Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

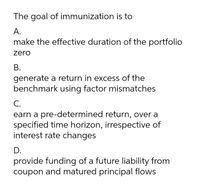

Transcribed Image Text:The goal of immunization is to

A.

make the effective duration of the portfolio

zero

В.

generate a return in excess of the

benchmark using factor mismatches

C.

earn a pre-determined return, over a

specified time horizon, irrespective of

interest rate changes

D.

provide funding of a future liability from

coupon and matured principal flows

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The expected value of an investment: Answer a. Is what the owner will receive when the investment is sold b. Is the sum of the payoffs c. Is the probability-weighted sum of the possible outcomes d. Cannot be determined in advancearrow_forwardAn efficient portfolio is one that: Select one: a. maximises return for a given level of risk. b. maximises risk for a given level of return. c. minimises risk for a given rate of return. d. Both A and C. are efficient portfolios.arrow_forwardFinancial advisors generally recommend that their clients allocate more to higher risk–return asset classes (like equities) if their investment horizons are long. Is this advice consistent with the basic M-V model? Does adding a shortfall constraint to the M-V model make a difference? If so, how? If not, why not? Assuming investment opportunities change over time, what type of asset return behavior would justify this advice within the M-V framework?arrow_forward

- i need the answer quicklyarrow_forwardWhich of the following statements describing the elements of intrinsic valuation is most accurate? a. A simple calculation of present values of expected cashflows of different investments using the risk free rate would be enough to determine which asset is best. b. The risk-free rate is the lowest rate that an investor can earn from short-term investments.c. When the present value of the cashflows is discounted with the appropriate rate end this present value is positive, then the asset providing these cashflows have a value to the investor. d.Cashflows may include depreciatipon expenses and amortization costs.arrow_forwardThe constant rupee value plan requires a. Investors to fix the expected value of their portfolio b. Investors to fix their periodical installments c. Investors to fix their rebalancing points d. All of the mentionedarrow_forward

- A project's internal rate of return (IRR) is the discount rate YTM on a bond. The equation for calculating the IRR is: timing Project A Project B 0 1 2 CFt is the expected cash flow in Period t and cash outflows are treated as negative cash flows. There must be a change in cash flow signs to calculate the IRR. The IRR equation is simply the NPV equation solved for the particular discount rate that causes NPV to equal zero 320 255 The IRR calculation assumes that cash flows are reinvested at the IRR If the IRR is greater ✔than the project's risk-adjusted cost of capital, then the project should be accepted; however, if the IRR is less than the project's risk-adjusted cost of capital, then the project should be rejected ✓✓✓. Because of the IRR reinvestment rate assumption, when mutually exclusive projects are evaluated the IRR approach can lead to conflicting results from the NPV method. Two basic conditions can lead to conflicts between NPV and IRR: ✔ differences (earlier cash flows in…arrow_forwardidentify the assumptions underlying the interest coverage ratio appropriate measure for analyzing long-term solvency risk? Alternatively, can you identify the assumptions underlying the interest coverage ratio appropriate measure for analyzing short-term solvency risk?arrow_forwardAn investment requires a total return that comprises: O a real rate of return and compensation for inflation. a real rate of return, compensation for inflation, and a risk premium. compensation for inflation and a risk premium. a real rate of return, compensation for inflation, a risk premium, and compensation for time and effort devoted to researching alternative investments. None of the abovearrow_forward

- Macaulay duration is the optimal holding period to immunize the interest rate risks, namely to make the reinvestment risk and selling price risk offset one another completely. O True O Falsearrow_forwardWhich one of the following is a property of a pure arbitrage portfolio?a. Negative investment.b. Zero return.c. Positive systematic risk.d. Zero total risk.arrow_forwardWhich of the following statements is correct? A delta-neutral portfolio is protected against large changes in the underlying asset price. The delta hedging error increases as gamma decreases. To change the vega of a portfolio, we need to trade the portfolio’s underlying asset. A delta-neutral portfolio needs to be rebalanced more frequently as the gamma increases to maintain delta-neutrality. Please explain and justify your choice using your own words.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education