FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Can you please solve this financial accounting question?

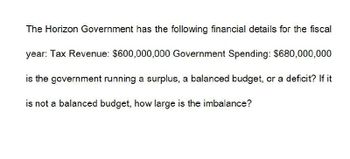

Transcribed Image Text:The Horizon Government has the following financial details for the fiscal

year: Tax Revenue: $600,000,000 Government Spending: $680,000,000

is the government running a surplus, a balanced budget, or a deficit? If it

is not a balanced budget, how large is the imbalance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Answer? Financial accountingarrow_forwardWe have the following information regarding the public budget of a given country for a given fiscal year (all amounts are expressed in euros): -Current revenues = 23,000 -Capital revenues= 3,450 -Capital expenditures = 5,500 -(Total) Current expenditures=45,000 -Interest payments of public debt =195 -Repayment of public debt= 15,000 -Sale of financial assets= 2,345 -Investment in financial assets= 135 Calculate then the following budget indicators: (i) Public deficit/surplus (ii) Primary deficit/surplus (iii) Debt issued (iv) Gross variation in the stock of debt (v) Net variation in the stock of debtarrow_forwardWhat revenue sources allow this budget to be balanced in each year? What revenue source will have the greatest impact on the budget? What assumptions have been made with respect to revenue sources? What two expenditures will have the greatest impact upon the budget?arrow_forward

- How do amendments to government policies effect the fourth-quarter budget of an organization?arrow_forwardWhich one of the following statements is true about a balanced budget? Group of answer choices Revenues should be less than expenses Revenues and expenses should be equal Expenses should not be greater than revenues Zero-based method should be used every other yeararrow_forwardYou are constructing an annual operating budget that estimates costs related to the current year's operations. What category would you typically exclude from that operating budget? A- Operating expenditure B- Debt payments C- Capital expenditure D- Insurance premiumsarrow_forward

- A provincial Minister of Education recently announced that his government's forecast expenditure of $2.68 billion on education next year represents 23.5% of the provincial budget.Rounded to the nearest million dollars, what is the province's total budget for the next year?Province's total budget = $ __Billionarrow_forwardConsider the following statements about zero-base budgeting: I. The budget for virtually every activity in an organization is initially set to the level that existed during the previous year. II. The budget forces management to rethink each phase of an organization's operations before resources are allocated. III. To receive funding for the upcoming period, individual activities must be justified in terms of continued usefulness to the organization. Which of the above statements is (are) true? A. II only. B. III only. C. I and II. D. II and III. E. I, II, and III.arrow_forwardE10.1 (LO 1, 2), K Connie Rice has prepared the following list of statements about budgetary control. 1. Budget reports compare actual results with planned objectives. 2. All budget reports are prepared on a weekly basis. 3. Management uses budget reports to analyze differences between actual and planned results and to determine their causes. 4. As a result of analyzing budget reports, management may either take corrective action or modify future plans. 5. Budgetary control works best when a company has an informal reporting system. 6. The primary recipients of the sales report are the sales manager and the production supervisor. 7. The primary recipient of the scrap report is the production manager. 8. A static budget is a projection of budget data at a single level of activity. 9. Top management's reaction to unfavorable differences is not influenced by the materiality of the difference. 10. A static budget is not appropriate in evaluating a manager's effectiveness in controlling…arrow_forward

- Discuss the relevance of the budget in public sector accounting.(300 words)arrow_forward"On what basis shall we allocate resources to Program A instead of Program B,” is the perennial statement in public sector budgeting. Identify and discuss at least five attempts, found in the budgeting literature, used to answer V.O. Key’s famous budgeting question. In your professional judgment, which type of budgeting system is most appropriate for public administration? Why do you feel this way?arrow_forwardToday is November 1, 2021. A continuous budget for the period from November 1, 2021 through October 31, 2022 is more reflective of current operating conditions than an operating budget for calendar year 2021 that was compiled in November 2020. True or false?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education