Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Accounting answer me

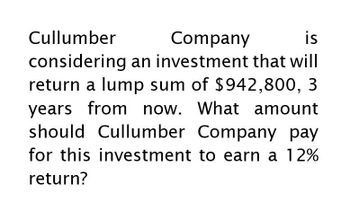

Transcribed Image Text:Cullumber

Company

is

considering an investment that will

return a lump sum of $942,800, 3

years from now. What amount

should Cullumber Company pay

for this investment to earn a 12%

return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me this question solutionarrow_forwardGeneral accountingarrow_forwardPlease only answer PART F d) Suppose the Internal Rate of Return (IRR) of this investment opportunity is 15%. Based on this information alone, should Limitless Ltd. make the investment? Why?Would this decision be consistent with that from B? Explain your reasoning.e) Suppose that, instead of paying the initial £500,000 now, Limitless Ltd. decides to pay it in equal instalments over the next 10 years. How much would the companyneed to pay each year to make all these payments equivalent to £500,000 today? f) Now assume that an alternative project would generate immediate (time zero) net profits of £500,000 upfront, but after that, it would result in annual losses of£120,000 over the next five years, and then the annual losses of £60,000 over the following five years. The cost of capital is 12% and the IRR is 15%. Should you start this project? Explain your reasoning. Would you make the same decision based on NPV and IRR? Why?arrow_forward

- If An investment costs $23,958 and will generate cash flow of $6,000 annually for five years. The firm's cost of capital is 10 percent? a. What is the investment's internal rate return? Based on the net present rate return, should the firm makeinvestment? b.What is the investment's net present value? Based on the net present value, should the firm make the investment?arrow_forwardSuppose a firm will invest $500 today, $600 a year from now, $700 two years from now, $800 three years from now, and $900 four years from now. What will the future value of the project five years from now assuming the interest rate of 12%? O $3,939.08 $4,303.79 $5,398.68 $4,820.25arrow_forward5. Calculating IRR A firm evaluates all of its projects by applying the IRR rule. If the required return is 11 percent, should the firm accept the following project? LO 3 Year Cash Flow -$157,300 1 74,000 87,000 46,000arrow_forward

- Ivanhoe, Inc., management is expecting a new project to start paying off beginning at the end of next year. Cash flows are expected to be as follows: 8.00% $432676 $473452 Future value Present value $ 2 If Ivanhoe can reinvest these cash flows to earn a return of 8.00 percent, what is the future value of this cash flow stream at the end of 5 years? What is its present value? (Round answers to 2 decimal places, e.g. 52.75. Do not round factor values.) LA $ 5 Year $484455 $486326 $544444arrow_forwardPlease help me to solve this problemarrow_forwardA company is considering an investment that will cost $759,000 and have a useful life of 6 years. The cash flows from the project are expected to be $450,000 per year in the first two years then $170,000 per year for the last 4 years. If the appropriate discount rate is 16.0 percent per annum, what is the NPV of this investment (to the nearest dollar)? Select one: O a. $316870 O b. $321617 O c. $1834870 O d. $439045arrow_forward

- i need the answer quicklyarrow_forwardA company has an investment project that would cost$10 million today and yield a payoff of $15 million in4 years.a. Should the firm undertake the project if theinterest rate is 11 percent? 10 percent? 9 percent?8 percent?b. Can you figure out the exact interest rate atwhich the firm would be indifferent betweenundertaking and forgoing the project? (Thisinterest rate is called the project’s internal rate ofreturn.)arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning