Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

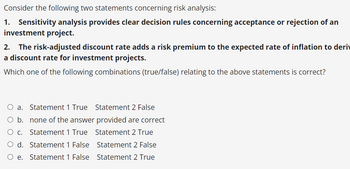

Transcribed Image Text:Consider the following two statements concerning risk analysis:

1. Sensitivity analysis provides clear decision rules concerning acceptance or rejection of an

investment project.

2. The risk-adjusted discount rate adds a risk premium to the expected rate of inflation to deriv

a discount rate for investment projects.

Which one of the following combinations (true/false) relating to the above statements is correct?

O a. Statement 1 True Statement 2 False

O b. none of the answer provided are correct

Statement 1 True Statement 2 True

Statement 2 False

c.

d. Statement 1 False

O e. Statement 1 False

Statement 2 True

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is the most valid justification for including real estate as part of an investmer portfolio? 1 High liquidity. 2 Low project-specific risk. 3 Low management and information costs. 4 Low correlation of real estate with shares and bonds,arrow_forwardThe Fama-French 3-factor model is a multi-factor models that includes two additional risk factors beyond the market risk factor in the CAPM model. These additional factors account for__________. A) Firm-specific risk that the CAPM does not measure. B) Sensitivities of an asset’s return related to its size and its ratio of book-to-market value. C) A and B are both correctarrow_forwardConsider the following statement: “In contexts of increased uncertainty, the usefulness of real options when valuing an investment opportunity increases”. Do you agree with this statement? Explain your answer.arrow_forward

- In choosing where to invest, return and risk for an investment must be compared. It is not sufficient to choose an investment based only on return without taking risk into consideration. There are two methods or measures that compare return and risk. State these two methods, the formula for each and the criteria used in evaluating alternative investment of each method.arrow_forwardWhich of the following statements correctly describe aspects of the diversification benefit associated with combining two assets into a portfolio? Group of answer choices A. When the returns of the two assets are perfectly positively correlated, a zero-risk portfolio can be formed. B. In order to achieve any diversification benefit, the returns of the two assets must be negatively correlated. C. More than one of the other statements is correct. D. Holding all else constant, as the correlation coefficient between the returns of the two assets falls, the risk of the portfolio will also be reduced.arrow_forwardTo obtain the maximum reduction in risk, an investor should combine assets that * A.are negatively correlated. B.have a correlation coefficient of negative one. C.are uncorrelated. Option 5 D.have a correlation coefficient of positive one.arrow_forward

- Forecasting risk can be defined as the possibility that _____ will lead to incorrect decisions. a. the inclusion of opportunity costs b. erosion c. errors in projected cash flows d. the exclusion of sunk costs e. net working capital costsarrow_forwardWhich of the following is false about diversification? Select one or more: a. diversification increases Sharpe ratios b. diversification eliminates risk c. diversification increases returns d. diversification increases alphaarrow_forwardWhat does risk tolerance measure in the context of investment strategy? This is a multiple choice question. Once you have selected an option, select the submit button below The ability to take on higher risks for potentially higher returns The willingness to accept losses in the short term The capacity to afford potential losses The preference for low-risk, low-return investmentsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education