FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

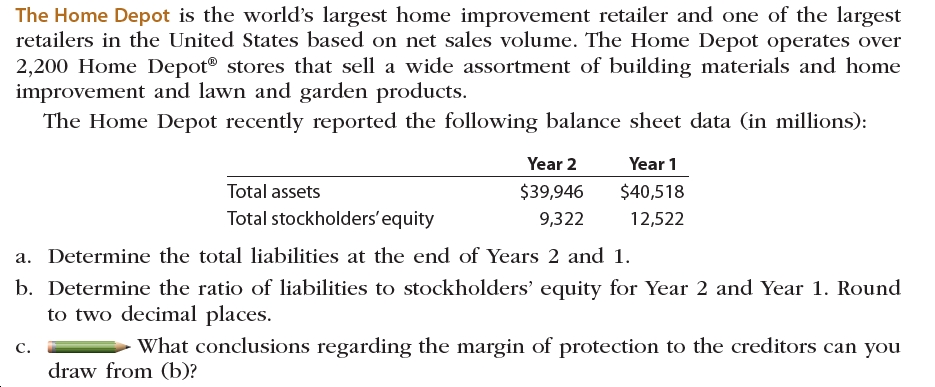

Transcribed Image Text:The Home Depot is the world's largest home improvement retailer and one of the largest

retailers in the United States based on net sales volume. The Home Depot operates over

2,200 Home Depot® stores that sell a wide assortment of building materials and home

improvement and lawn and garden products.

The Home Depot recently reported the following balance sheet data (in millions)

Year 2

Year 1

Total assets

$39,946

$40,518

Total stockholders' equity

12,522

9,322

a. Determine the total liabilities at the end of Years 2 and 1.

b. Determine the ratio of liabilities to stockholders' equity for Year 2 and Year 1. Round

to two decimal places

What conclusions regarding the margin of protection to the creditors can you

C.

draw from (b)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Inferring Transactions from Financial StatementsCostco Wholesale Corporation operates membership warehouses selling food, appliances, consumer electronics, apparel and other household goods at 721locations across the U.S. as well as in Canada, the United Kingdom, Japan, Australia, South Korea, Taiwan, Mexico and Puerto Rico. As of its fiscal year-end 2016, Costco had approximately 86.7 million members. Selected fiscal-year information from the company's balance sheets follows. Selected Balance Sheet Data ($ millions) 2016 2015 Merchandise inventories $8,969 $8,908 Deferred membership income (liability) 1,362 1,269 (a) During fiscal 2016, Costco collected $2,739 million cash for membership fees. Use the financial statement effects template to record the cash collected for membership fees.(b) Costco recorded merchandise costs (that is, cost of goods sold) of $102,901 million in 2016. Record this transaction in the financial statement effects template.(c) Determine the…arrow_forwardThe following information is taken from the financial statements of Down Home Deli for the last three years. The owner, John Walton is quite pleased to see that his sales are growing steadily. 2018 2017 2016 Sales $ 61,500 $ 50,400 $ 42,000 Cost of goods sold 27,670 21,170 16,800 Operating income 7,530 6,050 4,620 Net income 3,075 4,030 2,940 Instructions: (a) Calculate gross profit margin, profit margin, and profit margin using operating income. (b) Comment on whether the Deli is, in fact, doing better over the three years as John believes.arrow_forwardAmazon.com, inc. is one of the largest Internet retailers in the world. Wal-Mart is the largest retailer in the United States. Amazon and Wal-Mart compete in similar markets; however, Wal-Mart sells through both traditional retail stores and the Internet, while Amazon sells only through the Internet. Earnings and Common Stock Outstanding information was obtained from recent financial statements for both companies as follows (in million): Amazon . Wal-Mart Net Income $2,371 $14,694 Average Number of Common Shares Outstanding. . $ 474 $ 3,207 Required: a. Determine the Earnings Per Share for each company. Neither company had Preferred Stock Outstanding. Round to the nearest cent. b. Which company appears more profitable from an Earnings-Per-Share perspective. c. The market price of Amazon Common Stock was $750 per share at a time when Wal-Mart's was $69 per share. How would you explain this difference in Market Price given the Earnings-Per-Share computed in (a) for both companies?arrow_forward

- The Home Depot, Inc. (HD), is the world's largest home improvement retailer and one of the largest retailers in the United States based on sales volume. Home Depot operates over 2,200 stores that sell a wide assortment of building, home improvement, and lawn and garden items. Home Depot recently reported the following end-of-year balance sheet data (in millions): Year 3 Year 2 Year 1 Total assets $42,549 $39,946 $40,518 Total liabilities 36,233 30,624 27,996 Total stockholders' equity 6,316 9,322 12,522 Compute the ratio of liabilities to stockholders' equity for all three years. Round to two dec- imal places. a. b. What conclusions regarding the margin of protection to creditors can you draw from the trend in this ratio for the three years?arrow_forwardBelow is the common-sized statement for the current calendar year fo Hugo Boss and Industry average, Industry Hugo Boss Average Sales 100% 100% Cost of Goods Sold 46.7% 45.2% Gross Profit 53.3% 54.8% Selling Expenses 12.9% 16.7% Administrative Expenses 13.1% 14.5% Total Operating Expenses 25.0% 31.2% Income from Operations 27.3% 23.6% Other Revenue 1.8% 1.2% 29.% 24.8% Other Expense(Interest) 1.0 0.9 Income Before Income Tax 28.1% 23.9% Income Tax Expense 9.8 8.4 Net Income 18.3% 15.5% Using the common-sized statement above, compare Hugo Boss with the industry average and identify strengths and weaknesses that Hugo Boss has to the industry. Does Hugo Boss need any course correction. What does it need?arrow_forwardRotorua Products sells agricultural products in the burgeoning Asian market. The company's current assets, current liabilities, and sales over the last five years (Year 5 is the most recent year) are as follows: Sales Cash Accounts receivable, net Inventory Total current assets Current liabilities Sales Current assets: Cash Accounts receivable, net Inventory Total current assets Current liabilities Year 11 Year 2 Year 3 Year 4 Year 5 $4,545,400 $4,737,850 $ 5,126,380 $5,421,900 $5,776,190 Year 1 $ 88,854 418,283 800,380 $ 1,307,517 $ 313,578 Required: 1. Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year. Note: Round your percentage answers to 1 decimal place (i.e., 0.1234 should be entered as 12.3). % % % % % % Year 2 $ 88,845 $ 77,057 435,833 587,279 $ 90,380 417,076 876,061 $1,383,517 $ 1,350,248 $ 1,466,414 $1,552,502 $ 346,822 $ 336,685 $ 335,107 $ 390,612 825,570 882,078 % % % % % % Year 3 % % % % Year 4 % % $ 80,928 569,984…arrow_forward

- Vijayarrow_forwardneed both answerarrow_forwardProfitability Ratios East Point Retal, Inc. seils apparel through company-owned retail stores. Recent financial information for East Point follows (in thousands): Fiscal Year 3 Fiscal Year 2 $145,000 $(74,600) 3,000 11,200 Fiscal Year 3 Fiscal Year 2 Fiscal Year 1 Net income (los) Interest expense Total assets (at and of fiscal year) Total stockholders equity (at end of fiscal year) Assume the apparel industry average return on total assets is 5.0% and the average return on stockholders' equity is 8.0% for the year ended February 2, Year 3. $1,307,759 1,010,000 Fiscal Year 3 Fiscal Year 2 $1,243,965 990,000 $1,106,719 724,942 a. Determine the return on total assets for East Point for fiscal Years 2 and 3. Round percentages to one decimal place. If required, use a minus sign to indicate a negative return on total assets. % b. Determine the retum on stockholders' equity for East Point for fiscal Years 2 and 3. Round percentages to one decimal place. If required, use a minus sign to…arrow_forward

- Saved He Chevalier Company has identified five industry segments: plastics, metals, lumber, paper, and finance. t appropriately consolidated each of these segments in producing its annual financial statements. Information describing each segment (in thousands) follows: Accounts Sales to outside parties Intersegment sales Interest income from outside parties Interest income from intersegment loans Operating expenses Interest expense Tangible assets Intangible assets Intersegment loans (debt) Plastics $ 6,625 Metals $ 2,334 Lumber $ 701 Paper $ 412 Finance 146 169 134 146 $ 0 0 0 32 19 0 40 0 0 0 0 197 4,174 74 1,742 1,046 644 29 29 64 30 100 1,467 85 0 3,176 504 751 169 399 0 0 61 0 0 0 702 Chevalier does not allocate its $1,480,000 in common expenses to the various segments. Required: a1. Perform revenue test procedure to determine Chevalier's reportable operating segments. a2. Perform profit or loss test procedure to determine Chevalier's reportable operating segments. a3. Perform…arrow_forwardRevenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill’s data are expressed in dollars. The electronics industry averages are expressed in percentages. TannenhillCompany ElectronicsIndustryAverage Sales $800,000 100 % Cost of goods sold 512,000 70 Gross profit $288,000 30 % Selling expenses $176,000 17 % Administrative expenses 64,000 7 Total operating expenses $240,000 24 % Operating income $48,000 6 % Other revenue 16,000 2 $64,000 8 % Other expense 8,000 1 Income before income tax $56,000 7 % Income tax expense 24,000 5 Net income $32,000 2 % a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. Enter all amounts as positive numbers.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education