Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

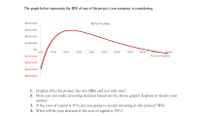

Transcribed Image Text:The graph below represents the IRR of one of the project your company is considering.

$400,000

NPV Profile

$300,000

$200,000

$100,000

$0

10%

20%

30%

40%

50%

60%

70%

80%

100%

-$100,000

Ceesl of Gesppilial

-$200,000

-$300,000

-$400,000

1. Explain why this project has two IRRS and not only one?

2. How can you make investing decision based on the above graph? Explain in details your

answer.

3. If the cost of capital is 15%, are you going to accept investing in this project? Why.

4. What will be your decision if the cost of capital is 90%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following table gives the available projects (in $millions) for a firm. A B C D E F G 90 30 60 50 150 40 20 60% 77% 35% 8% 10% 40% 40% 80 70 65 -10 100 32 10 Initial investment IRR NPV If the firm has a limit of $150 million to invest, what is the maximum NPV the company can obtain? Multiple Choice 160arrow_forwardA firm with a WACC of 10% is considering the following mutually exclusive projects: 0 1 2 3 4 5 Project 1 -$450 $50 $50 $50 $200 $200 Project 2 -$550 $200 $200 $150 $150 $150 Which project would you recommend? Select the correct answer. a. Both Projects 1 and 2, since both projects have IRR's > 0. b. Neither Project 1 nor 2, since each project's NPV < 0. c. Both Projects 1 and 2, since both projects have NPV's > 0. d. Project 1, since the NPV1 > NPV2. e. Project 2, since the NPV2 > NPV1.arrow_forwardA firm with a WACC of 10% is considering the following mutually exclusive projects: 1 2 3 5 + ㅓ Project 1 Project 2 -$300 $60 $60 $60 $175 $175 -$550 $250 $250 $150 $150 $150 Which project would you recommend? Select the correct answer. Oa. Both Projects 1 and 2, since both projects have NPV's > 0. Ob. Both Projects 1 and 2, since both projects have IRR's > 0. Oc. Project 2, since the NPV2 > NPV1. Od. Neither Project 1 nor 2, since each project's NPV NPV2.arrow_forward

- Project A: IRR = 4%, Initial cost =100, NPV = 200 Project B: IRR = 14%, Initial cost =200, NPV = 230 Project C: IRR = 6%, Initial cost = 300, NPV = 300 Project D: IRR = 22%, Initial cost = 100, NPV = 260 If you can only choose 1 of the above projects above, which one should you choose? Project A Project B Project C Project D Not enough information to determine which project is preferredarrow_forwardHi please provide stepwise solution of all and not handwritten please good way ill like.arrow_forwardThe profitability analysis of three projects is provided below: Project A Project B Project C NPV $10,000 $5,000 - $1,000 IRR 10% 15% 15% WACC 8% 12% 16% If these projects were independent, which project(s) would be accepted? Why? If these projects were mutually exclusive, which project(s) would be accepted? Why?arrow_forward

- URGENTarrow_forwardA company only has £2,000 to invest at time t0 in projects P, Q and R. Each project is infinitely divisible but cannot be undertaken more than once. Project Investment at t0 NPV P £700 £224 Q £1,000 £360 R £1,500 £510 How much should be invested in project R to maximise the NPV achieved? A £0 B £1,000 C £1,350 D £2,000arrow_forwardA firm evaluates all of its projects by applying the IRR rule. If the required return is 14 percent, should the firm accept the following project? Input area: Required Return Year 0 Year 1 Year 2 Year 3 (Use cells A6 to B10 from the given information to complete this question.) Output area: 14% ($41,000) $20,000 $23,000 $14,000 IRRarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education