ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

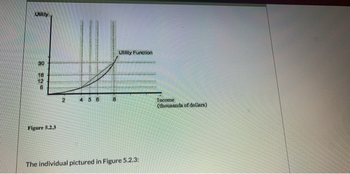

Transcribed Image Text:The individual pictured in Figure 5.2.3:

O would receive a utility of 12 from a sure $6000.

Owould receive a utility of 18 from a sure $6000.

O prefers a sure $6000 to a 50% chance of $4000 and a 50% chance of $8000.

has an expected utility of 12 from a 50% chance of $4000 and a 50% chance of $8000.

Transcribed Image Text:Ubility

30

18

12

6

Figure 5.2.3

N.

456

8

Utility Function

The individual pictured in Figure 5.2.3:

Income

(thousands of dollars)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Becky is deciding whether to purchase an insurance for her home againtst burglary. the payoff for her is shown as follow: Net worth of her Net worth of her home: $ 20000 burglary(10%) Net worth of her Net worth of her home: $50000 burglary (90%) The insueance would cover all the loss from burlary and the insurance fee is $8000. Her utility funtion is given as u=w ^0.3 Should Beck purchase the insurance Explain.arrow_forwardQ5arrow_forwardQuestion 4 Suppose that there is a 10% chance Ja'Marr is sick and earns $10,000, and a 90% chance he is healthy and will earn $70,000. Suppose further that his utility function is the following (utility = square root of income) U (I) = VIncome Ja'Marr's expected income is O $60,000 O $70,000 $40,000 O $64,000arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardIf a risk-neutral individual owns a home worth $200,000 and there is a three percent chance the home will be destroyed by fire in the next year, then we know 15. that: a) He is willing to pay much more than $6,000 for full cover. b) He is willing to pay much less than $6,000 for full cover. c) He is willing to pay at most $6,000 for full cover. d) None of the above are correct. e) All of the above are correct.arrow_forwardAn individual is o ered a choice of either $50 or a lottery which may result in $0and $100, each with equal probability 1/2 . If the individual has a utility function u(w) = 5 + 2w, which one would they choose? If the individual has a utility function u(w) =w1/2 + 1?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education