 30%. 3. Calculate diluted earnings per share for 2019 and the incremental EPS of the…arrow_forwardDinesharrow_forward

- Convertible Preferred Stock, Convertible Bonds, and EPS Francis Company has 21,600 shares of common stock outstanding at the beginning of 2019. Francis issued 2,700 additional shares on May 1 and 1,800 additional shares on September 30. It also has two convertible securities outstanding at the end of 2019. These are: Convertible preferred stock: 2,250 shares of 8.0%, $50 par, preferred stock were issued on January 2, 2016, for $60 per share. Each share of preferred stock is convertible into 3 shares of common stock. Current dividends have been declared and paid. To date, no preferred stock has been converted. Convertible bonds: Bonds with a face value of $225,000 and an interest rate of 6.0% were issued at par in 2018. Each $1,000 bond is convertible into 25 shares of common stock. To date, no bonds have been converted. Francis earned net income of $75,000 during 2019. The income tax rate is 30%. Required:arrow_forwardConvertible Preferred Stock, Convertible Bonds, and EPS Francis Company has 19,200 shares of common stock outstanding at the beginning of 2019. Francis issued 2,400 additional shares on May 1 and 1,600 additional shares on September 30. It also has two convertible securities outstanding at the end of 2019. These are: Convertible preferred stock: 2,000 shares of 8.0%, $50 par, preferred stock were issued on January 2, 2016, for $55 per share. Each share of preferred stock is convertible into 3 shares of common stock. Current dividends have been declared and paid. To date, no preferred stock has been converted. Convertible bonds: Bonds with a face value of $200,000 and an interest rate of 5.5% were issued at par in 2018. Each $1,000 bond is convertible into 20 shares of common stock. To date, no bonds have been converted. Francis earned net income of $70,000 during 2019. The income tax rate is 30%. Required: 1. Compute the number of shares of common stock that Francis should…arrow_forwardJay Give me correct answer with explanationarrow_forward

- Convertible Preferred Stock, Convertible Bonds, and EPS Francis Company has 12,000 shares of common stock outstanding at the beginning of 2019. Francis issued 1,500 additional shares on May 1 and 1,000 additional shares on September 30. It also has two convertible securities outstanding at the end of 2019. These are: Convertible preferred stock: 1,250 shares of 9.0%, $50 par, preferred stock were issued on January 2, 2016, for $60 per share. Each share of preferred stock is convertible into 3 shares of common stock. Current dividends have been declared and paid. To date, no preferred stock has been converted. Convertible bonds: Bonds with a face value of $125,000 and an interest rate of 6.0% were issued at par in 2018. Each $1,000 bond is convertible into 25 shares of common stock. To date, no bonds have been converted. Francis earned net income of $55,000 during 2019. The income tax rate is 30%. Required: 1. Compute the number of shares of common stock that Francis should use…arrow_forwardOriole Corporation issued $6600000 of 9%, ten-year convertible bonds on July 1, 2024 at 96.1 plus accrued interest. The bonds were dated April 1, 2024 with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line basis. On April 1, 2025, $1320000 of these bonds were converted into 600 shares of $20 par value common stock. Accrued interest was paid in cash at the time of conversion. If Interest Payable was credited when the bonds were issued, what amount should be debited to Interest Expense on October 1, 2024? O $155100 O $297000 O $141900 O $148500arrow_forwardThe table below shows a partial view of Webster Corporation's balancesheet. Webster CorporationBalance Sheet (partial)At December 31, 2021 Long-term debt Notes payable 10% $2,000,00010% convertible bonds payable 2,500,00012% convertible bonds payable 3,000,000Total long-term debt $7,500,000 Stockholders' equity 6% cumulative, convertiblepreferred stock, $100 par, 50,000shares outstanding. 5,000,000 Common stock, $1 par, 600,000shares outstanding. 600,000Additional paid-in capital 2,500,000 Retained earnings 8,500,000Total stockholders' equity $16,600,000 Notes and Assumptions December 31, 20211. Options were granted in December 2020 to purchase 25,000 shares of common stock at $25 per share. The average market price of common stock during 2021 was $35 per share. All options are still outstanding atthe end of 2021 2. Both the 10 percent and 12 percent convertible bonds were issued in2020 at face value. Each convertible bond is convertible into 50 shares of common stock.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education