ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

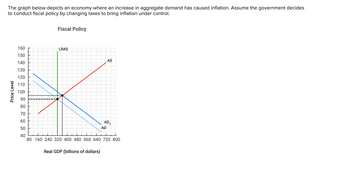

Transcribed Image Text:The graph below depicts an economy where an increase in aggregate demand has caused inflation. Assume the government decides

to conduct fiscal policy by changing taxes to bring inflation under control.

Price Level

Fiscal Policy

160

150

140

130

120

110

100

90

80

70

60

50

40

80 160 240 320 400 480 560 640 720 800

LRAS

Real GDP (billions of dollars)

AS

AD₁

AD

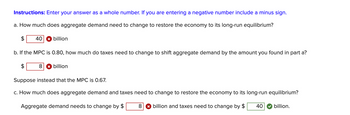

Transcribed Image Text:Instructions: Enter your answer as a whole number. If you are entering a negative number include a minus sign.

a. How much does aggregate demand need to change to restore the economy to its long-run equilibrium?

40 x billion

b. If the MPC is 0.80, how much do taxes need to change to shift aggregate demand by the amount you found in part a?

8 x billion

Suppose instead that the MPC is 0.67.

c. How much does aggregate demand and taxes need to change to restore the economy to its long-run equilibrium?

Aggregate demand needs to change by $

8 ✩ billion and taxes need to change by $

40

billion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Use the following figure to answer the next question. Price Level AS AD₂ AD₁ Y₁ Y₂ Real GDP Suppose the economy is currently at full employment with aggregate demand curve AD2. A further increase in consumption and investment spending will cause Multiple Choice Odemand-pull Inflation, and the new equilibrium output will be less than Y2. O cost-push inflation, and the new equilibrium output will be less than Y2. 0 O cost-push inflation, and the new equilibrium output will be more than Y2. demand-pull inflation, and the new equilibrium output will be more than Y2. MacBook Pro 66 27 & + ✓ 8 9 R T Y U ull 0 0 LL F G H J Karrow_forwardPlease answer everything in the photos including the graph.arrow_forward2arrow_forward

- Assuming that the economy shown in the figure below is in equilibrium, calculate the recessionary or inflationary gap in each case below. AS 350 AD 300 250 200 150 100 50 100 200 300 400 500 600 700 800 900 1000 Real GDP a. Potential GDP (LAS) is $300 then there is a(n) (Click to select) ♥ gap of $ (Click to select) b. Potential GDP (LAS) is $600 then there is a(n) inflationary recessionary Įgap of $ c. Potential GDP (LAS) is $750 then there is a(n) (Click to select) v gap of $ Price indexarrow_forward22.arrow_forwardThe graph below depicts an economy where an increase in aggregate demand has caused Inflation. Assume the government decides to conduct fiscal policy by changing taxes to bring Inflation under control. Price Level 160 150 140 130 120 110 100 90 80 70 60 50 Fiscal Policy LRAS AS Real GDP (billions of dollars) AD₁ AD 40 80 160 240 320 400 480 560 640 720 800 Instructions: Round your answers to 2 decimal places. If you are entering a negative number include a minus sign. a. How much does aggregate demand need to change to restore the economy to its long-run equilibrium? billion b. If the MPC is 0.75, how much do taxes need to change to shift aggregate demand by the amount you found in part a? $ billion Suppose Instead that the MPC is 0.5. c. How much does aggregate demand and taxes need to change to restore the economy to its long-run equilibrium? Aggregate demand needs to change by $ billion and taxes need to change by $ billion.arrow_forward

- Extra Credit The economy of the country Keinesia is heavily dependent on imported oil. Due to a crisis in the Middle East, the oil price has sharply increased. 1. What do you expect to happen to the equilibrium output and prices? Use the AD-AS model to illustrate it. 2. You are the economic adviser to the president of Keinesia. a. Would you advise him/her to implement Fiscal Policy? b. What type of Fiscal Policy would you recommend? c. Illustrate the effect of the Fiscal Policy on the equilibrium output and prices? Use the AD- AS model in part (a) to illustrate it.arrow_forwardof The economy of Langoria is currently in a state of long-run equilibrium in which the economy is producing at its Natural Real GDP. The level of Real GDP is currently 3 trillion dollars, and the price level is 130. 100 PRICE LEVEL 170 160 150 140 130 120 110 100 2 Changes in a Self-Regulating Economy AD AD₂ BRAS 1 2 3 LRAS 23arrow_forwardPrice level (GDP price index, 2012 140 130 120 110 105 100 90 90 19 Potential GDP ADO 21 20 AS 22 Real GDP (trillions of 2012 dollars) The figure above shows a nation's aggregate demand curve, aggregate supply curve, and potential GDP. In the figure above, the can change expenditure by gap is one trillion dollars. To close the gap, the government one trillion dollars. recessionary; exactly inflationary; more than recessionary; less than recessionary; more thanarrow_forward

- What is 8arrow_forwardSRAS PL2 PL AD2 AD REAL GDP The Aggregate Demand Model shows an increase in Aggregate Demand or an increase in GDP. Which Fiscal Policy Action would cause this change O Raise Taxes & Cut Government Spending O Decrease Taxes & Government Spending O Increase Taxes & Government Spending O Cut Taxes and Increase Government Spending PRICE LEVELarrow_forwardpols Homework (Ch 15) 4. Using fiscal policy to fight inflation Consider the hypothetical economy depicted on the graph. Initially, the economy operates below full-employment output at a price level of 105 and real GDP of $480 billion. Then aggregate demand (AD) increases from AD₁ to AD₂, moving the economy up along the intermediate and classical ranges of the aggregate supply (AS) curve. Real GDP increases to the full-employment output level of $540 billion, and the price level increases to 120. PRICE LEVEL (CPI) 130 125 120 115 110 100 95 90 85 80 400 420 440 AS AD₂ 460 REAL GDP (Billions of dollars) AD₁ 480 500 520 540 560 580 600 MacBook Pro (?) Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education