FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:The glue is not a significant cost, so it is treated as indirect materials (factory overhead).

a. Journalize the entry to record the purchase of materials in June. If an amount box does not require an entry, leave it blank.

a. Materials

Accounts Payable

Feedback

b. Journalize the entry to record the requisition of materials in June. If an amount box does not require an entry, leave it blank.

b. Work in Process

Factory Overhead

Materials

Feedback

c. Determine the June 30 balances that would be shown in the materials ledger accounts.

Fabric

Polyester Filling

Lumber

Glue

Balance, June 30

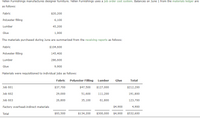

Transcribed Image Text:Yellen Furnishings manufactures designer furniture. Yellen Furnishings uses a job order cost system. Balances on June 1 from the materials ledger are

as follows:

Fabric

$20,200

Polyester filling

6,100

Lumber

45,200

Glue

1,900

The materials purchased during June are summarized from the receiving reports as follows:

Fabric

$104,600

Polyester filling

145,400

Lumber

286,600

Glue

9,900

Materials were requisitioned to individual jobs as follows:

Fabric Polyester Filling Lumber

Glue

Total

Job 601

$37,700

$47,500

$127,000

$212,200

Job 602

29,000

51,600

111,200

191,800

Job 603

26,800

35,100

61,800

123,700

Factory overhead-indirect materials

$4,900

4,900

Total

$93,500

$134,200

$300,000

$4,900

$532,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hankook Company employ new employee and are assigned to make Statement of Cost of Manufactured, Statement of Cost of Goods Sold, and Income Statement. The results attached on picture below Questions : a. Identify the factory overhead item and the total in USD b. Identify the period cost and the total in USD c. If there is something wrong with the income statement above, correct the income statement above so all the item cost is where it should be.arrow_forwardUsing predetermined factory overhead application rates to apply the manufacturing overhead to the products can cause the actual factory overhead to be different from the applied factory overhead. Discuss the accounting methods available for companies to dispose of the underapplied or overapplied factory overhead.arrow_forward1. Prepare journal entries dated June 30 to record: (a) raw materials purchases, (b) direct materials usage, (c) indirect materials usage, (d) direct labor usage, (e) indirect labor usage, (f) other overhead costs, (g) overhead applied, and (h) payment of total wages costs.arrow_forward

- Prepare journal entries for each type of manufacturing cost. (Use a summary entry to record manufacturing overhead.) (List all debit entries before credit entries. Credit account titles are automatically Indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation (a) Raw Materials Inventory (b) Accounts Payable (Purchases of raw materials on account) Work in Process Inventory Manufacturing Overhead (To record factory labor costs) (c) Utilities Payable Debit 19600 42400 Credit 1arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardVishalarrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPlease answer urgently and plz check plagiarismarrow_forwardQuestion: In a job order cost accounting system, which journal entry would be made when raw materials are transferred into production during the month? a. Debit Goods in Process Inventory and Credit Materials Expense. b. Debit Factory Overhead and Credit Raw Materials Inventory. c. Debit Goods in Process Inventory and Credit Raw Materials Inventory. d. Debit Raw Materials Inventory and Credit Goods in Process Inventory. e. Debit Finished Goods Inventory and Credit Goods in Process Inventory.arrow_forward

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2022, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. 2. 3. 4. 5. Purchased additional raw materials of $75,600 on account. Incurred factory labor costs of $58,800. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various…arrow_forwardMatch each description to the appropriate term. Answers may be used more than once. Selling and administrative expense Factory overhead Indirect materials used Sales supplies used Rent expense on factory building Factory supplies usedarrow_forwardXYZ Company uses a job costing system. The direct materials for Job Y were purchased in September and put into production in October. The job was not completed by the end of October. At the end of October, in what account would the direct materials cost assigned to Job Y be located? Select one: O a Work-in-Process Inventory. Ob. None of the given is correct. ON Finished Goods Inventory. Od. Raw Materials Inventory. O e. Cost of Goods Sold.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education